Taxing Dreams

The construction industry in Canada faces a myriad of challenges that continue to impede progress, despite recent tax breaks. High building costs, soaring interest rates, and substantial government charges collectively pose significant hurdles, making it increasingly difficult for builders to turn a profit on new construction projects.

Ed Sonshine, the founder and chairman of RioCan REIT, aptly points out the current uneconomical nature of new construction projects. The combination of high interest rates and construction costs creates an environment where profitability remains elusive. This, in turn, has a direct impact on the housing construction efforts in Canada, particularly for purpose-built rental housing, which Sonshine suggests is financially challenging except in extraordinary circumstances.

The recent removal of the Goods and Services Tax (GST) on new rental builds by the federal government was a step in the right direction. However, it only partially addressed the overarching cost issues. Taxation still represents a substantial portion, accounting for 30% of a construction project’s costs. The removal of GST, while positive, hasn't completely alleviated the financial burden, as evidenced by RioCan REIT's decision to halt all new construction starts due to rising costs.

Jonathan Gitlin, the CEO of RioCan REIT, emphasizes that, in the short term, new construction isn't the most effective use of shareholders' money. This sentiment underscores the gravity of the challenges faced by the industry, where even major players are reevaluating their strategies in light of the current economic landscape.

The impact of government policies on construction costs is evident. While the removal of GST was a welcome move, it was somewhat offset by an increase in interest rates. The delicate balance between addressing cost hurdles and meeting the demand for housing construction remains a crucial challenge for policymakers.

Recent statistics from Statistics Canada indicate ongoing activity in the construction sector, with 64,400 new residential construction permits issued in the third quarter of 2023. This, however, is juxtaposed against the cautious outlook for the industry. The need for a balance between addressing cost hurdles and meeting the demand for housing construction is evident.

Real estate developer Brad Cartier provides a personal perspective on the taxation impact on new housing in Canada. Developers face substantial tax burdens, with Cartier citing an example of paying about $427,250 in taxes on a six-unit building, roughly a third of the total cost. The Canadian Center for Economic Analysis (CANCEA) report further reveals that governments make up to three times more money on new housing construction than developers do, with the tax burden in Ontario averaging 31% of the purchase price.

The study highlights the inconsistency in tax approaches, comparing the higher taxation on housing with lower taxes on industries like alcohol and casinos. While positive changes, such as the removal of GST on rental housing construction, have been implemented, Cartier calls for a fundamental shift in how governments treat housing. He argues that housing should not be a profit center for governments and urges prioritization of affordable housing by reducing tax burdens and promoting construction.

Ontario's recent decision to eliminate eight percent of the provincial harmonized sales tax (HST) on new purpose-built rental housing aligns with the federal government's initiative to waive general sales tax on new rental developments. This move, when combined with the federal decision, results in a total tax cut of 13 percent for all new long-term rentals in Ontario.

The provincial tax elimination is retroactive to September 14, in alignment with the federal government's announcement. The aim is to make thousands of homes economically viable, facilitating their construction in the coming years. Municipal Affairs and Housing Minister Paul Calandra emphasizes the economic viability of removing the provincial portion of HST, making the construction of purpose-built rentals a more feasible endeavor.

Further support for purpose-built rental housing comes from the federal government, introducing an enhanced rebate effective immediately, relieving the goods and services tax (GST) on construction. The rebate applies to certain residential rental buildings, including apartments, student housing, and senior residences, with construction starting between September 14, 2023, and December 31, 2030, and completion by December 31, 2035.

The enhanced rebate, with proposed changes increasing the rental rebate to 100%, aims to encourage the construction of purpose-built rentals. Qualification criteria include specific conditions for residential units and a focus on long-term residential units. The changes also encourage provinces to align their provincial sales tax with federal relief, promoting a cohesive approach to support housing affordability.

This relief significantly benefits real estate developers and investors involved in the construction of new purpose-built rental housing, aligning with the government's focus on addressing housing affordability challenges. The legislative process is ongoing, with updates expected, emphasizing the dynamic nature of the industry.

Amidst these initiatives, the residential construction landscape in Ontario faces challenges, with a 3.7% decline in building permits in August. This decline underscores a substantial challenge for a province aspiring to reach 170,000 new homes annually. Projections, however, hover around 100,000 or even less, revealing a potential shortfall in meeting the growing demand.

