The Price of Ownership: Exploring the Impact of Maintenance Fees on Condo Affordability in the GTA

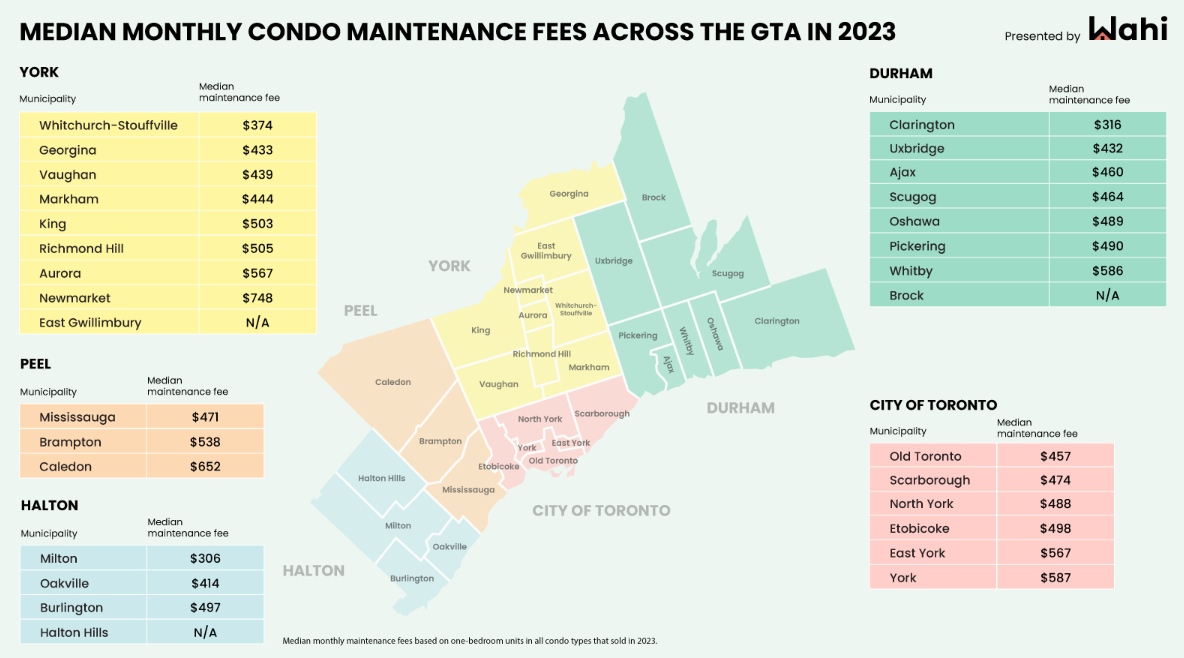

In the Greater Toronto Area (GTA), condominiums have long been touted as a more affordable housing option compared to detached homes. However, a significant and often overlooked aspect of condo ownership is the monthly common element fees, also known as maintenance fees. These fees, which cover expenses such as building insurance, common area maintenance, amenities, and contributions to the reserve fund for future repairs, have been steadily increasing, contributing to the growing unaffordability of condominiums in the region.

According to data from condos.ca, the average monthly maintenance fee across 12 Toronto neighborhoods rose by 5.51% in 2023. This sharp increase is particularly concerning for potential condo buyers, as maintenance fees are a substantial additional cost on top of mortgage payments. Andrew Harrild, co-founder of condos.ca, acknowledges the impact of inflation on these rising fees and suggests that similar increases may continue into the future.

"It's reasonable to assume the same kind of rise into 2024," says Harrild. "After mortgage payments, maintenance fees are the next biggest expense for condo owners." This statement underscores the financial burden that maintenance fees impose on condo buyers and highlights the importance of considering these fees when budgeting for a condo purchase.

The rising cost of maintenance fees is especially challenging for first-time homebuyers like John and Sarah, a young couple eager to own their first property in the GTA. With skyrocketing housing prices making detached homes unattainable, John and Sarah turned to condominiums as a more feasible option. However, they were taken aback by the high maintenance fees associated with many condo units within their budget.

"We initially only accounted for our mortgage," Sarah recalls, echoing the sentiment of many prospective buyers. "But when we started looking at condos, the additional cost of maintenance fees caught us by surprise." John adds, "It's been challenging to find a condo that fits within our budget once we factor in all the associated costs."

The impact of rising maintenance fees extends beyond individual buyers to the broader housing market in the GTA. As condo prices continue to climb, fueled by demand from both local residents and investors, the affordability gap widens, making homeownership increasingly elusive for many. Even with a sizable down payment, the combination of mortgage payments and maintenance fees can strain household budgets, limiting options for potential buyers.

It is emphasized that assessing a building's financial health is crucial before making a purchase decision. The focus should not solely be on low maintenance fees. Instead, it's essential to review the building's status certificate to identify any potential risks, such as special assessments or insufficient reserve funds for future repairs.

Special assessments, in particular, can pose a significant financial burden for condo owners. These one-time costs or budget shortfalls are typically passed on to unit owners, requiring them to cover additional expenses on top of their monthly maintenance fees. Brown warns against overlooking these risks, urging buyers to thoroughly examine a building's budget and potential repair needs before making a decision.

The challenge of rising maintenance fees is compounded by the lack of affordable housing options in the GTA. With rental prices also on the rise, many residents feel pressured to pursue homeownership as a means of stability and long-term investment. However, the reality of escalating maintenance fees forces potential buyers like John and Sarah to reconsider their options and adjust their expectations accordingly.

Despite the financial hurdles, some buyers remain optimistic about the prospect of homeownership in the GTA. For Michael, a young professional saving to purchase his first condo, the allure of building equity and securing a stable living arrangement outweighs the challenges posed by maintenance fees. "Owning a home is a long-term goal for me," Michael explains. "While the rising costs are concerning, I believe it's worth it in the end."

The rising unaffordability of condominiums in the GTA due to increasing maintenance fees underscores the need for comprehensive housing policies and solutions. As demand continues to outpace supply, policymakers, developers, and stakeholders must collaborate to address affordability issues and ensure that homeownership remains accessible to all residents, regardless of income level.

The escalating cost of maintenance fees poses a significant barrier to homeownership in the Greater Toronto Area. Prospective buyers must carefully consider these fees when evaluating their housing options and seek guidance from experienced professionals to navigate the complexities of the real estate market. By prioritizing transparency, financial stability, and long-term planning, individuals can make informed decisions that align with their goals and aspirations of homeownership in the GTA.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.