Revolutionizing Heights: How Investors Are Redefining Toronto's Condo Skyline

In the ever-evolving realm of Toronto's real estate, the dominance of investors has become a defining factor. According to recent StatsCan data, a whopping 56.7% of condos built since 2016 are investor-owned, painting a vivid picture of a market skewed toward the interests of financial players. This paradigm shift, highlighted in Clarrie Feinstein's exposé on The Star, intertwines with a myriad of factors, creating a housing landscape that has become increasingly unattainable for many.

Privatization, Ineffective Rent Control, and Cheap Capital: A Recipe for Investment Boom

The rise of investor dominance finds its roots in a concoction of privatization, ineffective rent control, and the allure of cheap capital. The StatsCan data resonates with the ongoing struggle of federal and provincial authorities, as well as the central bank, attempting to navigate the consequences of a real estate game increasingly dictated by investors.

The Evolution from Co-ops to Condos

To truly understand this shift, let's rewind a bit. The Canadian Housing Statistics Program (CHSP) sheds light on the broader picture. Data from 2020 in Nova Scotia, New Brunswick, Ontario, Manitoba, and British Columbia unveils a varied investor landscape. Nova Scotia leads with 31.5% of property owners being investors, while Ontario trails at 20.2%.

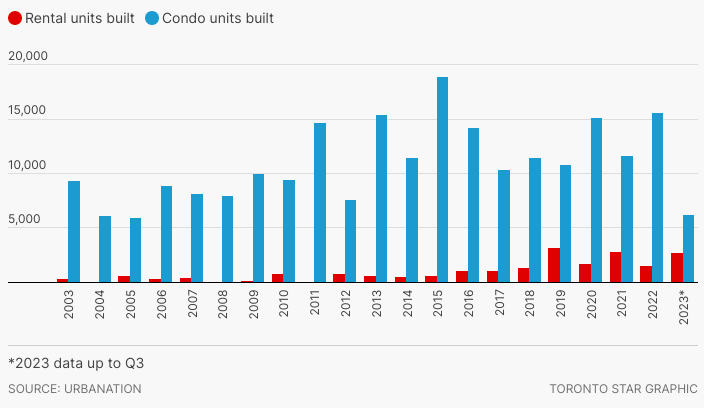

Condos are the darling of investors, with Ontario boasting a staggering 41.9% investment rate. Over the last two decades, Toronto has witnessed the construction of 83 purpose-built rental projects, comprising a total of 20,288 units, as reported by the research firm Urbanation. In contrast, during the same timeframe, a considerably larger scale of development occurred in the condominium sector, with 968 projects yielding a total of 234,535 units.

Rent Control Rollercoaster and the Impact on Prices

The removal and reinstatement of rent control have been pivotal, argues Dania Majid, a lawyer at Advocacy Centre for Tenants Ontario. Premier Mike Harris's Bill 96 in 1997 removed rent control, creating a playground for investors. Fast forward to 2020, and the CHSP tells us that almost 22% of owners in the specified provinces were investors, with Nova Scotia and New Brunswick surpassing British Columbia, Manitoba, and Ontario. The removal of rent control for new builds by Premier Doug Ford further fueled the fire, leading to higher prices and increased investor activity.

The Role of Interest Rates and the Pandemic Boom

Low interest rates and pandemic-induced innovations in lending practices have been key players in the market's growth. The CHSP data aligns with the narrative, revealing that condo apartments were more popular with investors than houses, with rates ranging from 22.6% to 41.9% across provinces. Home Equity Lines of Credit (HELOCs) became the unsung hero for investors, contributing to the surge in property prices.

Investor Exodus and Its Aftermath

As we look to the present, the CHSP tells us that almost 40% of homes constructed since 2016 in Toronto are investor-owned, setting the stage for a potential investor exodus as interest rates rise. However, the legacy of investor influence lingers, shaping the market's future trajectory.

Addressing the Challenges: Government Intervention and Legislative Changes

To curb the commodification of housing and restore balance, the federal government is taking steps to scrutinize revenue streams for investors. New tax measures aim to remove incentives for short-term rentals, while increased funding supports efforts to enforce compliance with local laws. Legislative changes, including rent control reinstatement and measures against property hoarding, are proposed to foster a more equitable housing landscape. But will it?

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.