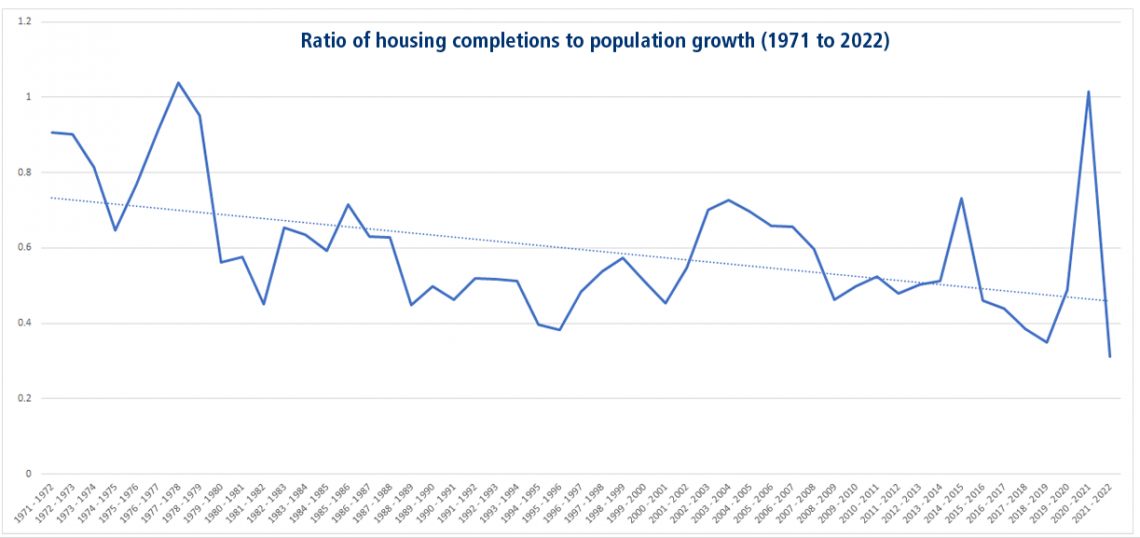

Canada is lagging behind international peers in total homes per person. A comparison over time reveals a significant decline in the construction of new homes relative to population growth.

Before 1989, Ontario municipalities negotiated "lot levies" with developers on a site-specific basis, a process that became financially unpredictable and risky for local governments. The Municipal Act required justifying these charges by demonstrating the direct or indirect need for services resulting from the construction of a specific subdivision. However, larger and more sophisticated developers could leverage their influence, reducing contributions and leaving municipalities to cover the remaining costs. This unpredictability led municipalities to seek a more stable approach.

In the 1970s, a new home was built for every 1.2 additional Canadian inhabitants, while in the 2010s, this ratio increased to one home for every 2.1 new inhabitants. The 1970s saw consistent completion of over 200,000 homes each year, a pattern not replicated in the 2010s. The overall trend shows a decline of about 40% in the ratio of annual housing completions to population growth from 1971 to 2022.

The disconnect between a robust 68% increase in population since the 1970s and a discouraging 23% decrease in the annual rate of new housing completions presents a socio-economic conundrum. The lack of affordable housing options is triggering an exodus of the younger demographic from cities, emphasizing the urgency for decisive intervention to reverse this adverse trend.

The paradigm shifted in 1989 with the introduction of the Development Charges Act (DCA), empowering municipalities to enact bylaws for property owners to cover capital costs associated with growth. This marked a departure from the site-specific negotiation model to a uniform municipal-wide approach. The Act defined the items for which developers could be charged, spanning both "hard" infrastructure like sewers and roads, and "soft" infrastructure like municipal administration buildings. The legislation aimed to bring consistency to charge calculations across the municipality and mitigate the financial risks associated with the site-specific method, ultimately concluding the longstanding debate over how charges should be assessed.

The residential construction sector in Ontario, contributing nearly $58 billion to the province's GDP, is a linchpin in the economic framework. It employs over 600,000 individuals, underscoring the necessity to address challenges confronting the industry. Proposed solutions, emerging from deliberations at the Housing Supply Summit, emphasize the imperative to streamline approval processes, expedite construction initiation, and confront systemic issues, notably bureaucratic red tape and onerous taxes, fees, levies, and development charges.

The tax burden on new housing, standing at an imposing 31% of the purchase price, represents a clear misalignment with the broader economy. Research findings reveal a stark contrast, with the federal government garnering 39% of tax revenue from new housing while contributing only 7% to infrastructure investment in Ontario.

As Canada faces the imminent need for up to six million new homes in the next decade, urgent calls for federal intervention resonate. Incremental adjustments are insufficient; substantial, far-reaching plans and reforms are required to holistically address the multifaceted challenges bedeviling the residential construction sector in Ontario.

In a scenario where a consumer buys a $1 million home, the buyer pays $310,000 in taxes, fees, and levies. When mortgaged over 25 years at six percent, this amounts to $285,020 in interest. The disparity between the federal government's 39% share of tax revenue generated from new housing and its meager 7% contribution to infrastructure investment in Ontario underscores the need for comprehensive reforms.

The urgency of the situation demands a fundamental reconsideration of tax policies to ensure the viability and sustainability of construction projects. Real estate developers, investors, and the general population stand to benefit from a concerted effort to address the root causes of the challenges facing the construction industry. As the legislative process unfolds, it's essential to stay informed about the dynamic changes shaping the future of housing construction in Ontario.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.