Haunted Housing Hurdles

As Halloween casts its spooky shadow over us, it's time to dive into a chilling saga that's not just about ghosts and ghouls. No, dear readers, we're about to unravel the hair-raising story of Canada's housing market, where the real frights are economic, political, and financial.

The Economy's Haunting Uncertainty

First, let's peer into the haunted crystal ball of the economy. The Bank of Canada, led by Carolyn Rogers, has been caught in a nail-biting dilemma. On one hand, they've been raising interest rates, pushing potential homeowners to the brink of a horror story - mortgage payments that just won't quit. These sky-high borrowing costs have potential buyers breaking out in cold sweats as they watch their dream homes slip away into the shadows.

But wait, what's this? Carolyn Rogers, the senior deputy governor of the Bank of Canada, sounds almost surprised. "As interest rates come down, house prices will move up a bit and they'll come off as interest rates come back up," she says. But guess what? This time, it's not going as expected. Like a ghost refusing to stay in its grave, house prices haven't tumbled as predicted.

Between the bank's rate hikes, we witnessed an 18% drop in the benchmark home price. However, prices didn't stay down; they clawed their way back up like reanimated zombies. You might call it a "spring resurgence," but we'd say it's more like a terrifying twist in the housing plot.

But what's haunting the real estate market, keeping prices from taking a nosedive? The Bank points the ghostly finger at a "structural lack of supply." According to Carolyn Rogers, "Until we address that supply issue, interest rates on their own are not going to help us get back to a housing affordability situation."

Frightening Figures

Now, let's delve into the numbers. Toronto, a major player in the Canadian housing saga, has seen home prices that could send shivers down your spine. Despite some upticks in the supply of available homes, the average selling price continues to haunt potential buyers, remaining steadfast in its ascent.

In September, the Toronto Regional Real Estate Board (TRREB) reported a 7.1% drop in home sales compared to the same month in 2022. Sales of ground-oriented homes, especially semi-detached houses and townhouses, suffered a particularly gruesome fate. A glance at the statistics reveals a market seemingly better supplied with listings. Yet, it's not enough to stop the average selling price from creeping up like a malevolent specter.

For the faint-hearted homebuyers, it's been an ongoing nightmare of high borrowing costs, rising inflation, and that ever-lingering uncertainty around Bank of Canada decisions. As we endure this eerie climate, the average price of a condo apartment in Toronto hovers above $700,000.

"TRREB's annual consumer polling has shown that half of intending home buyers in Toronto will be first-time buyers in any given year," notes TRREB CEO John DiMichele. The ghostly twist? The first-time buyer exemption threshold for the City's upfront land transfer tax has been stuck at $400,000 for a staggering fifteen years. It's like a plot twist where the main characters are stuck in a never-ending loop.

The Demons of Debt

But the real horror story in this narrative isn't just about high prices, it's about the grim debt realities. With rising interest rates, many homeowners are feeling vulnerable. A survey reveals that 31% of mortgage holders are set to renew their mortgages in the next 18 months. Of that cohort, a whopping 74% are haunted by the looming impact of higher interest rates.

Now, if you're a horror movie buff, you know that bad things happen when people are forced into a corner. When folks start cutting their spending elsewhere to cope with higher mortgage payments, it's like the prelude to a supernatural thriller. Cut too deep, and we could see a chilling domino effect that leads to job cuts and even more economic horror.

And speaking of spiraling economic horrors, the Bank of Canada recently released its Monetary Policy Report. It highlights that while "financial stress" has increased among households, delinquency rates for mortgages remain eerily low. The report ominously points out that delinquency rates on car loans have risen to pre-pandemic levels and exceeded them. Now, those are signs of trouble brewing beneath the surface.

In summary, if the Bank of Canada is forced to keep interest rates high for longer – well, that's a recipe for a deeper dive into the housing market abyss. It might mean a much greater weakening of the housing market, like a phantom that's unleashed to haunt the living.

The Ghosts of International Students

Let's not forget the international students, hovering on the fringes of this ghostly tale. There's been talk of putting a cap on their numbers. Immigration Minister Marc Miller compares this to "performing surgery with a hammer." A heavy-handed approach indeed.

The influx of international students has played a significant role in the housing market. These students face substantially higher tuition fees, which contribute a hefty sum to Canada's economy. However, the growing divide between domestic and international students has cast a dark shadow on the affordability and accessibility of higher education. Some of these students might even be moonlighting as amateur ghost hunters, given the challenges they face.

