Shelter Shock: Rent and Property Taxes Propel CPI, While Housing Markets Cool

In the dynamic realm of Canadian real estate, the recently released Consumer Price Index (CPI) for October 2023 offers a lens through which we can decipher the intricate dance of inflation and its impact on the housing market. Despite a drop in the house price index and a general easing in inflation, the spotlight remains on real estate, particularly in terms of shelter, mortgage interest, and rent.

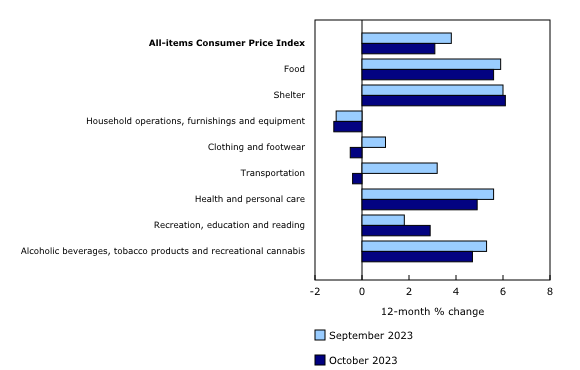

The CPI rose by 3.1 per cent year over year in October, a deceleration from the 3.8 per cent surge in September. This moderation can be attributed to various factors, with falling gasoline prices being a prominent contributor, declining by 7.8 per cent. While the overall price for goods decelerated, the price for services, including those in the housing sector, exerted upward pressure on headline inflation, registering a 4.6 per cent increase.

Amidst this macroeconomic backdrop, shelter costs emerged as a significant driver of the CPI. The price of rent, a crucial component of shelter costs, rose by a staggering 8.2 per cent year over year on a national basis while mortgage interest costs up by more than 30 per cent in the past year.

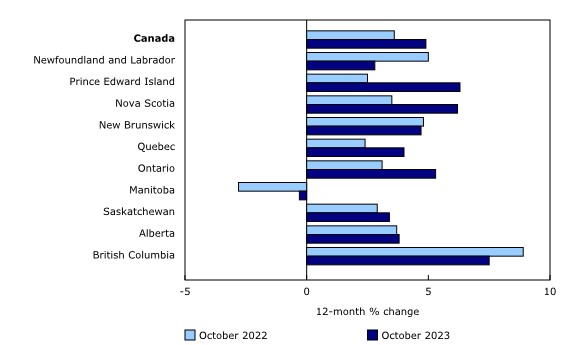

This acceleration comes on the heels of a 7.3 per cent jump in September. Notably, specific provinces experienced even more substantial increases, with Nova Scotia leading at 14.6 per cent, followed by Alberta (9.9 per cent), British Columbia (9.1 per cent), and Quebec (9.1 per cent).

Intriguingly, property taxes and other special charges, typically priced annually in October, marked a 4.9 per cent increase.

This uptick, the largest national rise since October 1992, played a crucial role in driving the monthly increase in the CPI. The increase in property taxes was a nationwide phenomenon, except for Manitoba, which recorded a 0.3 per cent annual decline in October.

Simultaneously, the Teranet-National Bank Composite House Price Index reported a 0.4% dip in Canadian home prices in October. This decline, the first in five months, signifies a broader cooling in the housing market. Approximately 60% of markets experienced a decline in house prices, attributed to rising interest rates, exacerbated affordability issues, and a less buoyant job market.

The real estate landscape showcased notable regional variations. While some cities experienced monthly declines, including Toronto (-1.6 per cent), Edmonton (-1.2 per cent), and Vancouver (-1.1 per cent), others witnessed increases. Montreal (+3.7 per cent), Halifax (+1.1 per cent), and Winnipeg (+1.0 per cent) were among those showing positive momentum.

In the midst of these trends, the Bank of Canada opted to maintain the key overnight interest rate at 5% in October. The decision was influenced by a nuanced understanding of various factors, including the impact of conflict in the Middle East, elevated global oil prices, and concerns about government spending hindering the return of inflation to the target of two percent.

Furthermore, the broader inflation landscape revealed signs of easing. The October inflation data showed a slowdown in the Headline CPI to 3.1% year over year, indicating a cooling economy and potentially delaying immediate interest rate hikes. The Bank of Canada's core measures, while still above the 2% target, displayed improvements on a 3-month rolling average basis.

The economic outlook, shaped by these inflationary and real estate dynamics, suggests a balanced trajectory. Real GDP growth slightly outpaced a flat performance in Q3, but signs of excess demand being gradually curtailed were evident. Despite positive inflation trends, the Bank of Canada is expected to remain on hold, with speculations about a potential rate cut around the middle of 2024.

The upcoming months will likely provide further insights into how these intertwined narratives unfold, shaping the path of real estate and the broader Canadian economy.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.