Roofs to Rates: Navigating the November Plunge in Canadian Housing Starts

The Canadian housing market, a crucial barometer of economic health, experienced a noteworthy shift in November 2023. The latest data released by the Canada Mortgage and Housing Corporation (CMHC) unveils a complex interplay of factors influencing housing starts, signaling potential implications for the real estate landscape.

The six-month trend in housing starts witnessed a 0.7% increase in November, reaching 257,777 units, compared to 255,876 units in October. However, the monthly seasonally adjusted annual rate (SAAR) took a significant hit, plunging by 22% to 212,624 units.

This decline was more pronounced in urban areas, with multi-unit starts dropping by 27% to 151,297 units, and single-detached urban starts decreasing by 7% to 44,066 units. Notably, major cities like Montreal, Toronto, and Vancouver saw substantial declines of 30%, 39%, and 39%, respectively, driven primarily by the downturn in multi-unit starts.

CMHC's Deputy Chief Economist, Kevin Hughes, provided valuable insights into the situation. He remarked, "The notable drop in the rate of housing starts in November, particularly in the multi-unit space, should not come as a major surprise and reflects tighter economic conditions impacting construction timelines."

Hughes emphasized that the challenging borrowing conditions and labor shortages are now manifesting in the starts numbers, hinting at a continued deceleration in the upcoming months.

Actual year-to-date housing starts in 2023 showcase a divergent pattern. Toronto and Vancouver experienced a surge of 17% and 31%, respectively, compared to the same period in 2022. This growth was predominantly fueled by higher multi-unit starts. However, on a national scale, year-to-date housing starts dipped by 8% in centers with a population exceeding 10,000, standing at 204,721 in November 2023, down from 222,177 in the same month of the previous year. This decline was primarily attributed to a substantial 27% drop in single-detached starts.

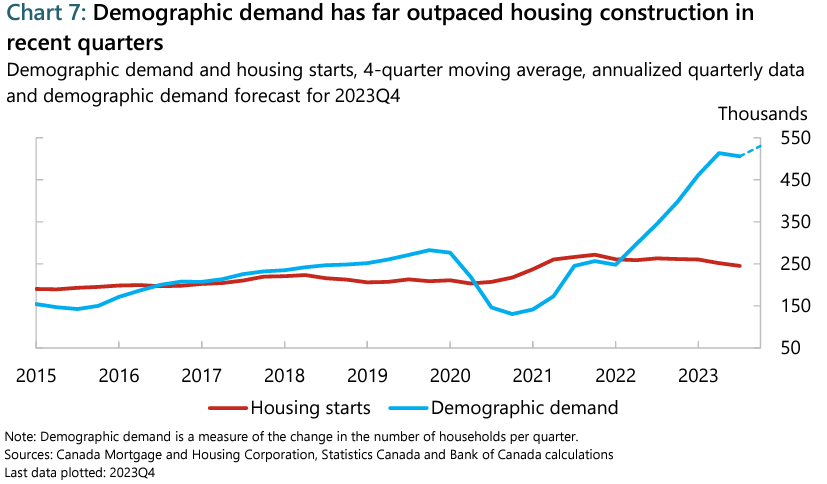

CMHC projects that if current construction rates persist, the housing stock will approach 19 million units by 2030. However, there is a recognized need for an additional 3.5 million units by that time to restore affordability.

The Bank of Canada, recognizing the housing challenge, has called for policy changes to spur more construction and alleviate inflationary pressures linked to housing shortages. Deputy Governor Toni Gravelle emphasized the need for governments at all levels to collaborate in accelerating new construction, citing zoning restrictions, permitting processes, and labor shortages as impediments to timely home building.

Gravelle highlighted the impact of shelter price inflation, contributing 1.8 percentage points to October's 3.1% inflation rate. He stressed the necessity of addressing barriers to adding housing capacity to mitigate inflationary pressures.

Despite the notable drop in November, the Canadian housing market remains robust, supported by factors such as government initiatives and robust population growth, as per TD Bank. The Bank of Canada's recent rate hikes aim to cool inflation, and while some impact on growth is expected, the overall demand remains strong.

The future trajectory of housing starts is expected to be influenced by factors like mortgage renewals at higher rates, government policies, and the broader economic landscape. As the year comes to a close, the December data, to be released on January 16, will offer further insights into the evolving dynamics of the Canadian housing market.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.