The Grim Reality of Labor Markets and Consumer Confidence

In recent times, the mainstream narrative about the US economy has painted an optimistic picture of a robust recovery. However, a closer look at the data reveals a starkly different reality. The labor market, consumer confidence, and financial trends indicate a struggling economy, far from the rosy outlook often portrayed. Retail giants like Walmart, Target, and Indeed provide sobering insights that challenge the prevailing optimism.

The Illusion of a Strong Job Market

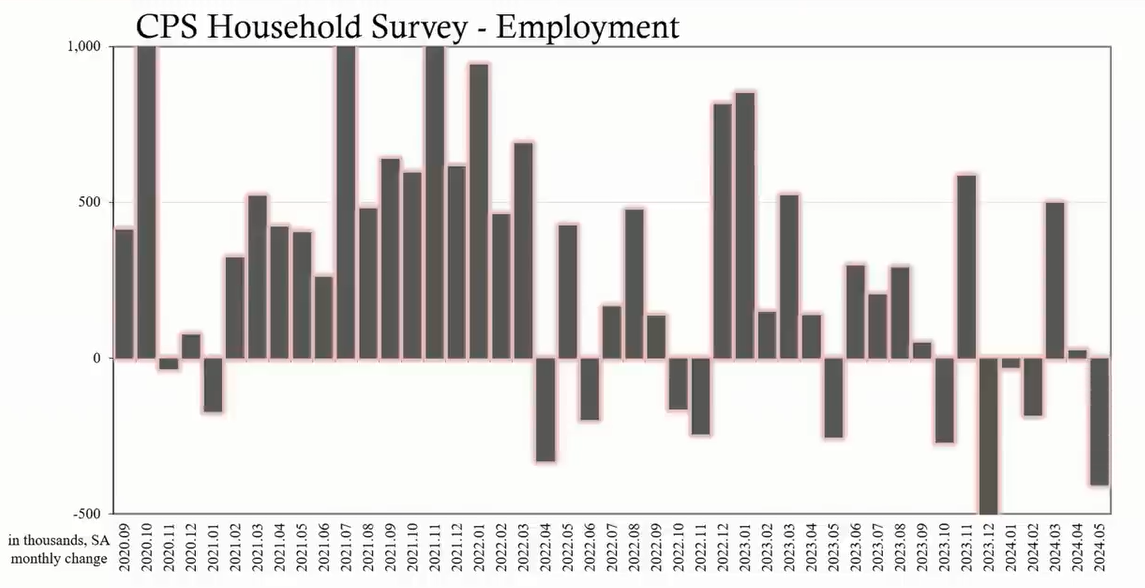

Despite the repeated assertions of a strong labor market, the reality for many American workers is bleak. Indeed, one of the largest staffing firms, recently announced another round of layoffs, cutting 1,000 jobs or 8% of its workforce. This follows last year’s layoffs of 2,200 employees. The company's CEO, Chris Hyams, acknowledged the grim truth in a corporate press release: "While the global economy has improved in several areas over the past year, we are not yet set up for sustainable growth... We don't really see any pickup, especially in the US."

Source: Eurodollar University

The situation at Indeed reflects a broader trend of job insecurity and weak labor market performance. The University of Michigan's consumer confidence index plummeted by the most in a single month in its 46-year history, driven primarily by fears of job loss. Consumers are increasingly skeptical of the so-called "booming job market," with many feeling that the market is a complete sham.

Financial Distress and Rising Delinquencies

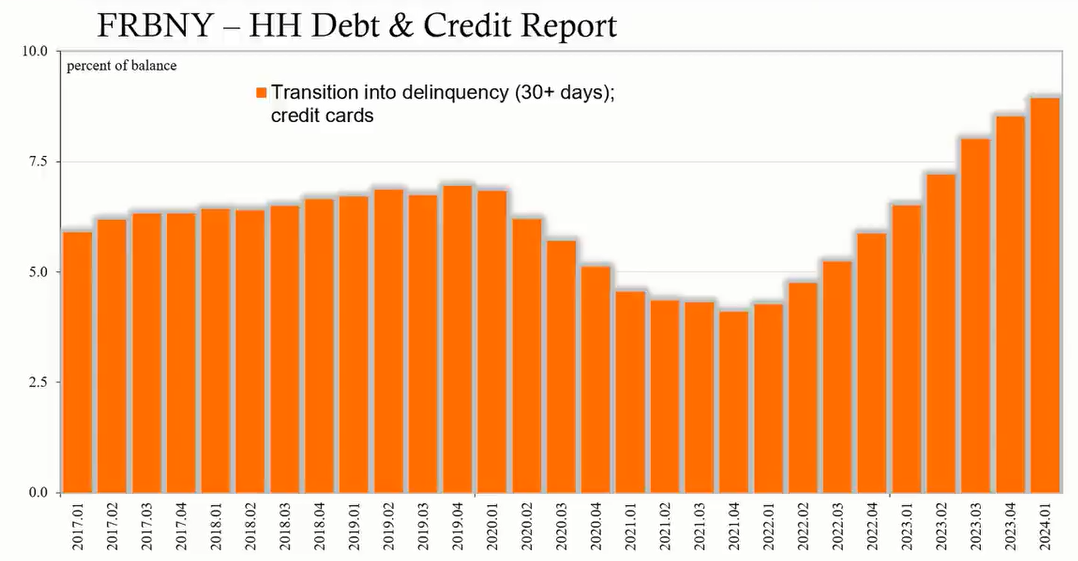

The financial distress among American households is becoming increasingly evident. The Federal Reserve Bank of New York reported an alarming rise in missed credit card payments, signaling worsening financial conditions. According to their data, the share of maxed-out borrowers is approaching pre-pandemic levels, and delinquency transition rates are noticeably higher than before the pandemic. The New York Fed warned that if these trends continue, credit card delinquencies are likely to rise further, posing significant risks to the banking system.

