The Road to Recovery

The Canadian real estate market is undergoing a significant transformation, with recent reports from the Royal Bank of Canada (RBC) indicating signs of a potential upturn. This shift is particularly noticeable in Toronto, where the housing market may be on the brink of a substantial transition. These reports are grounded in various factors, including trends in residential transactions, mortgage interest rates, and economic conditions.

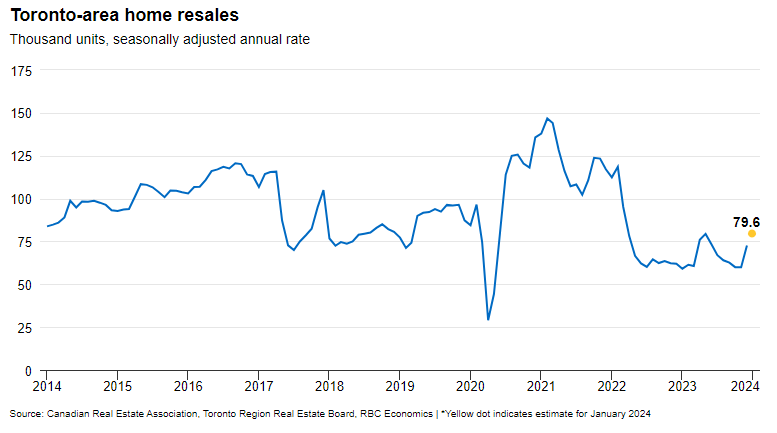

January witnessed a remarkable increase in residential transactions across major Canadian markets, marking the second consecutive month of growth. This uptick suggests a possible reversal of the downturn that began in the spring of 2022. Contributing to this rise is the decline in fixed-rate mortgage interest rates since November, which has made homebuying more accessible for many Canadians. Moreover, growing expectations of a rate cut by the Bank of Canada have bolstered buyer confidence, further stimulating market activity.

However, while these developments are encouraging, a robust and sustained recovery in the housing market is not anticipated until interest rates decline further, likely in the latter half of 2024. The potential for a more substantial turnaround hinges on continued improvements in economic conditions and affordability metrics.

One noteworthy aspect highlighted in the reports is the absence of a significant increase in sellers, despite concerns about higher borrowing costs. Instead, new listings have remained relatively subdued, leading to tighter demand-supply conditions in many markets. Nevertheless, there is a risk that mortgage renewal payment shocks could trigger a wave of distressed sales if not carefully managed.

While most major markets in Canada have witnessed declines in housing prices, Calgary has bucked the trend, with prices continuing to rise. RBC predicts a modest nationwide decrease in prices for 2024, with slight variations across provinces. Specifically, Alberta is expected to see a slight increase in prices, while Ontario may experience a decline.

In the Toronto area, signs of a potential turnaround in the housing market are evident. Increased residential transactions in recent months, coupled with favorable weather conditions, have contributed to a more optimistic outlook. However, affordability concerns remain a significant barrier for many potential buyers, keeping them on the sidelines until conditions improve further.

Meanwhile, the Toronto Regional Real Estate Board (TRREB) has released projections for the Greater Toronto Area (GTA) real estate market in 2024. According to TRREB's chief market analyst, Jason Mercer, demand for ownership housing in the GTA is expected to improve, driven by factors such as population growth, a resilient economy, and declining mortgage rates in the latter half of the year.

TRREB's projections indicate a total of 77,000 home sales for the year, with an average selling price of $1,170,000 across all home types. Despite ongoing challenges in listing inventory availability, there is continued interest in home purchases, albeit with some uncertainty among potential buyers.

The report emphasizes the urgent need for increased housing supply to accommodate the record population growth driven by immigration. TRREB president Jennifer Pearce and CEO John DiMichele have called for proactive planning and streamlined processes to address affordability and supply issues effectively. They stress the importance of avoiding short-term solutions that may exacerbate existing problems.

