United in Uncertainty: Exploring the Shared Challenges of the US and Canadian Labor Markets

The latest US jobs report for February brought both encouraging and concerning news for the economy, shedding light on the complexities underlying the current employment landscape. Despite the headline figure showing a robust increase in job creation, the reality painted by downward revisions and unexpected shifts in key metrics suggests a more nuanced and potentially challenging situation than initially perceived.

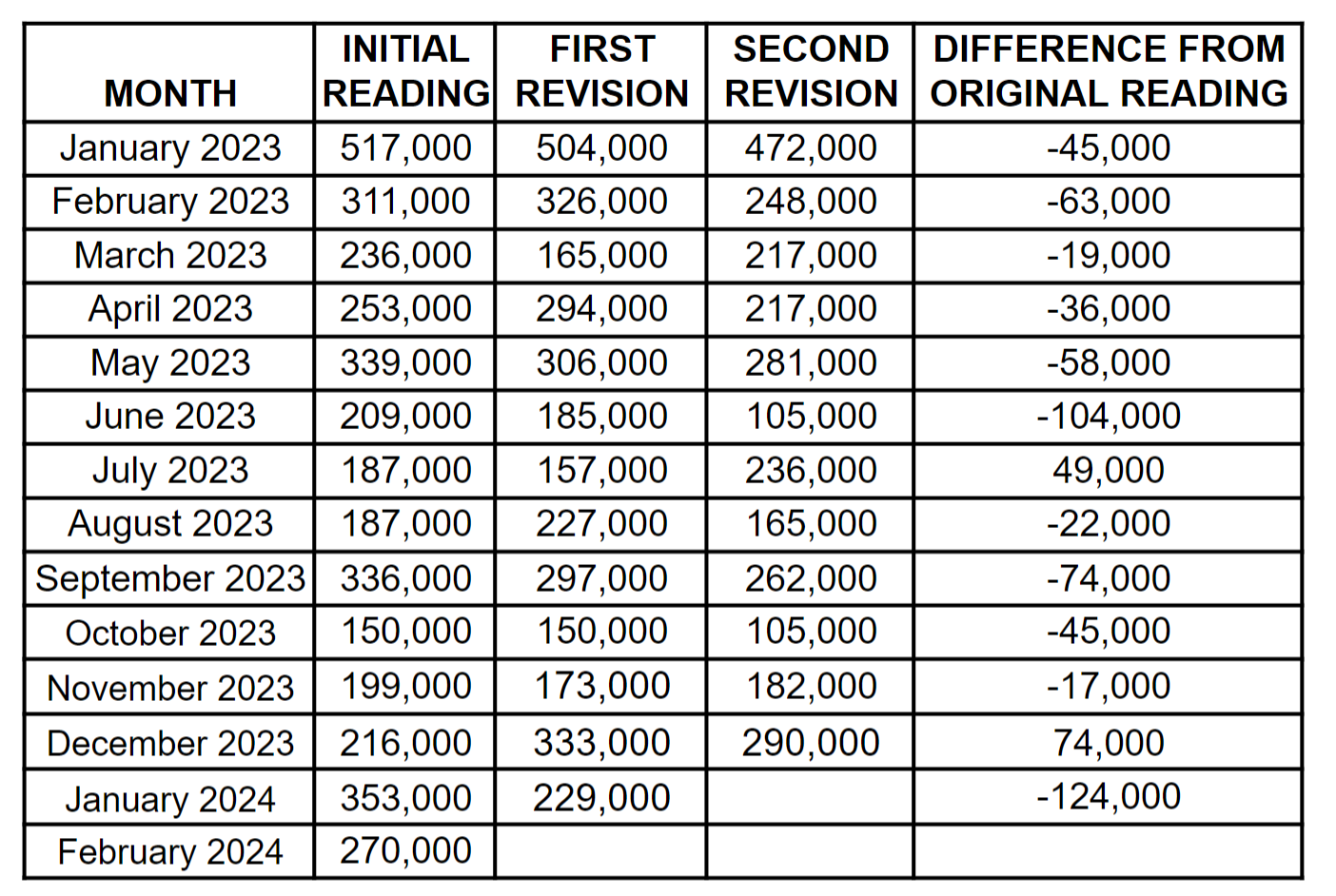

In February, the job report revealed a noteworthy surge in employment, with the addition of 275,000 jobs surpassing expectations. This uptick was particularly notable in sectors such as healthcare, government, and food services, reflecting a diverse range of industries contributing to the growth. However, this positive momentum was undercut by the revelation of significant downward revisions to January's job numbers. Initially reported at 353,000, January's job gains were revised sharply downward to 229,000, indicating a substantial discrepancy between initial estimates and actual figures.

