From Permits to Problems: Is Canada Building Enough Homes?

Canada's housing market has always been a cornerstone of its national economy, reflecting broader economic health and influencing sectors from construction to finance. Recent data on residential permits and housing starts present a nuanced view of this vital industry. By analyzing the latest figures, comparing them with previous months, and understanding the underlying factors, we can better grasp the current trends and their long-term implications.

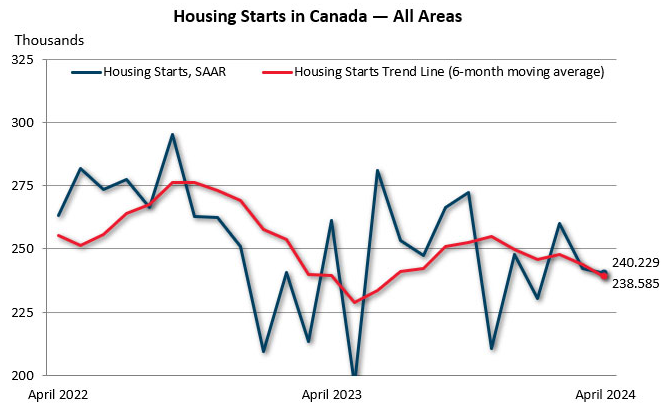

As of April 2024, housing starts in Canada were reported at 240,229 units, showing a slight 1% decrease from March's seasonally adjusted annual rate (SAAR) of 242,267 units. Urban housing starts remained nearly flat at 220,123 units, with a minor decrease in multi-unit starts and a small increase in single-detached starts. Rural housing starts were estimated at 20,106 units.

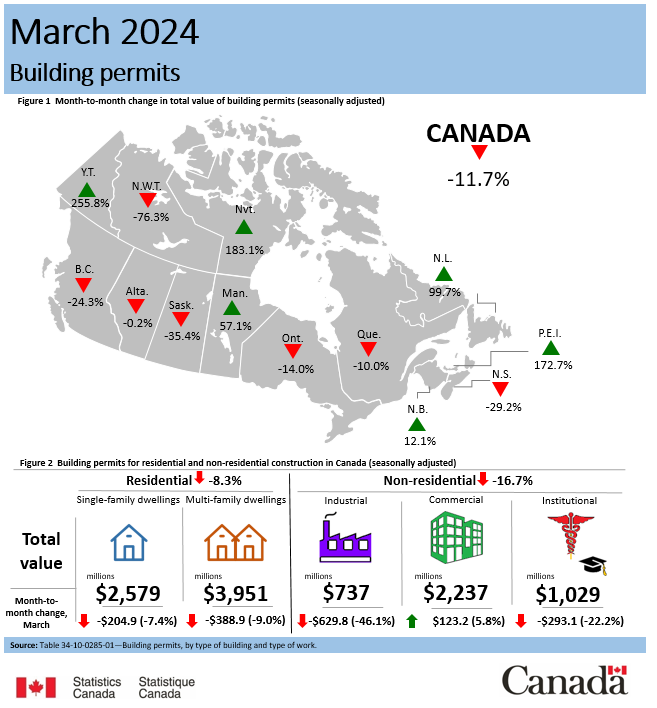

The total value of building permits in Canada experienced a significant decline of 11.7% in March 2024, amounting to $10.5 billion. This drop followed a 9.3% increase in permit values in February 2024. In the residential sector, there was an 8.3% decrease to $6.5 billion, while the non-residential sector fell by 16.7% to $4.0 billion. However, the commercial component within the non-residential sector showed a 5.8% increase, providing a silver lining amidst the overall downturn.

To understand the broader trend, it is essential to compare the recent data with previous months. Over the past year, housing starts have remained relatively steady despite minor fluctuations. The annual pace of housing starts for April 2024 showed a modest decline compared to March, indicating a stable yet slightly downward trend. This stability contrasts with the more pronounced monthly changes in building permits, which experienced significant drops in March after an increase in February. The first quarter of 2024, however, saw a partial rebound with a 3.7% increase in the total value of building permits compared to the previous quarter.

