January Jitters: Canadian Housing Starts Dip 10% Amid Economic Uncertainty

The Canadian housing market serves as a crucial barometer of economic health and consumer sentiment, influencing various sectors and individuals across the country. Understanding the latest housing data and trends is essential for stakeholders ranging from policymakers and economists to homebuyers and real estate professionals. In January 2024, the Canadian housing market experienced notable shifts, with key indicators reflecting both challenges and opportunities.

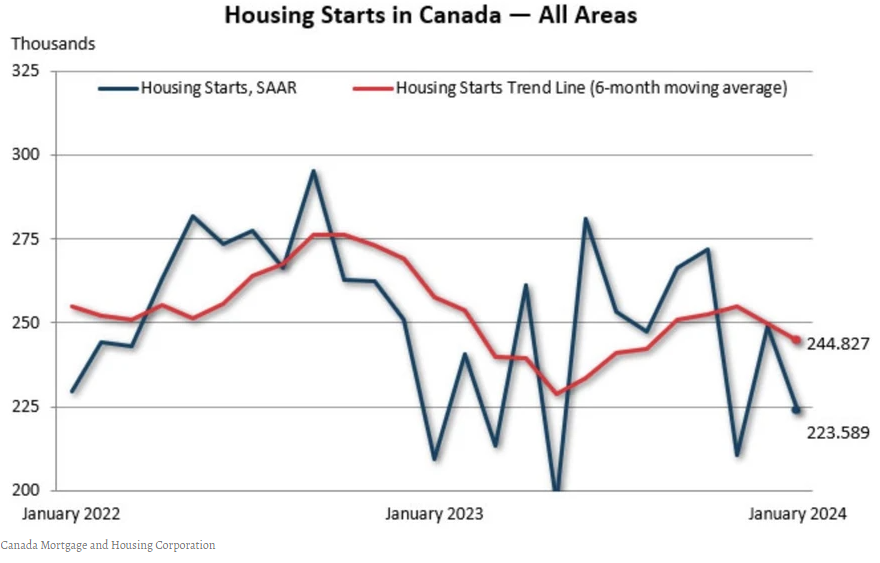

Housing starts, a pivotal metric in gauging the health of the real estate sector, exhibited a noteworthy decline in January. The annual pace of housing starts in Canada slowed by 10% compared to December 2023, according to data from the Canada Mortgage and Housing Corp. (CMHC). This decline was attributed to various factors, including reduced investment demand, higher borrowing costs, and declining job vacancies in the construction sector. Economic uncertainty, stemming from factors such as inflation, interest rates, and geopolitical tensions, also contributed to cautiousness among developers and investors, dampening confidence in the housing market and discouraging new construction projects.

Regional variations were evident in the housing starts data, with Toronto standing out with a significant increase. Toronto experienced a remarkable 179% surge in the annual rate of housing starts, driven primarily by a surge in multi-unit projects. Conversely, other regions such as Montreal and Vancouver saw declines in housing starts, with significant drops attributed to reductions in multi-unit projects. These regional disparities underscore the complex dynamics at play within the Canadian housing market, influenced by factors ranging from economic conditions to local market dynamics and government policies.

In addition to housing starts, housing prices, and market sentiment also underwent notable shifts in January. Several major cities in Canada experienced significant declines in house prices, signaling a substantial correction in prices. For instance, Toronto saw single-family houses drop by 20% from their peak, while Vancouver experienced an 8% drop and Hamilton plummeted by 25%. These price declines reflect potential imbalances between supply and demand or affordability challenges in these markets. Market sentiment was influenced by expectations of Bank of Canada rate cuts and a drop in fixed mortgage rates, which could potentially stimulate sales and lead to a rebound in homebuilding.

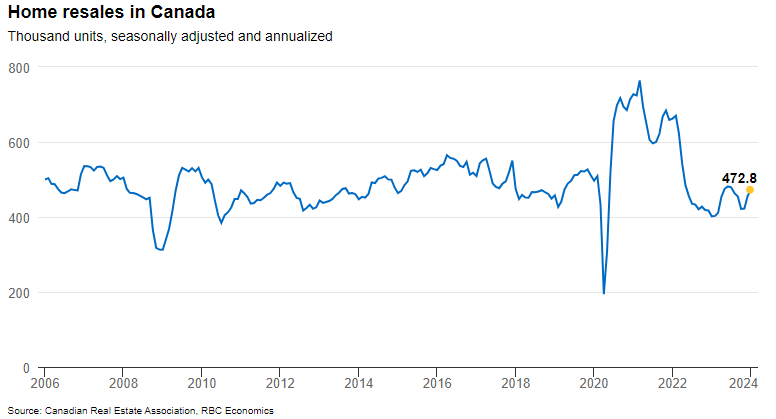

Existing home sales, meanwhile, showed signs of recovery in January, with an increase in activity and a tightening of market conditions. Despite the uptick in sales, prices continued to fall in several markets, highlighting ongoing affordability concerns.

Regional variations persisted, with some areas experiencing price drops despite increased sales activity. The interplay between pent-up demand and increased listings in the upcoming spring season will likely shape market dynamics in the coming months.

In light of these developments, policymakers face the challenge of addressing affordability concerns and stimulating homebuilding to meet demand. Canadian housing supply targets set by policymakers are deemed unrealistic by some analysts, with builders responding more to market conditions than government initiatives. The potential impact of impending interest rate cuts on stimulating sales and leading to a rebound in homebuilding remains a topic of debate and analysis within the real estate sector.

Thinking about selling your home?

Get in touch. We'll guide you through every step of the process to ensure a smooth transaction that meets your goals.