Housing in the Headwinds: Decoding the Economic Downturn

The Canadian real estate landscape is undergoing a transformation, shaped by an impending economic downturn and delayed rate hikes, Desjardins outlines in their latest outlook about the Canadian housing market for 2024. In this comprehensive analysis, we unveil the intricacies that define the slow spring real estate season, with a keen focus on Ontario, Toronto, and the Greater Toronto Area (GTA).

Since the Bank of Canada's rate hike, sales and prices have experienced a significant dip, setting the stage for a challenging period ahead. The economic downturn forecast for 2024 adds to the complexity, particularly impacting large cities like Ontario and BC.

Factors at Play

1. The Role of Interest Rates

A deep dive into the Bank of Canada's policy reveals its impact on the real estate sector. High interest rates contribute to market sensitivity and pose challenges for potential homebuyers.

2. Labour Markets in the Crossfire

Unraveling the impact of job losses on the real estate market, the labour market becomes a crucial player amid economic headwinds.

3. Affordability Quandary

Balancing housing demand amidst economic challenges becomes a significant concern. Affordability remains stretched, influencing migration patterns and demand for different housing types.

4. Population Growth as a Pillar

Despite economic uncertainties, decades-high population growth continues to support housing demand, with some shifts expected in temporary migration trends.

Construction Conundrum

The surprising resilience of housing construction faces challenges in the form of high interest rates, building costs, and labour shortages. The article assesses trends and predicts the future of construction activity.

Ontario

Ontario experiences a roller coaster in its housing market, from peaks to declines post the rate hike. Predicting the bounce-back amid economic contractions becomes crucial for the province.

Atlantic Region

Softening markets in Atlantic Canada prompt a comparative analysis with higher-priced jurisdictions. Homeowners feel the impact of high borrowing costs, influencing market dynamics.

Quebec

Quebec's resale housing market faces challenges, with a difficult year marked by weak population growth and easing supply-demand tightness.

British Columbia

Beyond Vancouver, housing weakness in BC spreads, influenced by economic momentum shifts and challenges compared to Ontario.

Navigating the future entails finding opportunities amidst economic uncertainty. The analysis suggests a mild recession by historical standards in 2024, with the potential for a rebound as the Bank cuts rates and economic recovery takes shape.

FAQs

1. How will the economic downturn impact housing affordability?

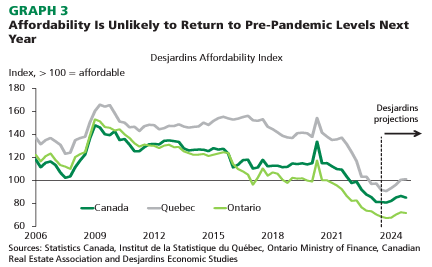

Affordability improvements are anticipated, but challenges persist. The Desjardins Affordability Index indicates a potential improvement from current levels, "But prices should still stay high relative to the last two decades amid elevated interest rates. Therefore, improvements should be modest, leaving most major housing markets in Canada less affordable than before the COVID‑19 pandemic began."

2. What role does population growth play in supporting housing demand?

Decades-high population growth remains a crucial pillar supporting housing demand, despite potential shifts in migration trends.

3. Can we expect a rebound in construction activity despite the challenges?

The construction sector's surprising resilience is expected to face a slowdown, influenced by factors like high-interest rates, labor shortages, and economic softness.

4. How do regional markets differ in their response to economic challenges?

Regional variations are evident, with some regions showcasing resilience while others face pronounced market sensitivity to interest rate changes.

5. What factors contribute to the spread of housing weakness in BC beyond Vancouver?

Beyond Vancouver, BC's housing market is influenced by factors such as new listings, economic momentum, and the impact of higher rates on households.

Navigating the future entails finding opportunities amidst economic uncertainty. The analysis suggests a mild recession by historical standards in 2024, with the potential for a rebound as the Bank cuts rates and economic recovery takes shape.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.