Yet, the government is sending mixed signals, introducing enhanced verification processes to prevent fraudulent acceptance letters while promoting "recognized institutions" that offer mental health services and affordable housing to international students. Like a spooky labyrinth, it's a complex web of policies that's hard to untangle.

Housing Affordability's Ghoulish Past

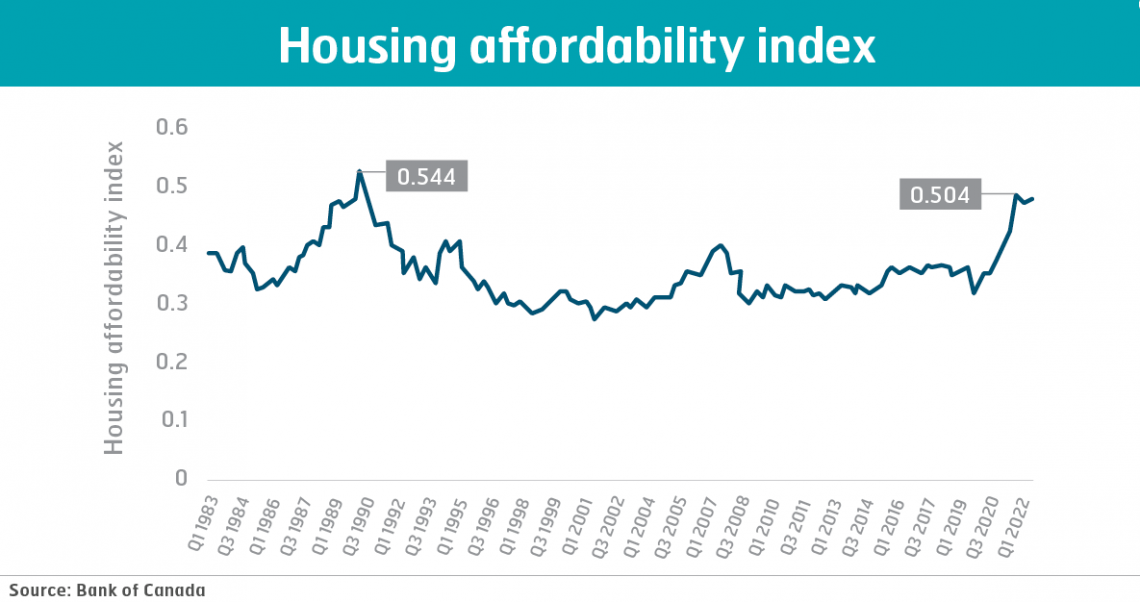

Now, let's uncover a chilling connection to history, much like a ghost reaching out from the past. Housing affordability in Canada hasn't been this bad since 1989 when interest rates were as high as they were.

High interest rates are back, casting a shadow reminiscent of the late 1980s and early 1990s. In July 2023, the Bank of Canada raised its interest rate to 5%, marking its highest level since 2001. The bank aimed to fight inflation by making loans more expensive, hoping it would slow down rising prices. However, it seems like this time, higher mortgage rates are fueling inflation rather than curbing it.

In July 2023, mortgage interest costs, which are included in the Consumer Price Index (CPI) basket, rose by over 30% compared to the previous year. According to Statistics Canada, mortgage interest costs were the single largest contributor to inflation in July. If we exclude these costs, inflation would have been 2.4% instead of 3.3%. It's like a classic ghost story where the hero's attempts to vanquish the apparition only make it stronger.

But why are 5% rates having the same effect as higher rates in the late 1980s and early 1990s? The answer lies in the fact that households today have more debt. Home prices have surged for various reasons, including relatively low interest rates and the perception of housing as an investment. However, income growth hasn't kept pace with rising prices, forcing people to take on significantly more debt to become homeowners. In 1990, the average household's debt was only 90% of its disposable income. By fall 2022, this had more than doubled to 186%.

In a chilling twist, back in 1990, after the affordability bubble peaked, house prices in Toronto fell by over 30%, while in the rest of Canada, the average home price remained stable throughout the rest of the decade. Stable prices and falling interest rates made homeownership more affordable for a period. Economists have been waiting for a similar correction in Canada's housing market since the financial crisis in 2008, but it never materialized.

Whether housing becomes more affordable over the next decade depends on a variety of factors, including interest rates, government housing policy, and wage growth. It's like a long-running horror series with an uncertain ending.

