Space to Live? Canada's population grew by 430,635 and housing starts fell 22%

A complex interplay of factors molds the course of property values and rental markets in Canada. The endeavor to reinstate housing affordability in Canada emerges as a joint venture involving both the private sector and the government, with the private sector assuming a pivotal role. However, this collaborative pursuit encounters hurdles within the economic landscape, marked by the surge in interest rates, escalating construction costs, and burgeoning development fees.

This trio of challenges has not only culminated in a reduction of planned projects but has also intensified the existing affordability crisis. Notably, the population experienced a staggering growth rate of 430,635 in just three months, from July 1 to October 1, further amplifying the urgency of addressing these pressing issues within the Canadian real estate sector.

Rental developers in Canada are navigating a landscape fraught with challenges, including a surge in construction costs and higher lending rates. Adjusting strategies to cope, smaller developers with higher financial indebtedness have been more likely to pause or scale back future projects, indicating a reduction in planned projects. Conversely, developers with more capital and long-term investment plans are leaning towards purpose-built rental projects, enticed by the potential positive returns over time.

Current market conditions further complicate the landscape, as highlighted by the Canadian Rental Housing Construction Survey. Smaller developers, burdened by higher financial debt, are hesitating to proceed with future projects. Conversely, developers with more capital and long-term investment plans are leaning towards purpose-built rental projects, enticed by the potential positive returns over time.

Recognizing the need to stimulate the construction of new rental housing, the federal government has introduced legislation and policy changes. One significant initiative is the enhancement of the Canadian Mortgage Bond (CMB) program, unlocking $20 billion in low-cost financing for multi-unit rental construction. Another change involves the removal of the Goods and Services Tax (GST) on new purpose-built rental housing, providing tangible tax relief for developers.

As the economic environment tightens, developers have adjusted their strategies, either reducing the potential future supply of rental housing or adapting their strategies to move along new construction projects. Smaller developers with larger financial indebtedness are more likely to pause their new projects or reduce the number of future projects. In contrast, those with deeper pools of capital and longer-term investment horizons are likely to be active in purpose-built rental projects.

In the context of restricted financial conditions, the federal government's recent introduction of new legislation and policy changes aims to stimulate the construction of new rental housing. One notable initiative is the enhancement of the Canadian Mortgage Bond (CMB) program, unlocking $20 billion in low-cost financing for multi-unit rental construction.

Canada's population growth remains robust, with a 1.1% increase in the third quarter of 2023, driven primarily by strong permanent and temporary immigration. This growth has implications for both the short-term and long-term aspects of the economy, influencing demand for goods and services. The six-month trend in Canadian housing starts, although higher in November at 257,777 units, witnessed a 22% decrease compared to October.

International migration continues to be the main source of Canada's population growth, contributing to 96% of the growth in the third quarter of 2023. The reliance on net non-permanent resident (NPR) admissions, including temporary foreign workers and international students, presents both short-run and long-run implications for Canada's economic landscape. Addressing long-term issues such as housing supply, infrastructure spending, and productivity remains crucial for sustained prosperity.

The recent decline in housing starts, with a 30% decrease in Montreal and 39% in both Toronto and Vancouver, is indicative of the challenges developers face. Economic conditions, including borrowing difficulties and labor shortages, have translated into slower start rates. This slowdown poses risks to economic growth, particularly as labor market tightness abates.

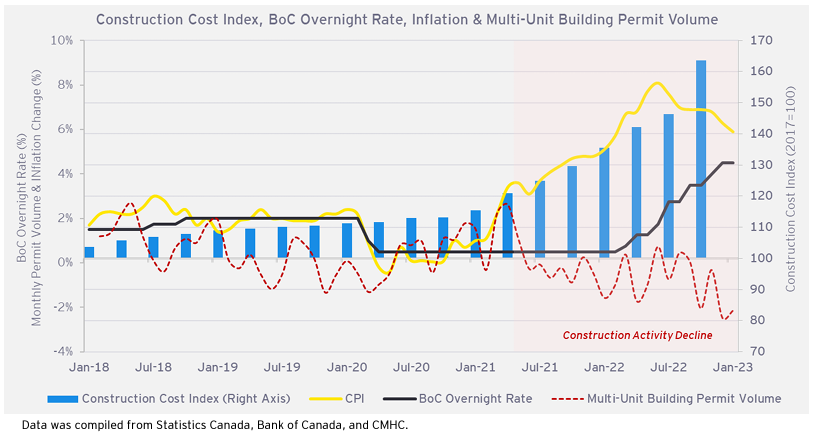

Affordability levels in Canada, influenced by inflation, construction costs, and the Bank of Canada overnight rate, play a critical role in shaping construction activity. Within less than five years, a significant 50% surge in construction costs, combined with an uptick in interest rates, has instigated a fundamental transformation in the landscape of homebuilding. This shift has resulted in a notable decline in residential permit activity throughout Canada.