One of the most striking revelations of the February report was the unexpected rise in the unemployment rate to 3.9%, marking its highest level since January 2022. This increase came as a surprise, as analysts had anticipated the rate to remain unchanged at 3.7%. Delving deeper into the data, it becomes evident that the rise in unemployment was driven primarily by a surge in youth unemployment, affecting individuals between the ages of 14 and 24. Conversely, the unemployment rate for those aged 25 and above saw minimal change, remaining steady at 3.2%.

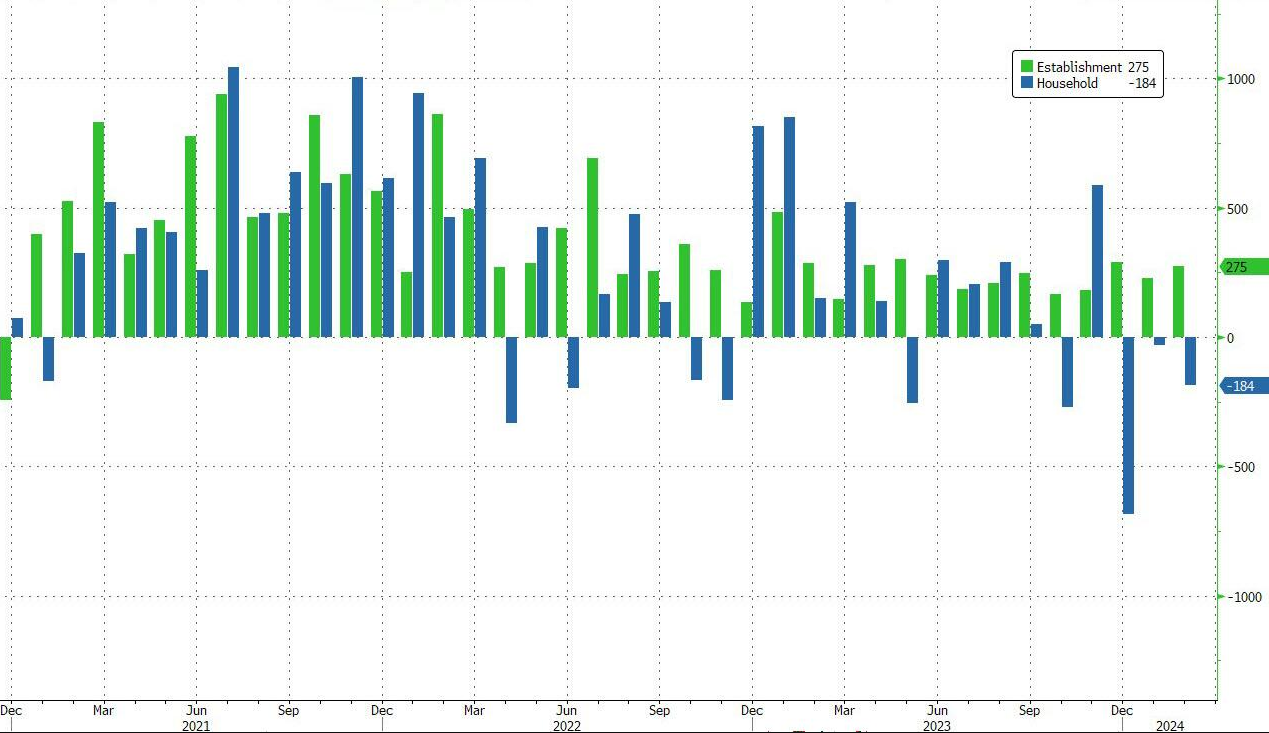

While the headline figures capture attention, it's essential to scrutinize the underlying dynamics revealed by different surveys. Discrepancies between the Establishment survey, which measures payrolls, and the Household survey, which tracks the actual number of employed individuals, highlight the complexity of assessing the true state of the labor market. This divergence underscores the importance of considering multiple sources of data to gain a comprehensive understanding of employment trends.

