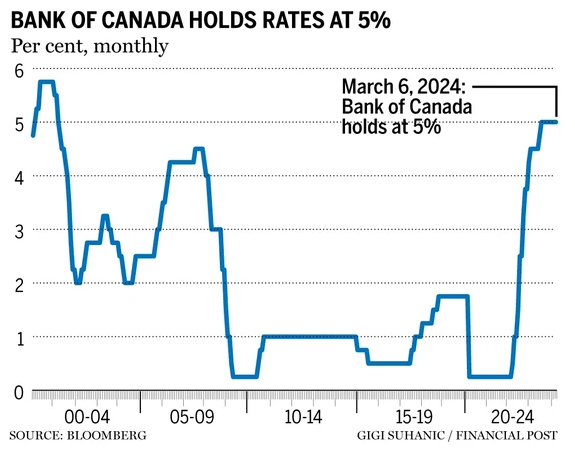

Spring Housing Market on Hold: Bank of Canada Holds Key Interest Rate At 5%

As the Bank of Canada convened for its most recent policy rate decision, market participants eagerly awaited insights into the central bank's strategy amidst evolving economic conditions. The decision to maintain the overnight rate at 5% marked the fifth consecutive meeting without a change, underscoring the bank's commitment to stability while navigating uncertain economic waters.

Governor Tiff Macklem's remarks during the press conference provided valuable context for the decision. Macklem emphasized the bank's data-driven approach, citing ongoing concerns about inflationary pressures despite recent moderation in headline inflation figures. The persistence of high core inflation measures suggests underlying inflationary forces, prompting the bank to proceed cautiously with any adjustments to the policy rate.

The decision reverberated across financial markets, with investors parsing through the nuances of the bank's communication for clues about future monetary policy actions. The Canadian dollar experienced a slight appreciation against major currencies following the announcement, reflecting market sentiment towards the bank's stance. Meanwhile, futures markets adjusted their expectations for the timing of potential rate cuts, signaling a more gradual path toward monetary easing.

This measured approach by the Bank of Canada reflects its assessment of the broader economic landscape. While recent data points to signs of recovery, including robust growth in certain sectors, uncertainties persist, particularly surrounding the trajectory of inflation and the labor market. The bank remains vigilant, closely monitoring economic indicators to ensure that its policy decisions support sustainable economic growth and price stability.

In assessing the economic landscape, the Bank of Canada faces a delicate balancing act between supporting growth and guarding against inflationary pressures. Recent economic data has painted a mixed picture, with some indicators pointing to a robust recovery while others suggest ongoing vulnerabilities.

One area of concern is the housing market, where policymakers are wary of potential overheating. Despite recent cooling measures, housing prices remain elevated, driven by strong demand and limited supply. The central bank's decision to maintain the policy rate reflects its intention to avoid exacerbating housing market imbalances while supporting broader economic objectives.

Another factor shaping monetary policy decisions is the labor market. While employment has rebounded strongly from the depths of the pandemic, there are lingering concerns about the quality of jobs being created and the extent of labor market slack. Wage growth, in particular, has been sluggish, suggesting that there may still be room for improvement in the labor market.

In addition to domestic considerations, policymakers must also contend with external risks, including geopolitical tensions and shifts in global financial conditions. The uncertain outlook for trade and the potential for supply chain disruptions add further complexity to the economic landscape, requiring policymakers to remain vigilant and nimble in their response.

Looking ahead, the Bank of Canada will continue to closely monitor economic developments and adjust policy as necessary to achieve its dual mandate of price stability and full employment. While the path forward may be uncertain, policymakers remain committed to supporting a sustainable and inclusive recovery for all Canadians.

The central bank's communication strategy plays a crucial role in shaping economic outcomes and influencing market behavior. By providing clear and consistent guidance, policymakers help to reduce uncertainty and volatility in financial markets, supporting overall economic stability and growth. Effective communication will remain a key tool in the central bank's efforts to support a resilient and sustainable expansion.

However, amidst this cautious approach, the Bank of Canada has signaled that it is not making any policy moves until it hears the federal budget on April 16, 2024. This stance is likely to put a damper on any hopes for a rebound in the spring housing market, as potential homebuyers may adopt a wait-and-see approach until there is more clarity on the economic and policy outlook.

The Bank of Canada's decision to maintain its key interest rate at 5% reflects a careful balancing of competing objectives. By holding rates steady, policymakers aim to support economic recovery while also guarding against inflationary pressures and financial instability. As the Canadian economy continues to navigate through uncertain waters, the central bank stands ready to adjust policy as needed to ensure a resilient and sustainable recovery for all Canadians.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.