The Visual Landscape: 10 Charts Exposing the Depths of China's Economic Crisis

The erstwhile flourishing real estate panorama in China has embarked on a tumultuous journey over the preceding triennium. Policy architects, in their endeavor to orchestrate a gradual deceleration to curb financial perils, inadvertently triggered a property debacle. This not only obliterated household fortunes but also reverberated shockwaves across the broader economic spectrum. This exposé meticulously dissects 10 compelling graphs from Bloomberg, vividly portraying the extensive repercussions of China's real estate quandary.

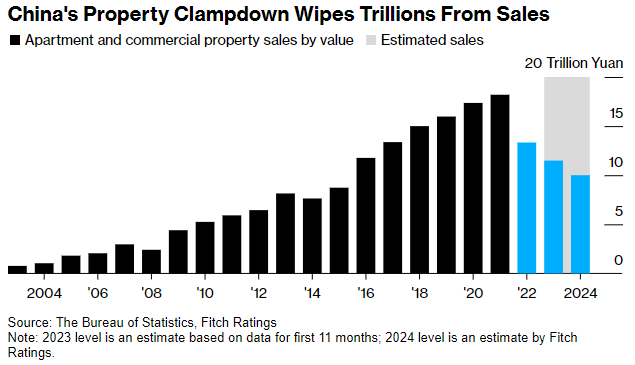

1. The Plummeting Trillion-Dollar Sales

The inaugural graph unveils an astonishing nosedive in nationwide property transactions, plummeting from the zenith of 18.2 trillion yuan ($2.5 trillion) in 2021. With real estate constituting a significant portion of China's economic framework, the subsequent 27% downturn in residential and commercial property transactions the subsequent year marked the most substantial annual contraction since 1998. The ongoing trajectory foretells an additional descent of 1.8 trillion yuan this year, accentuating the persistent hurdles in the real estate domain.

The paradigm of property transactions undergoes a seismic metamorphosis, with implications for developers, investors, and the broader economic tapestry.

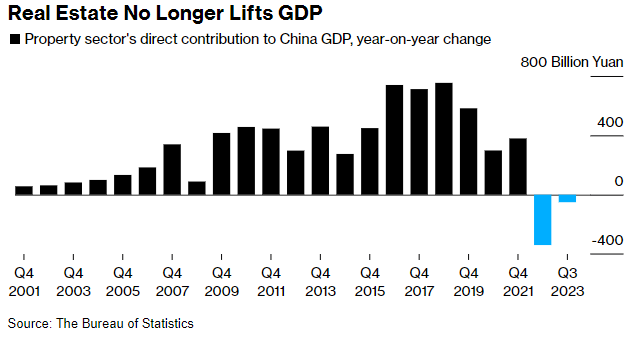

2. The Broad Spectrum of Impact

The second graph exposes the far-reaching consequences of the real estate crisis on China's economic fabric. Once a propellant of growth, the real estate sector now stands as a ponderous burden. Output contracted by 51 billion yuan in the initial three quarters, continuing a trend that witnessed a diminution of 340 billion yuan in the antecedent year. While a leaner real estate sector is viewed favorably in the long term, the immediate shock manifests in its intricate interconnection with over 60 sectors in China.

The ripple effect extends beyond real estate, influencing upstream and downstream industries, and painting a convoluted economic tableau.

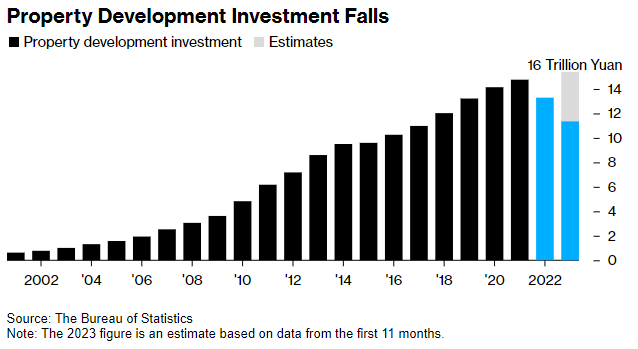

3. The Investment Exodus

The third graph delves into the investment topography, revealing a precipitous decline in real estate development investments. Plunging by 1.47 trillion yuan in 2022 and exacerbating through the first 11 months of the current year, this descent reverberates through the broader economic spectrum. As real estate development investments dwindle, it exerts pressure on fixed-asset investments, a pivotal cog in the machinery of the Chinese economy.

The investment panorama undergoes a metamorphosis, impacting not only developers but also the expansive economic ecosystem.

