The Steep Decline of Homeownership Among Young Adults in Canada

The Canadian homeownership landscape is undergoing a significant transformation, especially among young adults aged 25 to 44. In the past decade, there has been a marked decline in homeownership rates, raising concerns about the future of real estate in the country. This article explores the factors contributing to this trend, analyzes key demographic shifts, and provides insights into the challenges and opportunities facing prospective homebuyers.

The diminishing homeownership rate holds significant implications, not only for individual Canadians but also for the dynamics of the real estate market. As we explore the causes behind this trend, it becomes apparent that policymakers play a pivotal role in steering the trajectory of homeownership rates.

Ownership Decline for Young Adults (25-44)

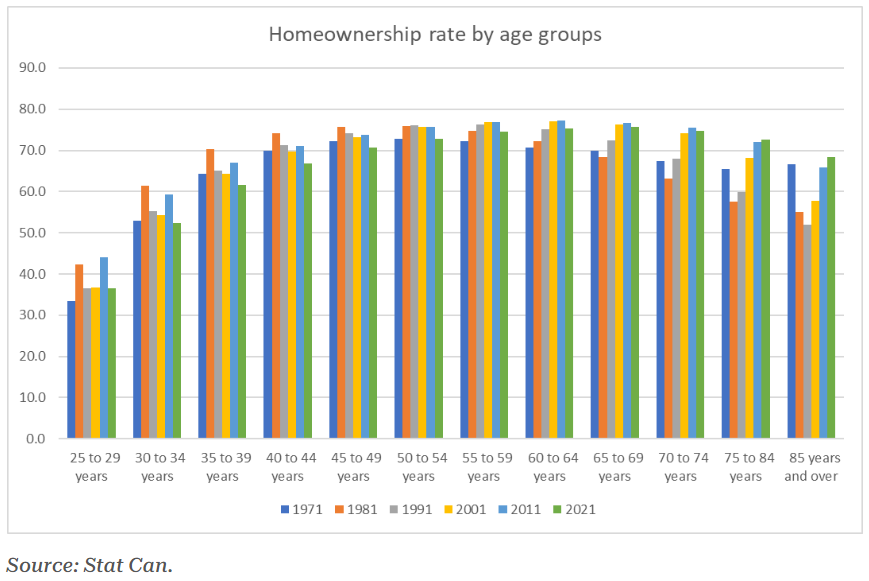

The most striking revelation in recent data is the sharp decline in homeownership among young adults. Between 2011 and 2021, the homeownership rate for this age group plummeted by at least 5 points, outpacing declines in other cohorts. The most significant dip occurred between the ages of 33 and 44, with a nearly 10-point decrease.

Homeownership Trends Over the Past 40 Years

To understand this decline, we must look back over 40 years. The last peak in homeownership rates coincided with an inflation crisis in the early 80s. Since then, individuals aged 25 to 54 have experienced a decline ranging from 5 to 10 points, with the sharpest drop in the 33 to 44 age group.

Boomers and Ownership

Contrastingly, baby boomers (60 years and older) have seen a consistent rise in ownership over the same period. Despite minor declines in some cohorts, the trend has increased by more than 10 points since the 1980s. However, survivorship bias may influence this trend, as wealthier households tend to live longer.

