Marching Towards Overbidding: GTA Neighborhoods Witness Unprecedented Overbidding Spree

The Greater Toronto Area (GTA) real estate market has experienced significant shifts in bidding dynamics over recent months, with fluctuations between overbidding and underbidding creating a dynamic landscape for buyers and sellers alike.

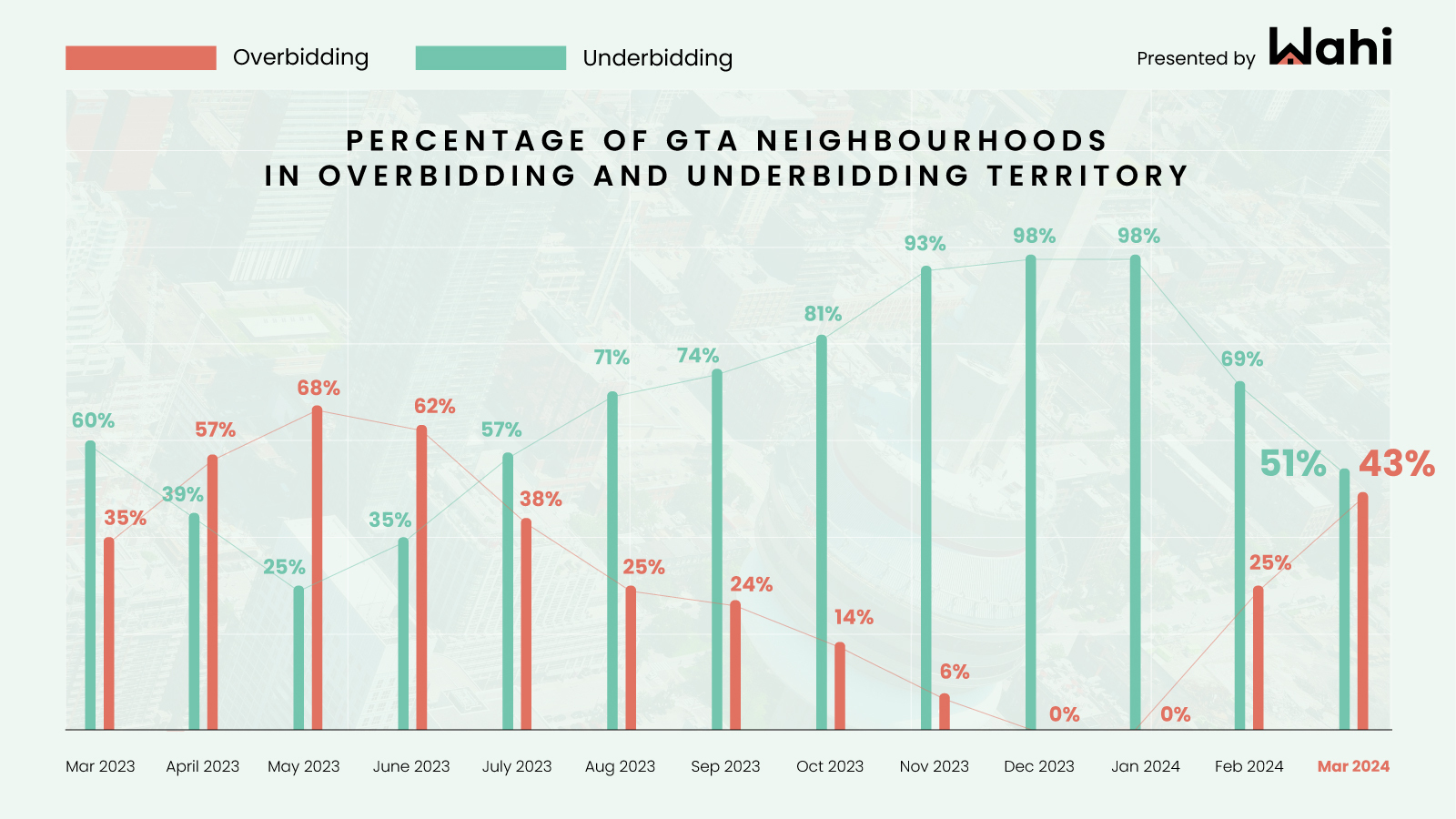

In January 2024, the GTA witnessed a stark contrast in bidding behavior compared to previous months. Data from Wahi's Market Pulse Report indicates that not a single neighborhood in the GTA was experiencing overbidding conditions, marking a significant departure from the prevailing trend. Instead, the vast majority of neighborhoods, a staggering 98%, were entrenched in underbidding territory. This stability in underbidding activity persisted for the eighth consecutive month, indicating a prolonged period of reduced competition among buyers.

Contrasting this trend, the surge in overbidding became pronounced in March 2024, following the trajectory established in February. According to Wahi's latest Market Pulse Report, 43% of GTA neighborhoods found themselves in overbidding territory, a sharp increase from the 25% recorded in February and a notable deviation from the absence of overbidding observed in January. This surge reflects a significant uptick in bidding competition as more homebuyers entered the market, seeking to secure desirable properties amidst limited inventory.

Delving deeper into the data, we can observe distinct trends in bidding dynamics between different segments of the housing market. In January, while no neighborhoods experienced overbidding conditions, 69% were underbid. However, by March, the landscape had shifted significantly, with only 51% of neighborhoods underbid, marking a considerable decrease over the same period.