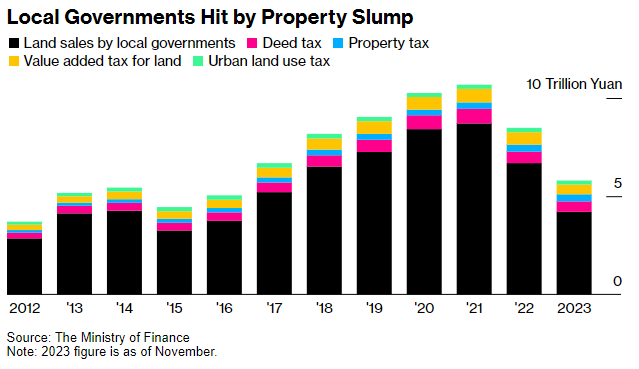

4. Local Governments' Fiscal Conundrum

The fourth graph sheds light on the fiscal conundrum faced by local governments due to the real estate downturn. Despite China's attempts to ease restrictions on land sales, local government revenue from land and property activities dwindled by 23% in 2022 and continued shrinking by another 18% in the first 11 months of the current year. This revenue downturn has prompted Beijing to deploy fiscal stimulus measures to address escalating concerns about burgeoning local government debt.

The fiscal well-being of local governments is intricately linked to the performance of the real estate sector, with implications for fiscal policies.

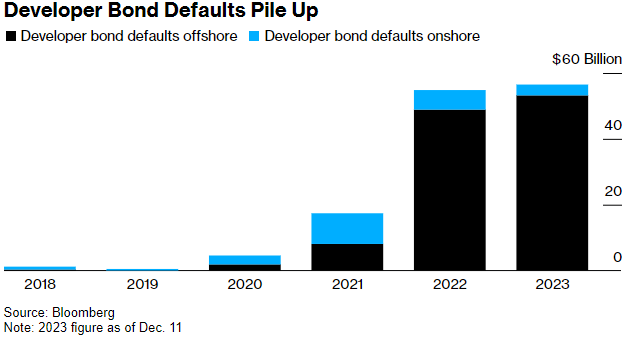

5. Demise of Developer Bonds

The fifth graph explores the demise of developer bonds, once a vogue in China's financial markets. The implementation of the "three red lines" policy in 2020 to curtail borrowing in the property sector dealt a blow to developer debts. Since then, defaults have surged, reaching $133 billion as of Dec. 11, 2023, leaving offshore investors grappling with substantial losses.

The shift in developer bonds mirrors a shifting risk landscape for investors, reshaping the financial terrain.

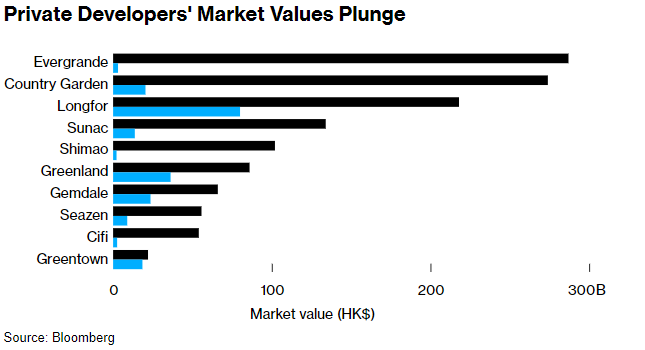

6. Plunge in Market Valuation

The sixth graph captures the ongoing plunge in the market value of Chinese property stocks, with the top 10 private real estate developers collectively forfeiting HK$1.1 trillion, or 84%, of their market value since early 2020. Despite policy interventions aimed at buttressing the sector, sentiment remains somber, and private developers may encounter liquidity challenges in the impending months.

Investors confront uncertainties as the market value of property stocks continues its descent, impacting the overall financial health of real estate companies.

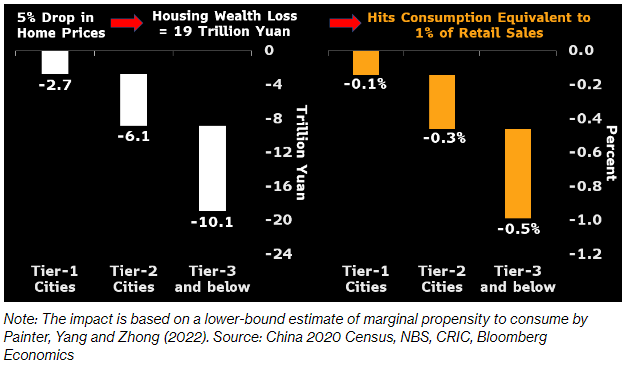

7. Consumption Downturn

The seventh graph delves into the impact of declining home prices on consumer spending. Existing-home prices have dwindled by 8% since July 2021, dissuading consumer expenditure. Bloomberg Economics estimates that a 5% decline in prices could result in an aggregate loss of 19 trillion yuan in housing wealth, potentially diminishing household consumption by at least 430 billion yuan.

