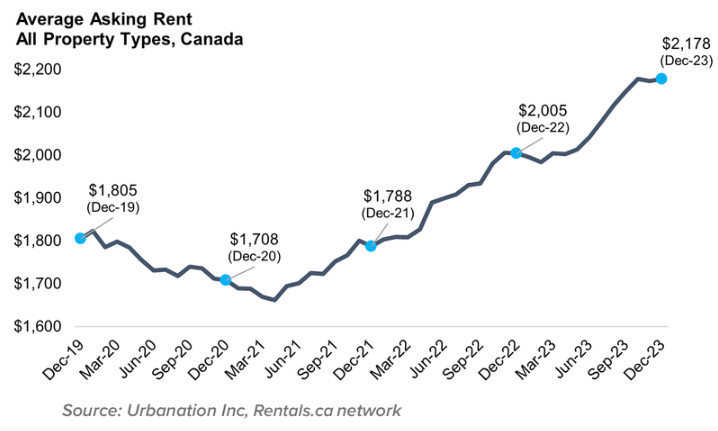

Rent in Canada Has Surged $390 Per Month Over the Past Two Years

The Canadian rental landscape hit a high note in the final month of 2023, with average asking rents soaring to $2,178—a substantial 8.6% surge from the previous year. This surge, part of a two-year increase totaling 22%, reflects the ongoing dynamics in the rental market, influencing not only housing decisions but also contributing to the broader economic picture, particularly within the Consumer Price Index (CPI).

Asking rents across Canada witnessed a robust 9% increase in 2023, making it a remarkable 22% surge over the past two years. Looking forward to 2024, the rental market is anticipated to remain undersupplied, converging towards a five-year average growth of approximately 5%. This scenario sets the stage for an intriguing interplay between the demand for rental properties and the broader economic context.

Factors such as a slowing economy, decreased non-permanent residents, and increased homebuying activity with declining interest rates contribute to the intricate web shaping the rental market. The expected rise in apartment completions and tenant turnover might introduce more supply, potentially tempering rent growth, albeit moderately.

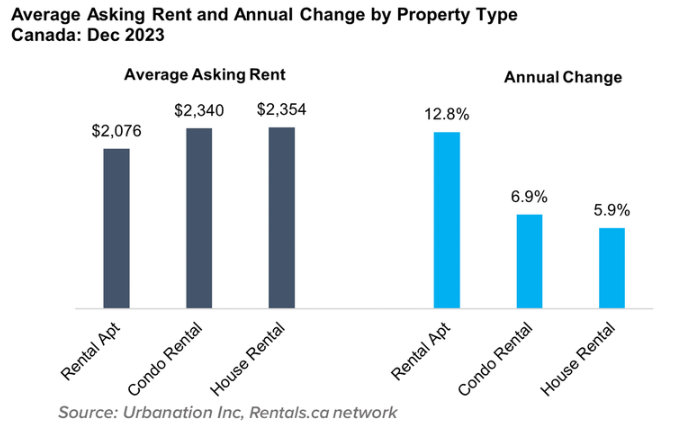

Diving deeper into the segments, traditional purpose-built rental apartments experienced the most significant growth in 2023, with a noteworthy 12.8% increase despite having the lowest average rents at $2,076. One-bedroom apartments took the lead in growth at 13%, reaching an average of $1,932, while studios closely followed with an 11.9% increase, averaging $1,552. Two-bedroom and three-bedroom apartments recorded increases of 9.8% and 9.9%, respectively.

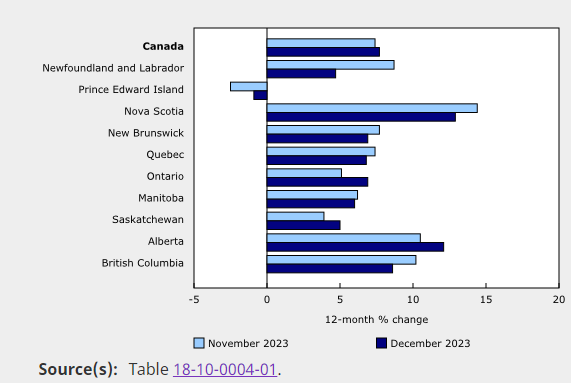

Zooming into provinces, Alberta led the pack with a staggering 16% rent growth in 2023, boasting an average rent of $1,691. Meanwhile, British Columbia maintained its position as the most expensive province with an average asking rent of $2,500, despite a slight 1.4% year-over-year decrease. Ontario, with rents averaging slightly below B.C. at $2,446, saw a 3.7% annual increase. Quebec, experiencing faster rent growth, reached an average of $1,953 in December 2023.