Despite the increase in job creation, concerns persist regarding the overall health of the labor market. The labor force participation rate, a key metric indicating the proportion of working-age individuals actively engaged in the labor force, remained unchanged at 62.5%. This stagnation in labor force participation suggests that while job opportunities may be available, there are challenges in attracting individuals back into the workforce.

Another aspect of the report that garnered attention was the trajectory of wage growth. While average hourly earnings showed a year-over-year increase of 4.3% in February, there was a slight dip in monthly earnings growth. This trend, coupled with the overall moderation in wage growth, raises questions about the sustainability of income gains for workers.

The reaction of financial markets to the February report was mixed, reflecting the diverse interpretations of its implications. Initially, markets responded positively, with futures spiking to new all-time highs and the dollar weakening against other currencies. However, analysts expressed a range of views, with some highlighting concerns about the unexpected rise in the unemployment rate and downward revisions to previous months' gains.

The broader context provided by alternative sources of data further complicates the assessment of the labor market. Insights from the NFIB survey's Small Business hiring plans offer additional perspectives on hiring trends, particularly in the context of small businesses. Understanding these nuances is crucial for policymakers and businesses alike as they navigate the evolving economic landscape.

In contrast to the official job report, alternative analyses and anecdotal evidence paint a more nuanced picture of the challenges facing the labor market. Reports of hiring freezes and declining job opportunities highlight the underlying economic strain experienced by many individuals. Despite claims of a strong economy, the reality for job seekers is one of frustration and uncertainty.

Anecdotal evidence and mainstream media reports echo the sentiment of economic stress, with many individuals struggling to secure employment despite their efforts. The prevalence of burnout among unemployed individuals underscores the emotional toll of prolonged job searches and economic uncertainty.

While the official job report may capture headline figures, it's essential to complement this data with alternative sources and qualitative insights to gain a comprehensive understanding of the employment landscape. The divergence between official statistics and on-the-ground realities highlights the importance of critically evaluating data and considering a range of perspectives when assessing economic conditions.

Transitioning from the discussion on the challenges facing the US economy to Canada's economic landscape, it's imperative to recognize the broader global context of sluggish growth and its implications for countries beyond America's borders. While the focus has been on dissecting the intricacies of the US jobs report, it's essential to zoom out and examine similar trends impacting Canada's economy.