Credit Access and Affordability

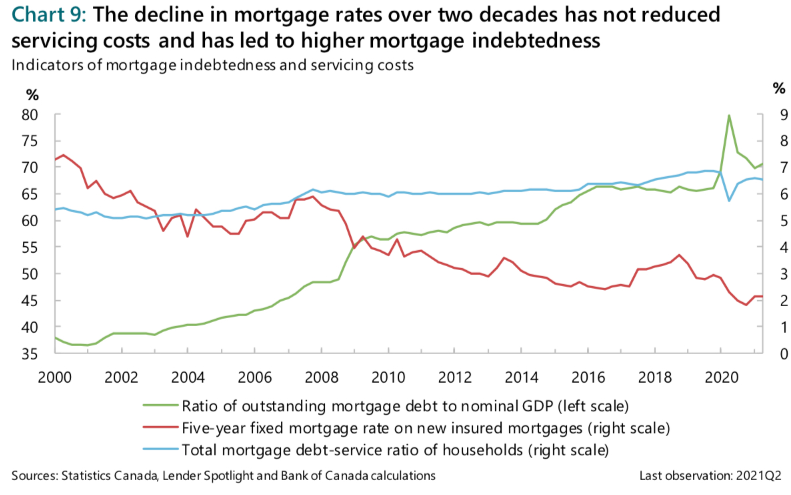

One might assume that easy access to credit would improve homeownership, but the reality is more complex. Falling interest rates over the past 30 years have not positively impacted affordability, contributing to higher home prices. Low interest rates have also allowed investors to dominate the market, potentially displacing first-time buyers.

Policy Response

In response to these challenges, Canadian policymakers are considering a return to a low-rate policy, signaling a recognition of the critical role of interest rates in homeownership dynamics.

Homeownership Trends in Canada

The overall homeownership rate in Canada declined to 66.5% in 2021 from a peak of 69.0% in 2011. This downward trend reflects a shift in housing preferences and market dynamics.

Rental Housing and Construction

Renter households grew faster than owner households, reaching 33.1% in 2021. The construction of rental housing, especially multi-unit buildings, has increased to meet the growing demand. This shift in preference is evident in the increased share of condominiums in the housing market, reaching 15.0% in 2021.

Downtown Housing and Renting

Downtown areas, particularly in large urban centers, have experienced significant growth in population and housing investment. Condominiums in these areas have seen a rise in renting, with over 50% being rented in 2021, contributing to the supply of rental units.

Affordability and Household Incomes

While housing affordability improved from 2016 to 2021, with a drop from 24.1% to 20.9% in unaffordable housing, challenges persist. The increase in median household after-tax income did not match the surge in home prices, impacting affordability for many Canadians..

Challenges Faced by Canadian Youth

The challenges in the Canadian housing market are part of broader issues affecting the well-being of Canadian youth. Approximately 19% of the population, comprising over 7.3 million individuals aged 15-29, faces challenges related to the high cost of living and housing affordability.

Investor Influence

Low-interest rates have played a pivotal role in increasing investor share, leading to the displacement of first-time buyers. This section explores the dynamics of this investor influence.

Source: Teranet

Housing Challenges

Canadian youth are more likely to rent, with a 63% rental rate compared to the national average of 33%. The higher shelter cost-to-income ratio for youth, especially in urban centers, significantly impacts their satisfaction levels and life choices.

Mental Health and Well-being

The challenges extend beyond housing, impacting mental health. Young Canadians face declining mental health, exacerbated by concerns about climate change, healthcare, and discrimination. There has been a decrease in hopefulness and life satisfaction among young Canadians aged 15 to 29 from 2016 to 2021/2022.

The Homeownership Landscape in 2023

As of 2023, the homeownership rate in Canada stands at 66.5%, the lowest since 2002. Baby boomers constitute over 40% of all homeowners, and newly built homes are less likely to be owned. Regional variations are evident, with Newfoundland and Labrador having the highest homeownership rate at 75.7%.

Mortgages and Financial Implications

Approximately 35.5% of Canadian homeowners have a mortgage in 2023, with millennials holding the largest number of mortgages. The recent 1% interest rate increase in July 2022 resulted in a 12% higher monthly payment for homeowners.

Housing Market Dynamics

House prices rose nearly 40% between 2016 and 2021, impacting affordability. In April 2023, average home prices in Canada were down 4% from the previous year. British Columbia and Ontario have the highest house prices.

The Longevity Gap and Socioeconomic Status

Beyond homeownership, a study on life expectancy in Canada reveals a significant disparity in longevity between the highest and lowest income groups.

Life Expectancy Disparity

Men in the highest income group have a life expectancy of 83 years, while the lowest income group can expect to live to 75. For women, the gap is less pronounced, with the richest women having a life expectancy of 86 compared to an average of 83 for poor women.

The decline in homeownership, especially among younger Canadians, coupled with surging home prices, reflects a changing housing landscape. Understanding these trends is crucial for policymakers, the housing industry, and prospective buyers as they navigate the evolving real estate market in Canada. In the coming years, addressing these challenges will be paramount to ensuring a stable and inclusive housing market for all Canadians.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.