"The Great Adjustment": Canadians navigate challenges and opportunities heading into 2024

The market is experiencing a significant shift, akin to a tempestuous sea. The past four years have been a rollercoaster ride, influenced by global events and economic forces, culminating in what experts are terming a 'great adjustment.' Let's delve deeper into the currents shaping the Greater Toronto Area (GTA) and the broader Canadian real estate scene.

The Royal LePage Market Survey serves as our reference, providing insights into the nuanced picture of highs, lows, and the promise of a transformative 'great adjustment.' The impact of a global pandemic in 2020 momentarily halted market activities, only to be followed by a swift surge in demand, driving property values to unprecedented heights by the spring of 2022.

The abrupt increase in interest rates, implemented to counteract inflation, triggered a correction in the market. This 'great adjustment' has introduced a new normal, with mortgage rates expected to stabilize between four to five per cent. Phil Soper, Chief Executive of Royal LePage, rightly terms this phase as the time when the acceptance of a mortgage rate of four to five per cent becomes the new norm, untethering pent-up demand.

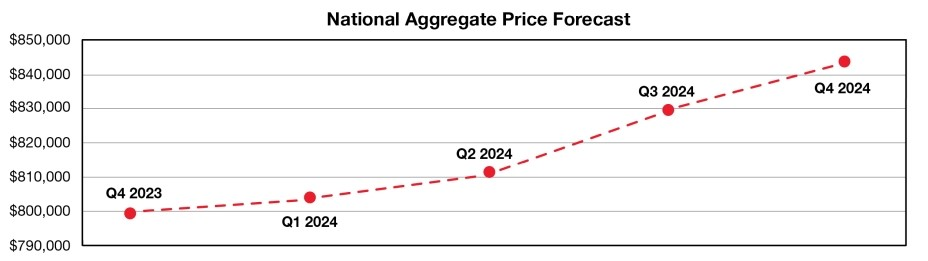

Royal LePage's crystal ball foresees a 5.5% year-over-year increase in the aggregate price of a home in Canada by the end of 2024, reaching $843,684.

However, the 'great adjustment' introduces uncertainties, especially in key markets like Toronto. The dance of supply and demand, coupled with the 'great adjustment,' makes Toronto a city to watch.

Beyond the city core, the GTA's real estate market is a dynamic ecosystem of its own. With a predicted 6% increase in home prices mirroring Toronto's trajectory, the suburbs emerge as integral players in the real estate symphony. As interest rates continue to influence market rhythms, the suburbs, flush with buyers' savings from the market's ebb, anticipate a resurgence in confidence in the second half of 2024.

Yet, challenges persist. Affordability remains a formidable hurdle, and the delicate balance between supply and demand is ever-shifting. For the past year, many Canadians have fixated on the idea of interest rates needing to decrease significantly before entering or re-entering the housing market. The acknowledgment that a mortgage rate of four to five per cent is the new normal should untether pent-up demand as first-time buyers regain the confidence to go home shopping.

Royal LePage's forecast not only anticipates a rise in home prices but also acknowledges the intrinsic connection between interest rates and buyer behavior. The second half of 2024, marked by predicted interest rate cuts, is poised to be a turning point, potentially heralding a resurgence in market activity.

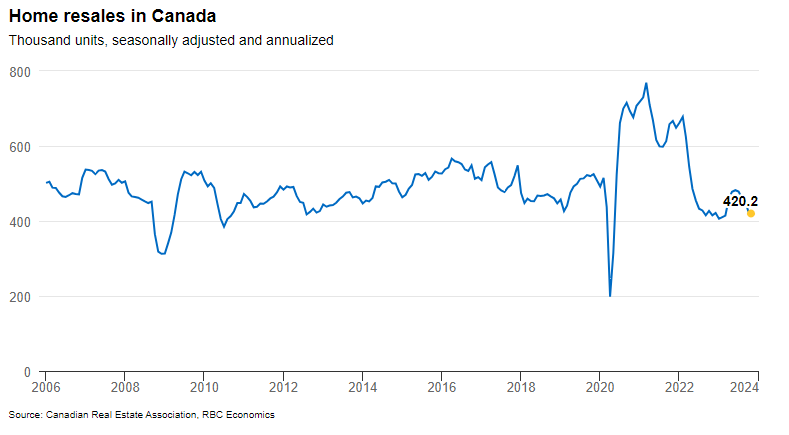

The plot continues to thicken as we look at the broader Canadian context provided by additional resources. Ontario, particularly, stands as a focal point of the housing market cooldown. Higher interest rates are exerting their influence, with home resales in the province falling for the fifth consecutive month in October, reaching levels not seen since the Great Financial Crisis, excluding the pandemic shutdown period.