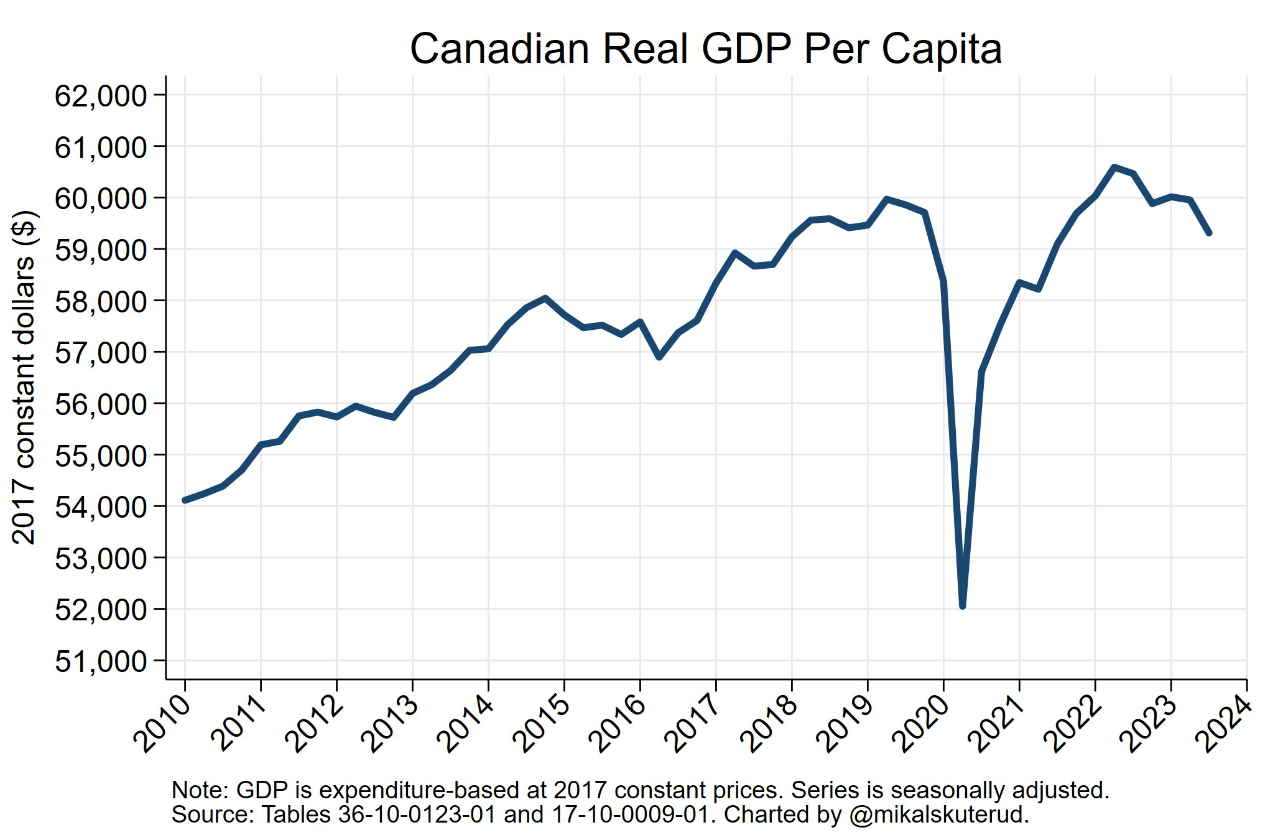

The latest figures from Statistics Canada paint a sobering picture of Canada's economic trajectory, with per capita GDP experiencing sustained declines over the past several quarters. Despite headlines emphasizing marginal gains in GDP, the underlying trend of sluggish growth persists, posing significant challenges to Canada's economic prosperity.

Over the past few decades, Canada's growth trajectory has been on a downward slope, with per capita GDP growth rates steadily declining. This secular trend underscores broader structural issues within the Canadian economy, characterized by slower growth rates and stagnant productivity.

Comparisons with other OECD countries further highlight Canada's relative decline in economic performance. Once considered among the richest nations globally, Canada now lags behind numerous counterparts in terms of per capita GDP and productivity growth. This downward trajectory has profound implications for Canadians' living standards and their sense of economic well-being.

Furthermore, demographic shifts, including an aging population and declining workforce participation rates, compound the challenges facing Canada's economy. As the population ages and healthcare costs escalate, the burden on public finances continues to mount, exacerbating fiscal challenges and placing additional strain on economic growth prospects.

Addressing Canada's growth crisis requires a multifaceted approach, encompassing policies aimed at boosting productivity, increasing investment, and fostering innovation. While the path forward may be challenging, acknowledging the urgency of the situation is crucial for charting a course toward sustained economic prosperity.

Just as the US grapples with the complexities of its labor market dynamics, Canada faces its own set of economic challenges that demand attention and decisive action. By recognizing the parallels between these two economies and embracing measures to stimulate growth and innovation, both countries can aspire to achieve sustainable economic success in an increasingly competitive global landscape.

Thinking about selling your home?

Get in touch. We'll guide you through every step of the process to ensure a smooth transaction that meets your goals.