While there are early signs of improvement in the Canadian real estate market, sustained recovery will depend on various factors, including interest rate movements, economic conditions, and affordability metrics. The coming months will be critical in determining whether the current uptick in activity will lead to a more significant and lasting turnaround in the housing market, particularly in Toronto and the Greater Toronto Area.

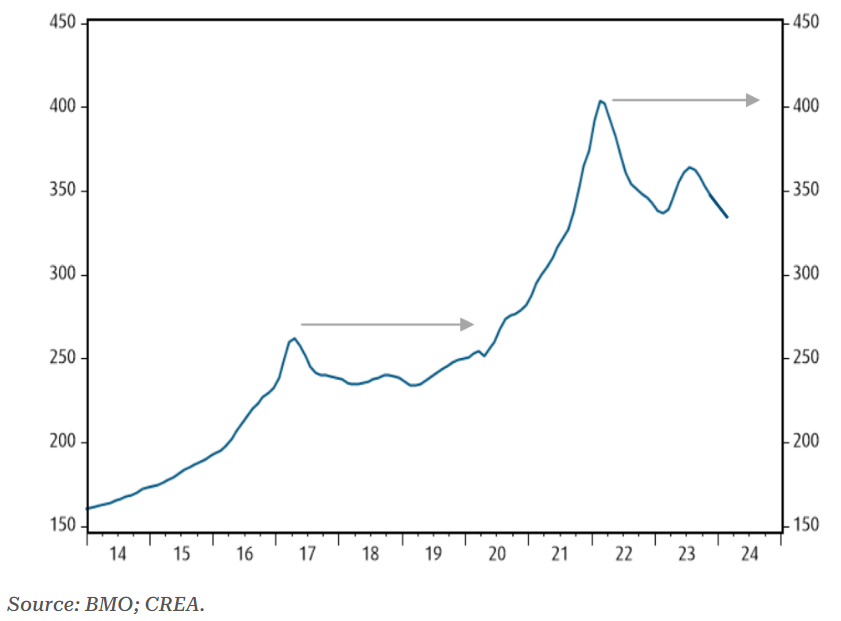

On the other hand, a recent analysis from one of Canada's largest banks, BMO, offers additional insights into the Toronto real estate market. Despite a substantial increase in existing home sales across Greater Toronto in January, prices continued to decline. BMO suggests that while the increased activity may prevent further declines and could eventually boost prices, it will take years for home prices in the region to return to their all-time highs.

Greater Toronto real estate experienced a sudden surge in activity, with TRREB reporting a significant increase in sales last month. Strength has been building in the market, particularly after bond yields peaked in October and subsequently slid lower, resulting in cheaper financing for potential buyers.

Robert Kavcic, senior economist at BMO, attributes the surge in activity to lower fixed mortgage rates, which have incentivized buyers. However, he cautions that while falling prices observed alongside increased sales may be temporary, sustained price recovery will take time.

BMO highlights that despite the increased activity, it is still a long journey back to the market's 2022 highs. Affordability remains a significant concern, and while well-qualified buyers have been waiting on the sidelines, their pent-up demand may not immediately translate into sustained price increases.

Historically, post-correction real estate markets have taken significant time to return to their previous highs. Psychological barriers and affordability challenges persist, prolonging the recovery process. While financing costs may become more favorable, it will likely be years before prices in the Toronto real estate market reach their pre-downturn levels.

While recent indicators suggest a potential upturn in the Canadian real estate market, challenges remain on the road to recovery. Factors such as interest rates, economic conditions, and affordability will continue to shape the trajectory of the market in the coming months and years. As stakeholders navigate these challenges, proactive planning and strategic interventions will be essential to ensuring a sustainable and inclusive housing market for all Canadians.

Thinking about selling your home?

Get in touch. We'll guide you through every step of the process to ensure a smooth transaction that meets your goals.