The overall trend reveals a notable gap between actual housing starts and the potential capacity for housing construction in Canada. While actual housing starts were reported at 240,229 units in April 2024, the potential capacity for housing construction is estimated to be nearly 400,000 units as of 2023. This discrepancy indicates that Canada is falling short of its housing construction potential, a gap that poses significant challenges in meeting the demand for new housing.

These figures reflect a broader pattern of decreasing housing starts that has persisted for the past two years. The decline coincides with the Bank of Canada's decision to increase its policy rate, which has had a lagging impact on new construction projects. As a result, the national housing agency anticipates a continued decline in housing starts this year, following a period of historically high levels in recent years.

Several factors contribute to the current trend in housing starts and building permits. Key among these are labor shortages, regulatory constraints, economic conditions, and material costs. The construction industry has been grappling with a shortage of skilled labor, which has slowed down the pace of new housing projects. This shortage is exacerbated by an aging workforce and insufficient training programs for new entrants.

Stringent regulatory requirements and lengthy approval processes for building permits have also hindered the timely initiation of new projects. These bureaucratic delays can significantly impact the overall pace of housing starts. High borrowing costs due to increased interest rates by the Bank of Canada have made financing new projects more expensive. This financial burden has led to a decline in multi-unit housing starts, which are more sensitive to interest rate fluctuations compared to single-family homes. Additionally, elevated construction costs, driven by global supply chain disruptions and inflation, have further strained the housing market. Higher prices for materials like lumber and steel have increased the overall cost of building new homes, leading to delays and cancellations of projects.

The impact of these factors varies across different regions in Canada. For instance, Ontario experienced a significant drop in residential building permits by 13.7% in March, while provinces like Quebec, Prince Edward Island, and Saskatchewan saw growth in the residential sector. Major cities such as Toronto, Vancouver, and Montreal exhibited notable decreases in housing starts, particularly in multi-unit projects, reflecting regional disparities in housing market dynamics.

The current trend in housing starts and building permits has several long-term implications for the Canadian housing market. The persistent gap between actual housing starts and potential capacity underscores a looming shortage in housing supply. As demand continues to outstrip supply, this could lead to increased competition for available homes, driving up prices and exacerbating affordability issues.

Reduced housing starts can lead to lower economic growth, affecting jobs and investments in related sectors such as real estate, manufacturing, and retail. Addressing the challenges in the housing market requires coordinated policy responses. Government initiatives to streamline regulatory processes, invest in training programs for construction workers, and support affordable housing projects are crucial for bridging the gap between actual and potential housing starts.

Over time, the market may adjust to these conditions. Rising rents and housing prices could incentivize more investment in housing construction, while technological advancements and innovations in construction practices could help reduce costs and improve efficiency.

Industry experts have weighed in on the current trends and their implications. According to Rishi Sondhi, an economist at TD Bank, despite the recent declines, housing starts remain at a healthy level, supported by government measures and rising rents. However, he anticipates further declines due to recent weakness in pre-sale activity, high construction costs, and elevated interest rates. Similarly, a report by the Canada Mortgage and Housing Corporation (CMHC) highlighted that addressing labor shortages and streamlining regulatory processes are essential steps towards meeting the potential capacity for housing construction.

The latest data on Canadian housing starts and building permits reveals a complex and evolving landscape. While the market shows signs of resilience, significant challenges remain in bridging the gap between actual housing production and potential capacity. Factors such as labor shortages, regulatory constraints, economic conditions, and material costs play crucial roles in shaping these trends. Understanding these dynamics and their long-term implications is essential for stakeholders across the housing sector.

Not sure if you should sell?

We get it. The market is weird. If you’re not sure if selling your home is the right move for you right now, get in touch. We’ll go over the details of your specific situation and help you make the right decision.