GTA Underbidding Soars to 98% in to End 2023

In the ever-evolving landscape of the Greater Toronto Area's real estate market, the echoes of bidding wars and strategic maneuvers have taken center stage, shaping the dynamics of buying and selling homes. As we delve into the recent developments, December 2023 emerges as a pivotal chapter, witnessing an unparalleled surge in underbidding activity.

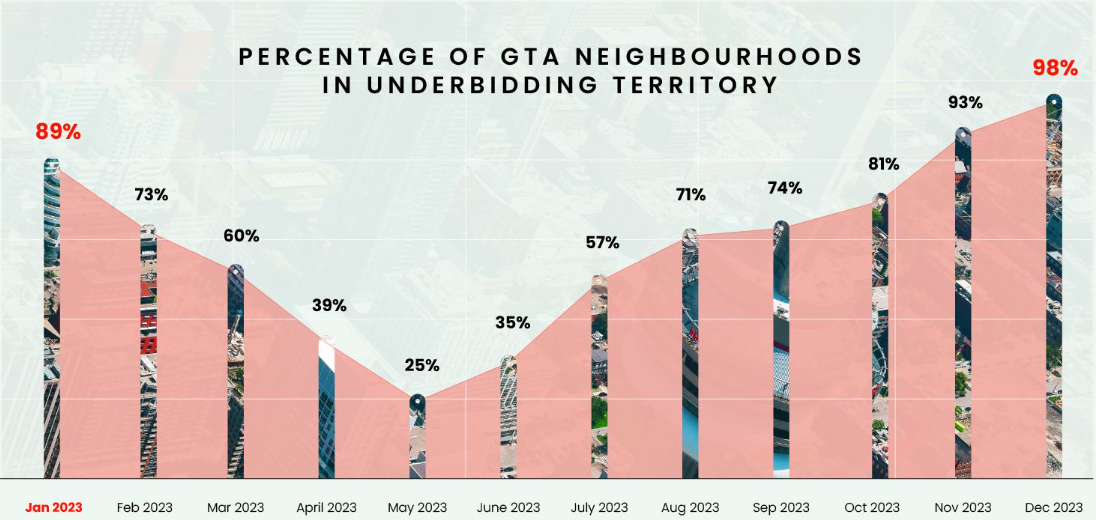

A staggering 98% of GTA neighborhoods found themselves in the realm of underbidding, marking the seventh consecutive month of increasing underbidding trends. This significant uptick from the preceding month's 93% highlights a trend that has become increasingly influenced by external factors, most notably the Bank of Canada's rate hikes.

The report's findings align with the broader narrative of the GTA real estate chessboard, where the interplay of underbidding and overbidding continues to evolve. The lowest percentage of neighborhoods in underbidding territory for 2023, occurring in May, stands as a historical point of reference. This coincided with the highest sales for a single month, totaling an impressive 8,962, and prices reaching their peak at an average of $1,195,546.

This underbidding surge in December not only sets a new record but also surpasses the previous high observed in November, showcasing the persistence of this trend in the local real estate scene. The evaluation criteria employed by Wahi, which compares median list and sold prices, excluding those with fewer than five transactions, provides a comprehensive snapshot of the market dynamics.

Remarkably, the limited overbidding activity in December is noteworthy. Out of approximately 400 neighborhoods evaluated, none ventured into overbidding territory, reflecting a decline from the 16 neighborhoods that did so in November. This shift can be attributed to the impact of rate hikes, as noted by Benjy Katchen, CEO of Wahi, who highlights their influence on real estate markets across southern Ontario.

Katchen suggests that with interest rates stabilizing or even falling, this period could present an opportune time for potential homebuyers. The stabilization of interest rates may open doors for exploration, allowing buyers to navigate a greater selection of properties and potentially secure more favorable deals.

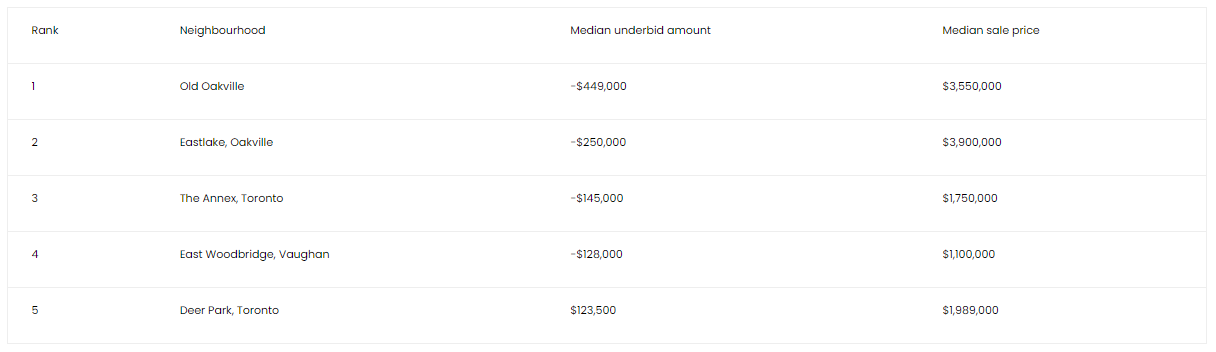

The top underbidding neighborhoods in December further illuminate this trend. Old Oakville, Eastlake (Oakville), The Annex (Toronto), East Woodbridge (Vaughan), and Deer Park (Toronto) take the spotlight as areas where underbidding activity is particularly pronounced.

In terms of numbers, the GTA-wide median underbid amount in December was $24,900, providing insight into the financial aspects of this bidding landscape. Comparative underbidding in other Ontario cities, including Hamilton, London, Waterloo, Barrie, St. Catharines, and Kingston, underlines the widespread nature of this trend as a percentage of median sold prices.

To understand the nuances of this underbidding and overbidding rollercoaster, we must consider the broader context. Seasonal factors play a role, with bidding activity influenced by the limited competition in the winter months, potentially reducing the intensity of bidding wars.

The current real estate landscape in the GTA underscores the dominance of underbidding trends, offering a potential window of opportunity for those considering entering the housing market.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.