Lack of Housing: A Haunting Truth

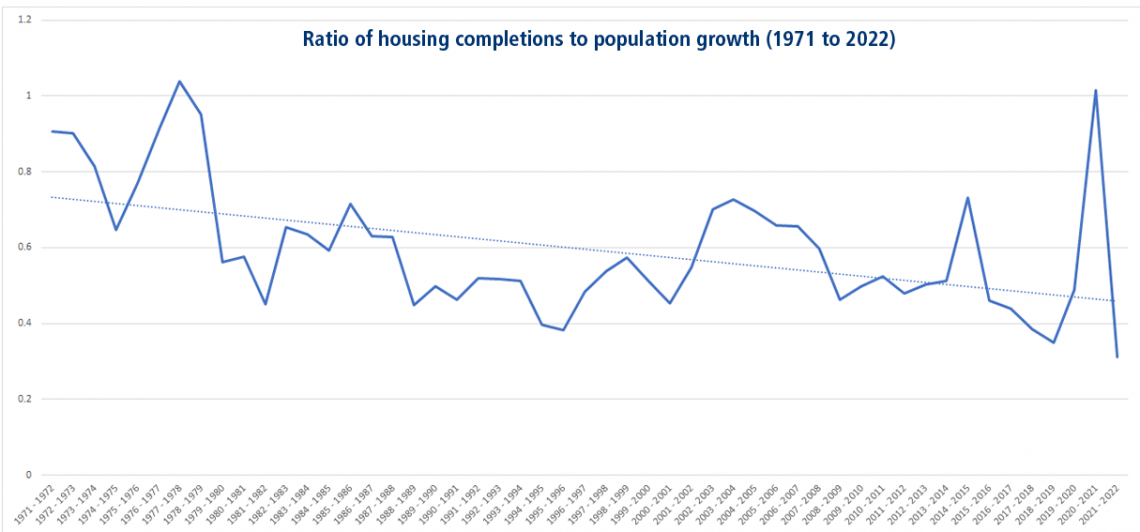

But there's one more terrifying revelation that connects this haunted narrative. Canada isn't building enough homes. According to recent comparisons, Canada lags behind its international peers in total homes per person. It's a haunting discrepancy.

To illustrate the current shortages, we can turn to the historical patterns. In the 1970s, a new home was built for every 1.2 additional Canadian inhabitants on average. But in the 2010s, a new home was constructed for every 2.1 new inhabitants. The supply of new homes is lagging behind population growth.

This trend should worry Canadians, as shelter is a basic need. With insufficient supply relative to demand, fewer homes are available to renters and buyers, leading to higher rents and home prices. This hits low-income families and first-time buyers the hardest.

Yet, there's a glimmer of hope in this dark tale. We've proven that we can balance supply and demand. If more homes were built in the 1970s than today, with a smaller population, then there's little reason why we can't do it again. It's a matter of political will and a commitment from Canadian policymakers at all levels of government.

So, as Halloween night falls upon us, we leave you with this chilling thought: the ghouls of the Canadian housing market may yet have more spine-tingling surprises in store. And until the government ghosts figure out their haunting roles, the nightmare continues for those seeking their own piece of Canada's real estate.

The Haunting Continues

The affordability crisis, interest rates as high as the late 1980s, soaring mortgage interest costs, and the haunting memory of 1990's debt levels all play a part in this spine-chilling narrative. We're trapped in a housing horror movie where the past refuses to stay buried, and the present is filled with ghoulish financial burdens.

The haunting question remains: Will the future hold relief for homebuyers, or are we destined to wander this labyrinth of uncertainty? Until government policies, interest rates, and economic factors align, the haunting of Canada's housing market may persist, casting a shadow over our dreams of affordable homeownership. Happy Halloween, indeed.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.

Text with Image Object

Lorem ipsum dolor sit amet enim. Etiam ullamcorper. Suspendisse a pellentesque dui, non felis. Maecenas malesuada elit lectus felis, malesuada ultricies. Curabitur et ligula. Ut molestie a, ultricies porta urna.

Text with Image Object

Lorem ipsum dolor sit amet enim. Etiam ullamcorper. Suspendisse a pellentesque dui, non felis. Maecenas malesuada elit lectus felis, malesuada ultricies. Curabitur et ligula. Ut molestie a, ultricies porta urna.