Teranet Index reports a second consecutive monthly decline

In the economic tapestry of Canada, the latest releases from the Teranet House Price Index and the RBC Canadian Inflation Watch offer a profound glimpse into the intricate dance between real estate markets and inflationary pressures.

The Teranet-National Bank House Price Index for November 2023 paints a nuanced picture of the Canadian real estate landscape. The Composite House Price Index, reflecting the second consecutive monthly decline, slipped by 0.5% month-over-month. This correction is not uniform across the nation, with Montreal leading the descent at -2.2%, followed by Hamilton, Winnipeg, Toronto, and Halifax, all experiencing negative month-over-month changes.

Delving deeper, regional disparities become evident. While Quebec City, Halifax, and Vancouver boast year-over-year gains, Edmonton faces a decline of -2.3%, and Hamilton remains stable. The Composite 11 index, a measure of 11 major Canadian metropolitan areas, saw a 0.9% decline in the 12 months, signaling a market correction.

The economic analyst behind these insights, Daren King from the National Bank of Canada, emphasizes the continuation of the correction trend, projecting no imminent relief for homeowners and anticipating further price declines in the coming months.

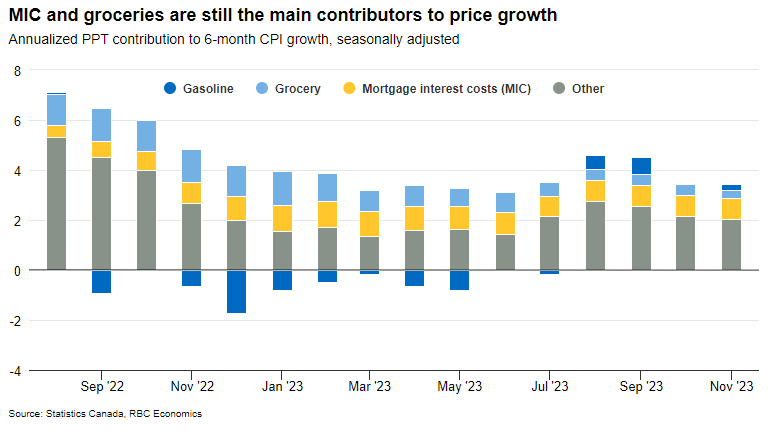

Shifting our gaze to the RBC Canadian Inflation Watch, we encounter a different facet of the economic landscape. In November 2023, the Canadian CPI held at 3.1%, slightly above the Bank of Canada's target range of 1% to 3%. The main contributor to this growth was mortgage interest costs (MIC) comprising 29.8% of the overall CPI reading.

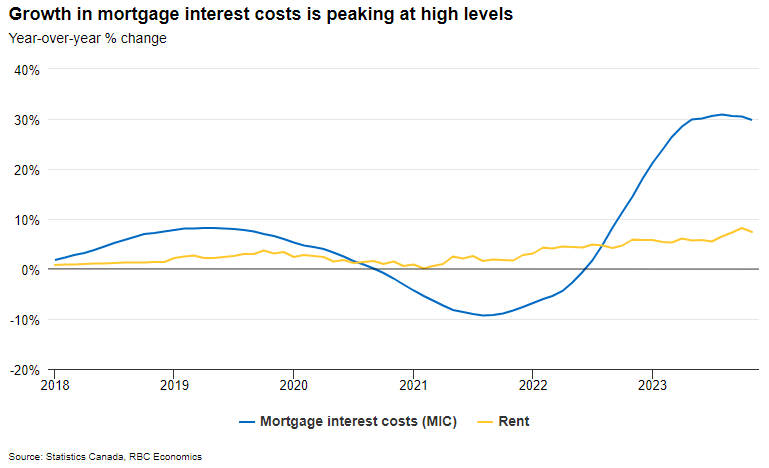

Claire Fan, an economist at RBC, underscores the macroeconomic trends and key indicators influencing Canada and the US. The report points out the peaking levels of mortgage interest costs, a factor contributing significantly to the inflationary pressures.

The real intrigue lies in understanding how the dynamics of the real estate market, as reflected in the Teranet House Price Index, intertwine with inflationary pressures, as highlighted in the RBC Canadian Inflation Watch.

Mortgage interest and shelter costs are the linchpin, showcasing how changes in Composite House Price Index values directly impact shelter costs. This influence extends to the CPI, where mortgage interest costs are identified as a key contributor to overall price growth.

Examining the regional disparities in real estate trends helps contextualize inflationary pressures. For instance, while Quebec City sees an 8.5% year-over-year gain in house prices, the inflationary pressures in Edmonton are counteracted by a -2.26% year-over-year change.

The RBC Inflation Watch delves into the components of the CPI, with mortgage interest costs and groceries taking the spotlight. As housing costs remain a dominant force, the inflationary impact of shelter services becomes apparent.

As we navigate the complexities of these economic indicators, the implications become multifaceted. While the Teranet Index hints at a continued correction, the RBC Inflation Watch suggests a delicate balance between contributing factors.

The surge in mortgage interest costs, as highlighted by the RBC Canadian Inflation Watch, signifies a pivotal moment in the real estate market dynamics. This peaking trend in mortgage expenses is not only a significant factor contributing to overall inflation but also appears to be exerting a palpable influence on the pace of real estate transactions.

The November inflation report offers a mix of surprises and expected trends. Shelter services, particularly owned accommodation, continue to be a major contributor to price growth. On the flip side, cellular services and energy prices present a counterbalance, exerting downward pressure on inflation.

Looking ahead, the reports provide a glimpse into potential future scenarios. The Teranet-National Bank Composite Index's ongoing correction signals challenges for the real estate market, while the RBC's cautious optimism hints at progress in inflation containment.

The intricate dance between real estate trends and inflationary pressures reveals a story of interconnected economic forces. The influence of mortgage interest and shelter costs on the CPI is undeniable, shaping the narrative of Canada's economic landscape. As we await the next chapter in January 2024, the synergy between real estate and inflation remains a central theme in the evolving saga of the Canadian economy.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.