Source: Liberty Street Economics

Auto loans, another major component of consumer debt, are also showing signs of strain. Delinquency rates for auto loans have reached their highest levels since the Great Recession, indicating that many households are struggling to keep up with their payments. The total outstanding auto loans now stand at a staggering $1.62 trillion, surpassing credit card debt. As more consumers fall behind on their auto loan payments, the signs of a late-stage economic cycle become increasingly apparent.

Retail Giants Sound the Alarm

Retail giants like Walmart and Target have provided additional evidence of the economic struggles facing American consumers. Walmart's recent financial results revealed a concerning trend: while sales figures appeared strong, they were primarily driven by inflation rather than increased consumer spending. The company noted that consumers are spending more on necessities like groceries, leaving less disposable income for discretionary items.

Target, on the other hand, has been grappling with a significant shift in consumer behavior. The company reported that shoppers are increasingly focused on buying essentials, a clear indication of financial strain. Target's CEO highlighted the challenging economic environment, stating, "Consumers are feeling the pinch, and it's reflected in their spending habits. They're prioritizing needs over wants, and that's having a direct impact on our sales." In response to this, Target is lowering prices on 5,000 frequently purchased items.

The Housing Market: A Double-Edged Sword

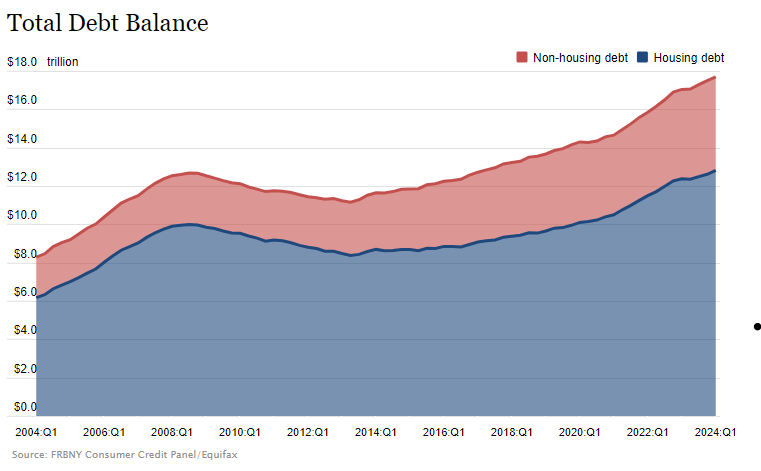

The housing market, often seen as a barometer of economic health, is also sending mixed signals. While home prices have risen, driven by low inventory and high demand, this trend has created affordability issues for many potential buyers. Home equity lines of credit have been increasing as homeowners tap into their equity to make ends meet. However, this reliance on home equity is a precarious strategy, especially as interest rates rise and the risk of defaults grows.

Source: Federal Reserve Bank of New York

The Federal Reserve Bank of New York's report on household debt highlights this concerning trend. The data shows that while home equity lines of credit have provided a lifeline for some, they also reflect the underlying financial distress. If banks tighten lending standards or if home values decline, many homeowners could find themselves in a difficult position, further exacerbating the economic challenges.

Consumer Sentiment: A Growing Divide

Consumer sentiment is another critical indicator of economic health, and recent surveys reveal a growing divide between the official narrative and the lived experiences of many Americans. The Conference Board's consumer confidence index fell to its lowest level in several years, with concerns about jobs and incomes dominating respondents' fears. Wage growth has failed to keep pace with rising prices, leaving many households feeling financially squeezed.

The Federal Reserve Bank of New York's survey of consumer expectations also paints a grim picture. One year ahead inflation expectations have risen slightly, but long-term expectations remain subdued. This suggests that consumers are more concerned about immediate financial pressures than about potential future inflation. The University of Michigan's survey echoed these findings, with respondents citing fears of job loss and income stagnation as major concerns.

The Path Forward: Uncertain and Fraught with Risks

The data and trends highlighted by retail giants, financial institutions, and consumer surveys all point to an economy that is far weaker than the official narrative suggests. The labor market struggles, rising delinquencies, and declining consumer confidence paint a picture of an economy in distress. As more consumers max out their credit cards, fall behind on loan payments, and tap into home equity, the risks to the broader financial system grow.

Source: Eurodollar University

The optimistic portrayal of the US economy as strong and resilient is increasingly at odds with the reality faced by many Americans. The data from Indeed, Walmart, Target, and other sources reveals a troubling picture of job insecurity, financial distress, and declining consumer confidence. It is crucial to acknowledge these challenges and address the underlying issues to ensure a more stable and equitable economic future.

Not sure if you should sell?

We get it. The market is weird. If you’re not sure if selling your home is the right move for you right now, get in touch. We’ll go over the details of your specific situation and help you make the right decision.