Jingle Bells and Mortgage Swells: Confronting the Grinch in Ontario's Housing Market

As the year 2023 draws to a close, Canadians find themselves at the intersection of anticipation and financial concerns. The holiday season is underway, but a sense of hesitation permeates as households continue to fortify their financial reserves despite the fully reopened economy.

Canadian consumers have deposited a staggering $175 billion in term deposits at chartered banks, reflecting a 40% increase over the past year. This cautious approach is further highlighted by the revelation that households saved 5.1% of their disposable income in the third quarter, a stark contrast to the 2.4% average between 2015 and 2019.

One notable factor contributing to this economic pause is the looming specter of mortgage renewals. With rate resets anticipated to significantly impact household finances, Canadians are contemplating strategies to weather the storm. The potential for upward of 70% increases in monthly mortgage payments looms large, prompting considerations of extending amortizations or making lump-sum payments.

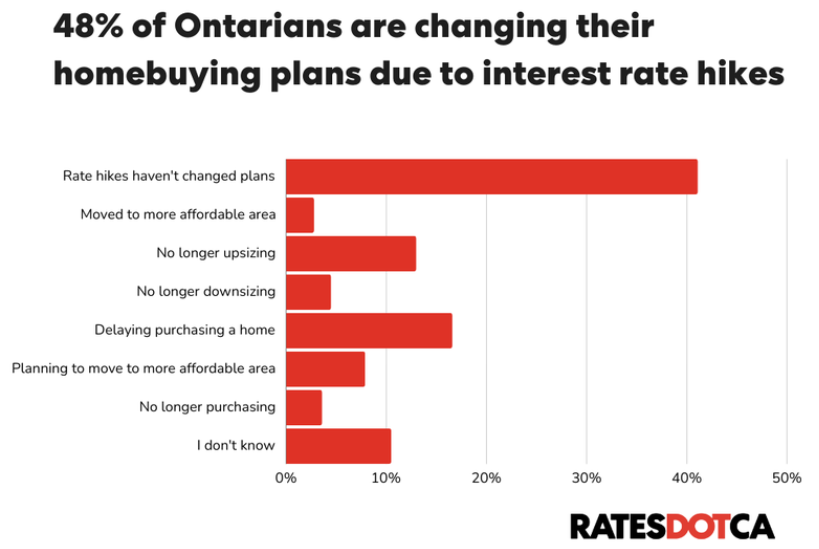

In a recent survey conducted by RATESDOTCA, 48% of Ontarians indicated that rising interest rates had influenced their decisions related to moving, upsizing, downsizing, or buying in some way.

The survey, conducted between November 4 and 5, 2023, provides valuable insights into the evolving landscape of homeownership in the face of economic shifts.

Key findings include 17% of respondents delaying their plans to purchase, and an additional 17% expressing a change in their perception of homeownership as a good investment. Notably, 4% of respondents admitted regretting their home purchases altogether, shedding light on a nuanced reconsideration of this significant life milestone.

The shifting sands of the real estate market are also evident in changing beliefs about homeownership. While 30% of respondents still view real estate as a good investment if affordable, 17% have undergone a perceptual shift, no longer considering homes a sound financial investment. The data indicates that the traditional concept of a home as a solid financial decision is undergoing a transformation.

The Generational Struggle

The dynamics of the real estate market are particularly challenging for millennials, a cohort comprising adults aged 27 to 42. As they enter the prime house-buying age, the struggle for larger spaces or properties intensifies. However, 13% of respondents initially planning to upsize have reconsidered, facing the dual challenges of higher interest rates and the stringent CMHC mortgage stress test.

Millennials, with financial goals like starting families or buying homes, now grapple with increased difficulty in qualifying for mortgages due to rising interest rates. The current economic landscape, characterized by high inflation and soaring house prices, has left many millennials despondent about their prospects of entering the housing market.

The challenges extend beyond millennials to the baby boomer generation, particularly those approaching or at retirement age. Financial planners, such as Jacqueline Porter, observe a delicate balancing act among clients navigating personal housing challenges while supporting adult-aged children.