In the realm of major metros, Calgary and Edmonton stole the spotlight with rent growth leading at 14.0% and 13.5%, respectively. On the flip side, Vancouver and Toronto, known for their high living costs, witnessed slower rent increases in 2023. However, Quebec markets outpaced them all, with Pointe-Claire and Quebec City recording annual growth rates of 25.6% and 18.9%, respectively.

For the third consecutive month, average apartment rents in Toronto have declined. This shift underscores the local dynamics such as rising inventories, providing a distinctive contrast to the broader national trend.

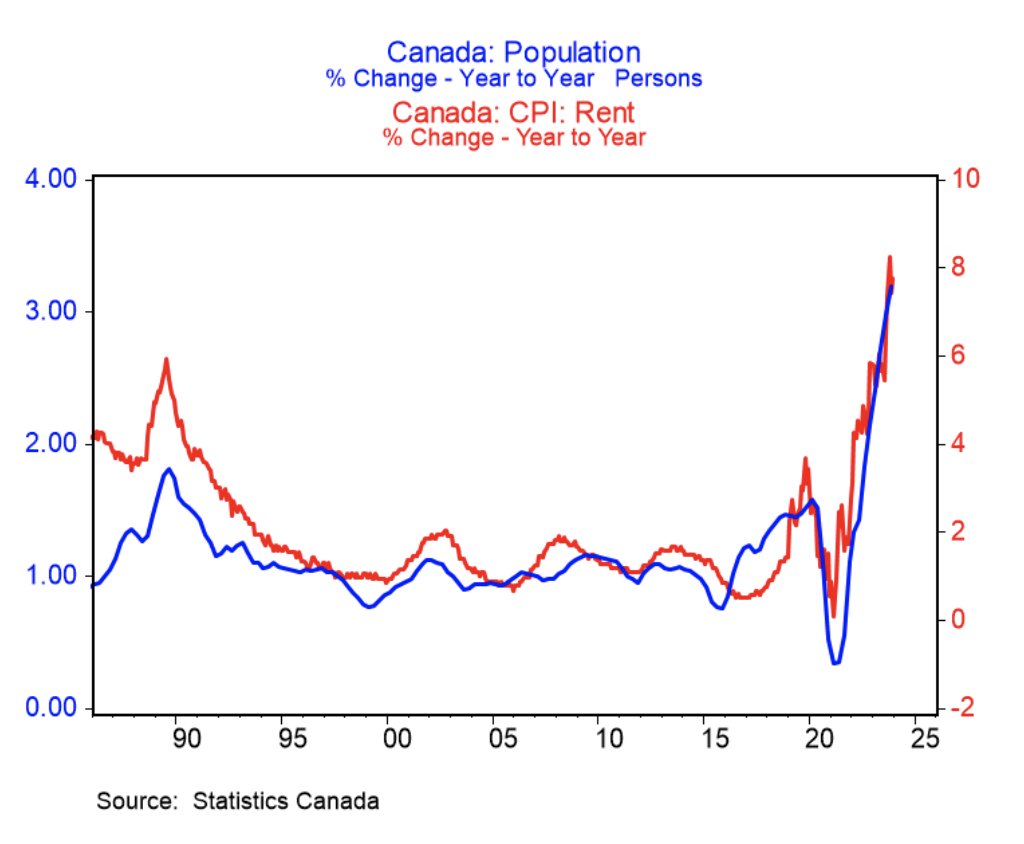

The Consumer Price Index (CPI) revealed a year-over-year increase of 3.4%, surpassing the 3.1% observed in November. Amidst the diverse factors contributing to this inflationary trend, such as gasoline and air transportation, rent emerged as a prominent player. Rent prices experienced a robust 7.7% year-over-year increase in December, following a 7.4% uptick in November, playing a pivotal role in the CPI acceleration.

This surge, driven by a higher interest rate environment, draws attention to a notable correlation. It becomes evident that high levels of immigration over the past two years have played a significant role in influencing rent inflation, mirroring the simultaneous increase in the Canadian population. Understanding this intersection between population growth and rent inflation adds a layer of complexity to the economic landscape, emphasizing the multifaceted nature of these trends.

The January 2024 Rentals.ca rent report paints a vivid picture of the Canadian rental market's dynamism, with regional variations influencing the broader economic landscape. While Toronto experiences a unique trend with declining average apartment rents for the third month, the CPI's unveiling of inflation trends further emphasizes the crucial role of rent in shaping the economic narrative.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.