Rent Inflation Accelerates to 5-Month High

The Rentals.ca rent report for March 2024 provides a comprehensive glimpse into the flourishing Canadian rental market. With a keen focus on Ontario, the Greater Toronto Area (GTA), and Toronto, this report offers invaluable insights into the trends shaping the rental landscape. In this analysis, we delve deeper into the report's key findings, unraveling the factors fueling rent inflation and regional nuances.

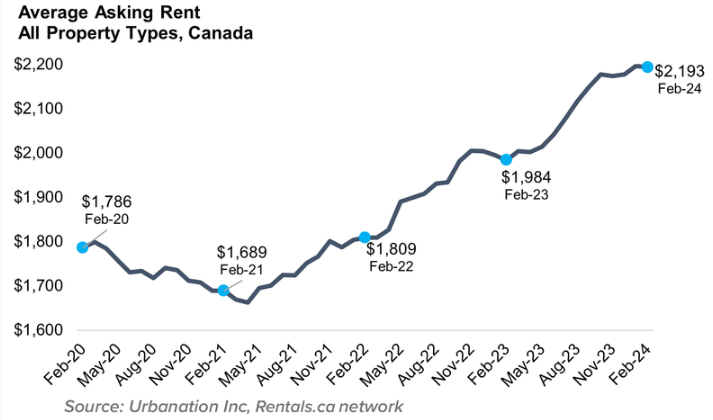

A standout revelation from the March 2024 Rent Report is the acceleration of rent inflation to a 5-month high. Average asking rents in Canada have surged by an impressive 21% since February 2022, signaling robust demand. This significant increase, averaging $384 per month, underscores factors like population growth and urbanization driving rental demand.

In February 2024, average asking rents for all residential property types in Canada reached $2,193, marking a notable 10.5% year-over-year increase. Purpose-built rental apartments witnessed the highest growth at 14.4%, with average rents hitting $2,110. Strong demand persists across all segments, with studio apartments leading in annual rent growth at 14.8%.

While Canada's rental market flourishes, Ontario and the GTA exhibit unique trends. Ontario saw sluggish growth, with a mere 1.0% annual increase in asking rents. Similarly, Toronto experienced a slight decline of 1.3% annually for purpose-built and condo apartments. These trends hint at a potential market stabilization amid broader economic shifts.

Contrasting current data with past insights provides crucial context. January 2024 saw another record high in average asking rents, reaching $2,196. Purpose-built rental apartments led growth, rising by 13.5%. However, Toronto and the GTA witnessed a slowdown, indicating evolving market dynamics.

Despite challenges, the rental market remains resilient, driven by persistent demand fueled by population growth and lifestyle changes. Looking ahead, a balanced market is forecasted, with rent growth converging towards a five-year average of around 5%. This cautious optimism considers various economic factors and market trends.

The March 2024 Rent Report underscores a surge in roommate listings and shared accommodations, reflecting shifting renter preferences. With a 72% annual increase in roommate listings, demand for communal living rises, contributing to an overall uptick in average asking rents.

As we anticipate the next CPI release on March 19, the implications of this data on inflationary trends and economic indicators cannot be overstated.

Thinking about selling your home?

Get in touch. We'll guide you through every step of the process to ensure a smooth transaction that meets your goals.