The cooling trend extends to other regions, albeit to a lesser degree. Even the usually robust Alberta is displaying early signs of softening, with resales falling 8.3% month-over-month in October. Nationally, home resales have dropped nearly 12% over the past four months, reversing three-quarters of the spring rebound.

This nationwide decline in resales, coupled with a growing number of homes listed since spring, has entirely unwound the tight demand-supply conditions observed earlier this year. Buyers, now in a stronger bargaining position, have successfully extracted price concessions from sellers, leading to a decline in the national aggregate MLS Home Price Index.

The supply side presents a nuanced perspective. While new listings have trended higher since spring, their levels remain within a pre-pandemic range. Little evidence suggests an acceleration in new listings, and in fact, new listings fell in Canada and most major markets in October.

Looking ahead, the market is likely to remain quiet into the next year. High interest rates, affordability challenges, and mounting economic uncertainty have subdued homebuyer demand. The prospect of higher interest costs may bring more sellers to the market, potentially giving buyers even more pricing power in the months ahead.

The Canadian real estate landscape is undergoing a profound transformation. The 'great adjustment' reshapes buyer behavior, while external factors such as interest rates exert their influence. The GTA and its suburbs find themselves at the epicenter of these changes, facing challenges of affordability and navigating the delicate dance between supply and demand.

This downturn is not unique to the GTA; Ontario, in particular, experiences a notable cooldown. Home values face downward pressure, with property values in Ontario declining in the last three months at an accelerating pace. The MLS Home Price Index for Ontario fell 1.4% month-over-month in October, reflecting the broader shift in the province.

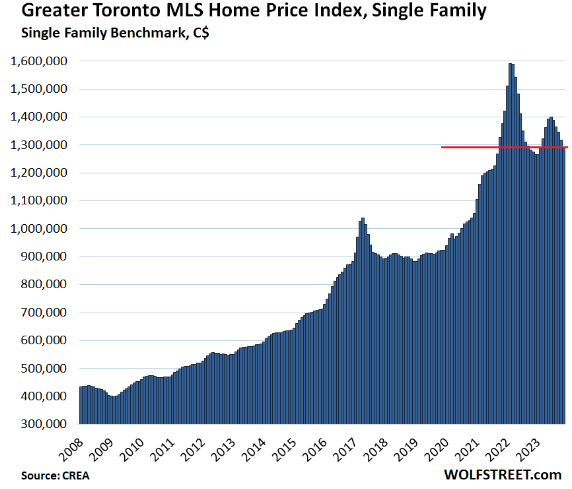

The GTA, a traditionally vibrant real estate hub, sees its own set of challenges. The MLS Home Price Benchmark Index for single-family houses in the Greater Toronto Area fell 2.0% in November from October, marking the fifth consecutive month of declines. The November drop whittled down the year-over-year gain to 1.3%.

The ripple effect extends to other markets, with Hamilton experiencing a 3.0% drop in the benchmark price in November from October, reaching a cumulative decline of 25.4% since its peak in February 2022. Meanwhile, Calgary bucks the trend, with the single-family benchmark price rising to a record $638,600, up by 12.1% year-over-year.

As we dissect these numbers, it's evident that the central-bank engineered easy-money spikes are giving way to market corrections. Home prices are undergoing declines across various markets, with Toronto witnessing a 19% drop from its peak, bringing values back to September 2021 levels.

The broader Canadian context reveals a trend of declining home prices, driven by the impact of high-interest rates. The Bank of Canada's decision to keep rates at 5.0% since July has reshaped the real estate landscape. Home prices have fallen 1.7% in November from October, marking the fifth consecutive month of declines. This has whittled down the year-over-year gain to a mere 0.9%.

The housing market, once characterized by a frenzy of activity and soaring prices, is now grappling with the aftermath of the easy-money era. The Bank of Canada's decision to raise rates has set the stage for a correction, with Toronto, Hamilton, and other markets experiencing notable declines.

Looking ahead, sluggish activity is expected to linger into 2024. With interest rates likely to stay high, elevated ownership costs will remain a deterrent for homebuyers. This is particularly pronounced in Ontario and B.C., where affordability is most stretched. The prospect of higher interest costs may trigger more sellers to enter the market, giving buyers additional pricing power.

The Canadian real estate market is navigating uncharted waters. The GTA and its suburbs, once bustling with activity, now face headwinds of affordability and shifting demand-supply dynamics. As the market adjusts to the new normal, the ripples are felt not only in Ontario but across the nation. Having settled into the post-easy-money era, the real estate market is undergoing a period of correction and recalibration.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.