The quandary faced by boomers involves not only affordability but also sustainability. Supporting children in a scenario where financial circumstances become unstable raises critical questions about the long-term viability of such assistance.

Traditionally, downsizing has been a strategy for older homeowners to navigate their golden years comfortably. However, the landscape has shifted. The survey indicates that 5% of respondents halted plans to move to a smaller home, highlighting the complexities introduced by current mortgage rates.

While downsizing might have been an appealing money-saving move, the current mortgage rates on new homes may negate much of the potential financial gain. The intricate decision-making process involves evaluating whether the move is practical for the family, considering social connections, healthcare accessibility, and long-term suitability.

Market Dynamics

The impact of interest rates on moving plans is palpable, with higher rates making it increasingly challenging to qualify for mortgages. The CMHC mortgage stress test, requiring borrowers to meet income levels for rates negotiated with lenders plus an additional two percent, adds an additional layer of complexity to the homebuying process.

The housing market is grappling with a persistent imbalance between demand and supply. Despite near-record levels of home building in Canada, demand continues to outpace supply, contributing to stubbornly high list prices, especially for single-family homes in the Toronto area.

The survey sheds light on the consequences, with 3% of respondents moving to more affordable areas than initially intended. An additional 8% postponed their plans, redirecting them toward more budget-friendly locales due to the impact of higher interest rates.

Interprovincial moves driven by financial considerations have become more common, providing individuals with financial flexibility. However, this trend introduces new challenges, requiring individuals to weigh the financial advantages against potential social and practical considerations.

Changing Perspectives on Real Estate

The shifting views on real estate as an investment underscore a nuanced evolution in the perception of homes. While 30% of respondents maintain that real estate is a good investment if affordable, 17% no longer view homes as sound financial assets. The survey reflects a growing sentiment that the traditional narrative of homeownership as a robust financial decision is undergoing transformation.

The evolving relationship between Canadians and their homes extends to the financial strain imposed by loans. With every dollar owned, the debt burden stands at $1.85, emphasizing the reliance on loans to finance essential needs. This has transformed the concept of homeownership from a solid investment into a pragmatic resource for retirement.

The decision to raise interest rates carries a dual purpose: combating inflation and instilling a cautious approach in Ontarians' home-buying plans. As economic uncertainty looms, individuals are not only reassessing their housing decisions but adopting a conservative stance across various goods and services.

While the current economic landscape presents challenges, economists, including those at BMO, forecast rate cuts starting in mid-2024. Concurrently, the construction industry remains active, contributing to a positive outlook for a more affordable future. The expectation is that rates will normalize, providing relief to those navigating the housing market.

Rising interest rates, changing views on real estate investment, and the evolving financial landscape have collectively influenced decisions related to moving, purchasing, and the very perception of homes as long-term investments.

As Ontarians navigate these challenges, it's crucial to recognize that the current economic landscape is a temporary phenomenon. The anticipated rate cuts in mid-2024 bring optimism for a more affordable future. The complexities introduced by higher interest rates are prompting a reevaluation of priorities and strategies, urging Ontarians to approach the housing landscape with resilience and optimism.

The dynamic narrative we've explored aligns with the broader economic context, including the Bank of Canada rate increase, the Variable Rate Interest Forecast 2023-2028, and the Canada Interest Rate Forecast. The uncertainties surrounding whether interest rates in Canada will go down in 2024 and the forecast for Canada Mortgage Interest Rates in 2023-2028 add depth to the ongoing discourse.

While the challenges posed by rising interest rates and shifting perspectives are evident, there's a resilience woven into the fabric of Ontarians. The housing market, often a barometer of economic health, reflects a community navigating uncertainties with pragmatism and adaptability.

The temporary nature of current challenges becomes apparent. The expected rate cuts in mid-2024 present a potential turning point, offering a glimmer of hope for a more balanced and accessible housing market. It's a reminder that economic landscapes are ever-evolving, and adaptability is key in steering through uncharted waters.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.