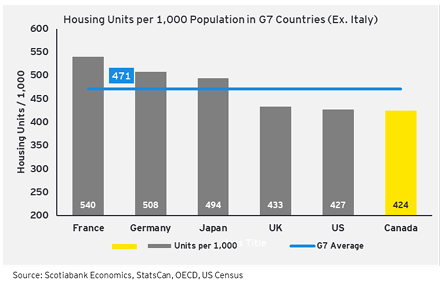

Canada grapples with a well-established national housing shortage, ranking lowest in per capita housing supply for G7 nations. Housing affordability has emerged as a pressing concern over the last decade, with insufficient housing supply identified as a pivotal factor contributing to the challenge.

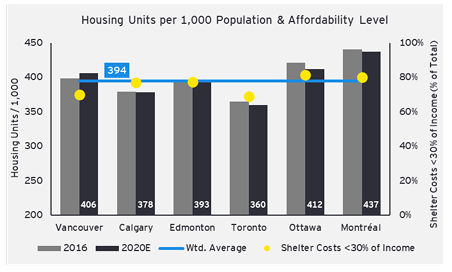

According to the Canada Mortgage and Housing Corporation (CMHC), an additional 3.5 million housing units are needed by 2030 to address affordability issues, a gap highlighted by the country's annual housing starts averaging nearly 200,000 units. Despite variations in housing supply levels across Canada's urban areas, affordability doesn't uniformly correlate, exemplified by Vancouver's growth in per capita housing supply from 2016 to 2020, yet remaining the least affordable alongside Toronto.

Rapidly growing immigration targets further compound the demand for rental housing, with significant percentages of new immigrants settling in major cities like Toronto, Montreal, and Vancouver. As new residents typically rent for the initial 5–10 years in Canada, the rental market witnesses increased demand, with 56% living in rented accommodation by 2018. However, this surge in demand exacerbates the challenges of affordability, as evidenced by Statistics Canada's 2021 survey indicating that 1 in 5 households across the nation spends more than 30% of income on shelter. Notably, Vancouver and Toronto exhibit an additional 1 in 10 households overspending on shelter compared to other major cities.

The generally accepted criterion for housing affordability, wherein less than 30% of gross household income is spent on shelter, is a benchmark that a significant portion of Canadian households fails to meet. The imbalance is further pronounced when considering housing tenure, with occupants of rental housing disproportionately allocating income to housing costs relative to homeowners. Factors such as household composition, average income levels, and localized supply and demand dynamics contribute to this stark contrast. Despite the surge in the number of renters over the past decade, the supply of rental units has not kept pace, perpetuating the affordability challenge within Canada's housing market.

Recent legislative changes, such as unlocking low-cost financing and removing the GST on new purpose-built rental housing, aim to address these challenges and stimulate construction.

In contemplating the future of Canada's real estate landscape, one is prompted to consider the ongoing trajectory of property values and rental rates in light of the prevailing conditions. The intricate interplay between the private sector's resilience, government initiatives, and the ever-shifting economic landscape sets the stage for a dynamic journey.

As the private sector adapts to challenges and the government introduces strategic measures, the sustainability of property values and rental rates comes into focus. The delicate balance between market conditions, population growth, and legislative changes raises questions about the continuity of these trends. Will the collaborative efforts between developers and government initiatives be sufficient to steer the course toward sustained growth? Can the adjustments made by developers navigate the complexities of the economic environment and contribute to long-term stability?

These questions linger as stakeholders navigate the evolving real estate landscape. The resilience demonstrated in the face of challenges, coupled with strategic adaptations, hints at a sector capable of weathering uncertainties. The future trajectory of property values and rental rates will likely depend on the efficacy of ongoing collaborations, the impact of legislative changes, and the ability of the real estate market to navigate economic nuances.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.