The reverberations of declining home prices extend beyond the real estate sector, influencing consumer behavior and overall economic activity.

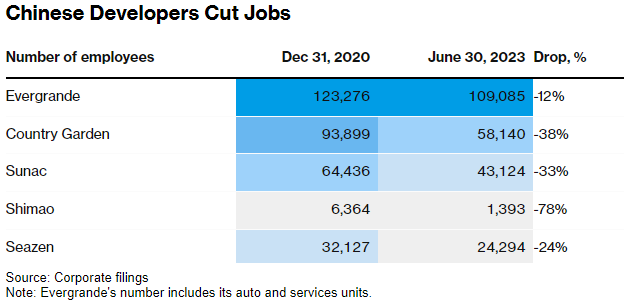

8. Human Toll of Layoffs

The eighth graph unveils the human toll of the real estate sector meltdown – mass layoffs by some of China's premier private real estate developers. Headcounts have been truncated by as much as nearly 80% since the inception of the "three red lines" regulations.

The "three red lines" are financial regulatory guidelines implemented in China since August 2020, specifically addressing the debt-to-cash, equity, and assets ratio. Introduced to curb the escalating indebtedness within the property-development sector, this regulatory measure aims to rein in financial risks, with a notable impact on major real estate players like Evergrande, which encountered a liquidity crisis in the fourth quarter of 2021.

The actual impact on household spending may be even more profound when considering the cumulative effect of job cuts. The employment landscape transforms, impacting not only developers but also individuals and households.

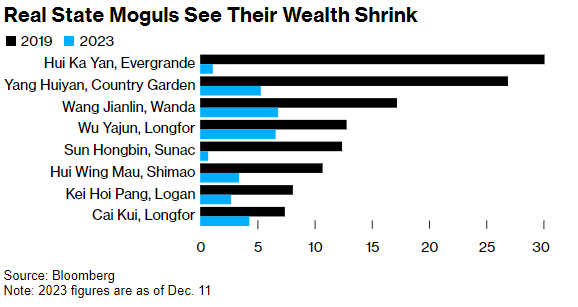

9. Ebbing Wealth of Tycoons

The ninth graph exposes the dwindling wealth of Chinese real estate magnates. Since the denouement of 2019, the wealth of property magnates has descended by at least $97 billion, primarily owing to the diminishing market values of their companies. This underscores the financial challenges faced by even the most opulent figures in the industry.

The erosion of wealth among real estate magnates signals a broader shift in the financial dynamics of the industry.

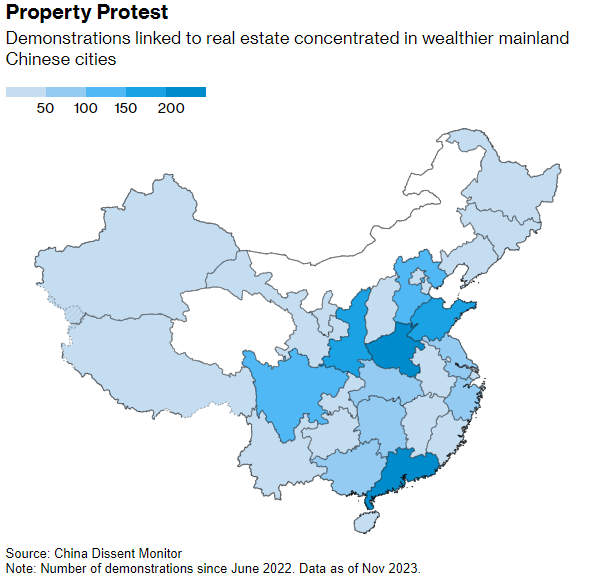

10. Protests on the Horizon

The final graph provides a glimpse into the societal unrest triggered by the real estate predicament. Over 1,800 demonstrations related to real estate have transpired in mainland China since June 2022, encompassing issues ranging from project delays to subpar workmanship. The persistence of protests suggests deep-seated apprehensions among homebuyers and construction workers.

The social implications are profound, as the real estate predicament fuels discontent and prompts widespread protests.

These ten graphs provide illuminate the challenges emanating from China's real estate turbulence. Spanning economic metrics to societal unrest, the repercussions are extensive, demanding a nuanced understanding of the interplay between the real estate sector and the broader Chinese economy.

Beyond the borders of China, the reverberations of these developments are not confined. The ripples extend globally, potentially influencing the world economy. From disrupted supply chains to altered investor sentiments, the multifaceted impact of China's real estate challenges can contribute to a reshaping of the global economic landscape. As we scrutinize the graphs, it becomes evident that what unfolds within China's real estate realm holds implications far beyond its borders, creating a web of interconnected economic dynamics on a global scale.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.