Rent Prices Propel Canada's Headline Inflation Rate, Surpassing 31%

In October 2023, the Canadian rental market underwent a significant transformation, revealing noteworthy trends in the Rentals.ca Rental Report. This detailed analysis delves into the data, trends, and factors shaping the landscape, with a particular focus on Toronto and the Greater Toronto Area (GTA).

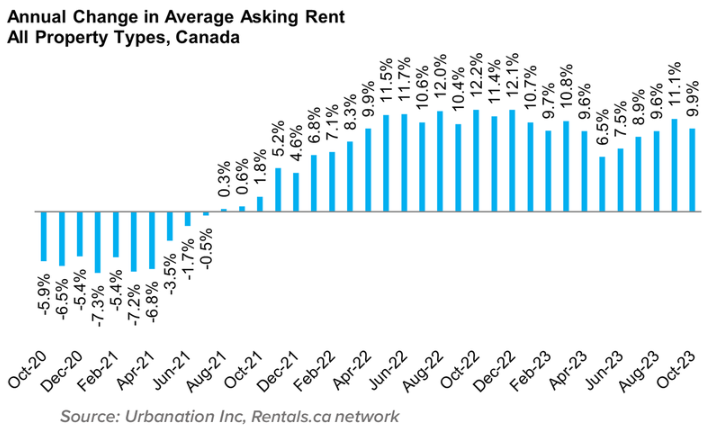

A standout observation was the national surge in rent, experiencing a substantial 9.9% annual growth, propelling average asking rents to an impressive $2,178.

This surge, contributing over 31% to Canada's headline inflation rate since April 2021, indicates a sustained upward trend.

The provincial and municipal dynamics were also intriguing. Alberta, Quebec, and Nova Scotia emerged as epicenters of rent inflation, with Alberta leading at a formidable 16.4% year-over-year increase. Conversely, Toronto faced an unexpected downturn, marking a 0.8% decline in asking rents. Despite this setback, Calgary continued its dominance, leading in annual rent growth for the ninth consecutive month.

Toronto's unique downturn marked the first decline in rents since August 2021, settling at an average of $2,908. This deviation from the consistent upward trajectory prompts a closer examination of the factors influencing this change. While Toronto experienced a setback, its suburbs, including Oakville, Vaughan, and Mississauga, continued their upward trajectory, showcasing resilient demand for rental properties beyond the city limits.

Zooming into the GTA's small- and medium-sized markets, North Vancouver, Coquitlam, and Richmond dominated as the most expensive markets. Despite the national surge, Toronto faced a decline in rents, signaling a potential shift in the city's rental dynamics. Conversely, the GTA's suburbs maintained their upward trajectory, reflecting the diverse and dynamic nature of the rental market in this region.

Over the last six months, the average rent in Toronto surged by $175, reaching $2,908 in October. Regional dynamics within the GTA showcased a varied picture, emphasizing the importance of understanding localized trends in this expansive region. The interplay of factors at both national and regional levels underscored the need for a nuanced understanding of the rental landscape.

Factors such as the addition of 700,000 non-permanent residents and government responses to housing affordability played crucial roles in shaping the rental market in Toronto and the GTA. Alberta, Quebec, and Nova Scotia's influence was felt in the broader provincial context, affecting the dynamics of the GTA's rental landscape.

Calgary continued to lead in rent price growth nationally, but Toronto's decline and the GTA's suburban growth added layers of complexity. Analyst Ben Rabidoux's insights were particularly relevant in dissecting the role of immigration levels in shaping rent prices in Toronto and the GTA.

Zooming into Toronto, the decline in purpose-built rentals under construction in the GTA, reaching 18,267 units, prompted a closer examination. The impact of the GST announcement and its potential to stimulate construction activity was particularly relevant in the local context, influencing future developments in Toronto and the GTA.

Toronto's pipeline for approved purpose-built rental units, totaling 41,034, with 10,113 units in the 905 Region, underscored ongoing demand. Record highs in average rents, with condominium leases at $2,937 and purpose-built rental buildings at $3,143, reflected a 9% annual increase.

The vacancy rate in purpose-built rental buildings completed since 2003 was 1.8% in Q3-2023 in the GTA, staying below 2% for seven consecutive quarters. Short-term supply relief was expected, with 13 rental buildings totaling 2,639 units scheduled to begin occupancy in Q4-2023.

The vacancy rate across the nation was 1.6% for condominiums and 1.9% for purpose-built rentals, the lowest on record and 50% below the average of 3.2%. Toronto's vacancy rate for condos was 1.1%, and 1.7% for purpose-built rentals. The GTA’s primary rental apartment universe increased by 2.1%, or 7,175 units, in 2022 from the previous year.

Looking ahead to 2024, the question of whether rent will decrease remains uncertain. The trends observed in October 2023 indicate a national surge in rents, but predicting future fluctuations involves considering multiple factors such as economic conditions, government policies, and market dynamics. On the one hand, the observed 9.9% annual growth in October 2023 suggests a market inclined towards increases. On the other hand, the unexpected downturn in asking rents in October 2023 introduces an element of uncertainty into the outlook for 2024. Local market dynamics, influenced by factors like construction activity and government policies, will play a crucial role in shaping future trends.

The Canadian rental market, with a focus on Toronto and the GTA, is undergoing dynamic shifts. While the Rental Report provides a snapshot of the current landscape, predicting future trends involves considering various factors and responding to the evolving dynamics of the rental market.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.