The condominium market presents an interesting contrast to the broader housing market trends. Despite the surge in overbidding observed in March, the majority of neighborhoods within the condominium segment remained underbid. In fact, only 14% of condominium neighborhoods experienced overbidding conditions, with a significant 82% still underbid. This discrepancy suggests unique factors at play within the condominium market, potentially influenced by pricing pressures from new-build condominiums entering the resale market.

The non-condominium segment, on the other hand, witnessed intensified competition among buyers, with approximately 61% of neighborhoods experiencing overbidding conditions in March, compared to 39% in February. This surge in overbidding activity underscores the heightened demand for non-condominium homes, driven by factors such as affordability concerns and lifestyle preferences.

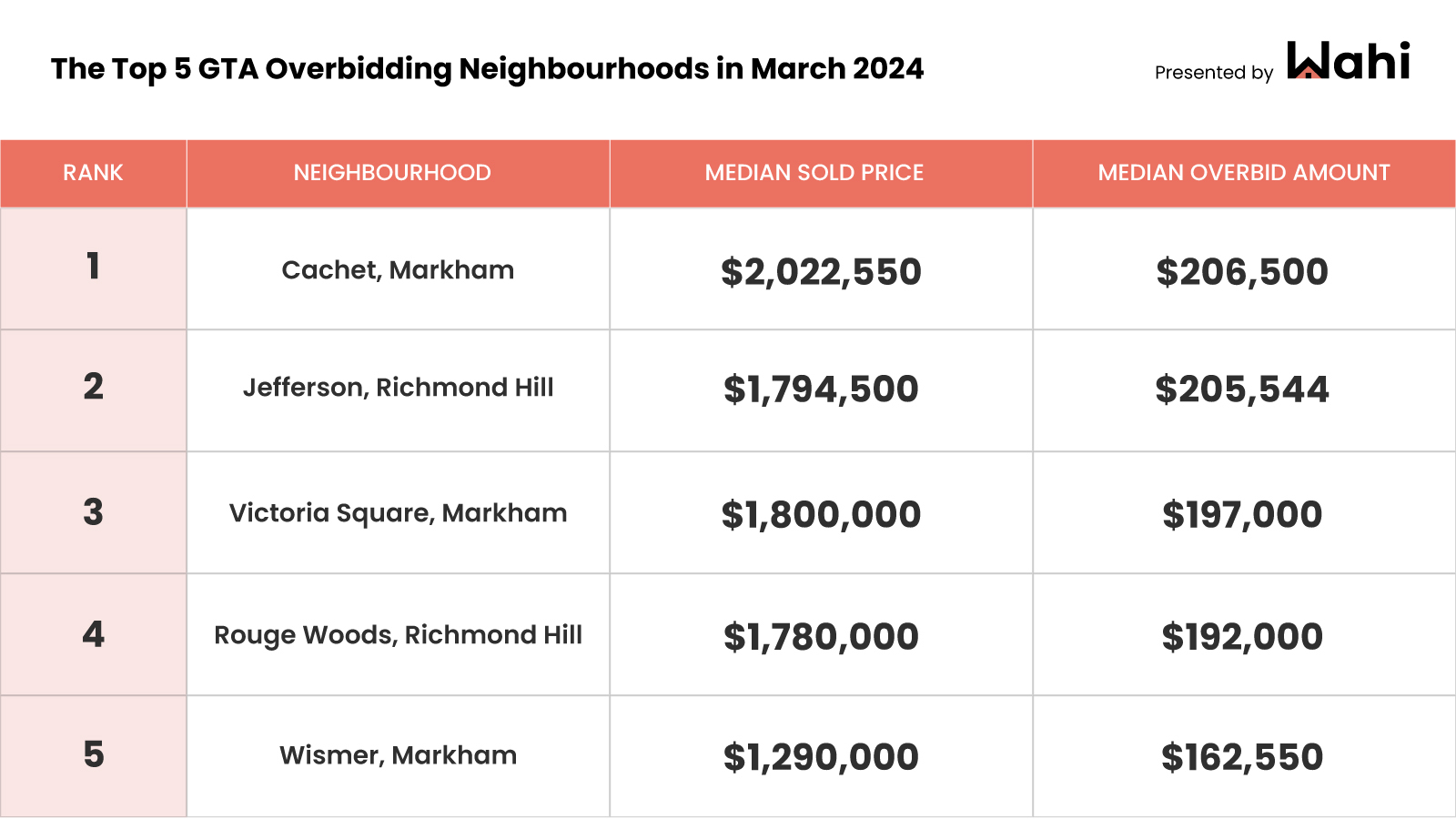

Regional variations also play a significant role in shaping bidding dynamics within the GTA real estate market. The top overbidding neighborhoods were predominantly located within the Regional Municipality of York, highlighting distinct regional preferences and market dynamics. Conversely, the top underbidding neighborhoods were more evenly distributed across the GTA, reflecting a diverse range of factors influencing bidding behavior.

Overall, the surge in overbidding observed in March 2024 marks a significant shift in the GTA real estate market, with increased bidding competition and renewed activity across the price spectrum. As buyers and sellers navigate these evolving dynamics, understanding the nuances of bidding trends and regional variations is crucial for making informed decisions in the competitive GTA housing market.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.