Over/Under

The Greater Toronto Area (GTA) witnessed a noteworthy surge in underbidding for homes, as reported by Wahi, a digital real estate platform. This trend marked the fifth consecutive month of increasing underbidding activity, with October's figures reaching the second-highest level observed this year, just shy of the peak seen in January. To comprehensively understand the dynamics of underbidding and overbidding in various neighborhoods, Wahi compared the differences between median list prices and actual sold prices for a variety of property types, excluding neighborhoods with fewer than five transactions per month.

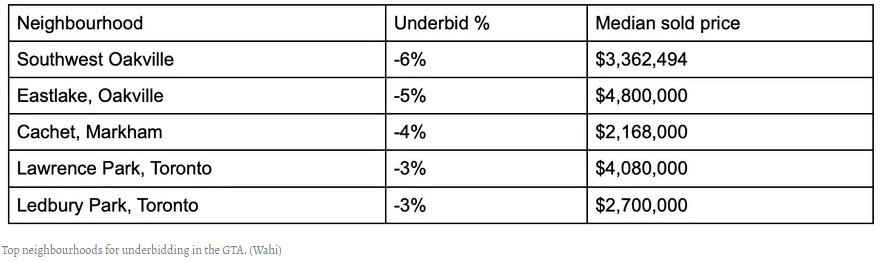

Top Neighbourhoods for Underbidding

Surprisingly, these neighborhoods tend to be more expensive, with overbidding neighborhoods having comparatively lower list prices. Here are the top underbidding neighborhoods, along with their respective overbid percentages and median sold prices.

This surge in underbidding, despite higher interest rates, provides opportunities for homebuyers to potentially secure better prices for their desired homes and negotiate favorable terms. The trend began in June, with 35% of neighborhoods in underbidding territory, compared to just 25% in May, possibly influenced by the Bank of Canada's rate hike that month. In contrast, only 14% of GTA neighborhoods were in overbidding territory in October, down from 24% in September. The remaining 5% were selling properties at the asking price.

It's essential to note that overbidding activity doesn't necessarily imply that buyers are overpaying for homes. Understanding the data and bidding dynamics in a desired area is crucial for GTA homebuyers. This report underscores the prevalence of underbidding in the GTA real estate market and its potential implications for both buyers and sellers.

Of the neighbourhoods in the GTA, 86% of them entered underbidding territory, according to data from Wahi's Market Pulse Tool, indicating a prevailing trend in the housing market. Despite the underbidding, homes in these areas remained largely unaffordable for first-time buyers, with listing prices ranging from $1,600,000 to $4,000,000, highlighting the ongoing challenges in the GTA real estate market. The top five neighborhoods with significant underbidding in October included two in Oakville, two in the City of Toronto, and one in North York, reflecting a widespread phenomenon. Notable instances of underbidding included Forest Hill, where the average home sold for a nine percent discount ($169,000) below the asking price, and Lawrence Park, where properties fetched an average of six percent below the listed price, amounting to $197,499. The most significant price discrepancy was observed in Oakville's Eastlake neighborhood, with homes selling for an average of 10 percent below the listed price, equivalent to $307,500. Wahi's Market Pulse Tool's data reveals that despite recent market changes, some regions in the GTA continue to experience "strong demand and steady pricing."

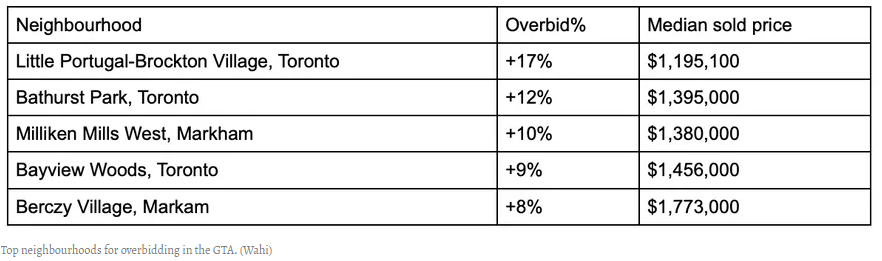

Top Neighbourhoods for Overbidding

In contrast to the prevalent underbidding, seven percent of GTA neighborhoods were in overbidding territory in October, primarily located in Markham and North York. These neighborhoods offered more competitively priced properties in the range of $1,000,000 to $1,600,000. Remarkable examples of overbidding included Westbrook in Richmond Hill, where homes sold for an average of 14 percent above asking, translating to $176,000, and Markham's Greensborough neighborhood, where properties commanded roughly a 10 percent premium, though slightly lower at $98,500. Homes in other neighborhoods, such as North York's Bayview Woods-Steeles, Oshawa's Kedron, and Markham's Wismer, also witnessed strong demand, selling for an average of nine percent above the asking price in October, further highlighting the diversity in the GTA's real estate landscape.

To fully grasp the underbidding and overbidding landscape, it's essential to consider the influence of active listings in the GTA. In October 2023, active listings in the GTA are up 50.1% year-over-year, marking a ten consecutive month increase of a whopping 124.8%. These figures shed light on the current state of the market and how it can influence the underbidding and overbidding trends. The surge in active listings suggests a more significant supply of properties on the market. When supply outweighs demand, as indicated by the rising number of active listings, it can contribute to underbidding, as buyers have more options and less pressure to meet or exceed asking prices. Conversely, in areas with fewer active listings and high demand, overbidding may prevail as buyers compete for limited available properties.

The GTA real estate market continues to experience fluctuations in underbidding and overbidding, with factors like higher interest rates and inflation playing a significant role. Understanding these dynamics, along with the impact of active listings, is crucial for both buyers and sellers navigating this ever-evolving market. As the market landscape continues to shift, staying informed and making informed decisions will be key to success in the Greater Toronto Area's real estate market.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.