Countering the Currents: OSFI's Preemptive Strike as Fixed Payment-Variable Rates Stir Concerns

In a significant move to address emerging risks in Canada's mortgage market, the Office of the Superintendent of Financial Institutions (OSFI) is mandating mortgage insurers to fortify their capital reserves. This directive comes in response to escalating concerns surrounding fixed payment-variable rate mortgages, where homeowners face potential challenges in the wake of record interest rate hikes.

Regulatory Response to Market Dynamics

OSFI's directive is a strategic response to the evolving landscape of Canada's nearly $2 trillion mortgage market. The recent interest rate hikes by the central bank have raised alarms about negative amortization—a situation where homeowners primarily pay interest, leading to extended repayment terms. To mitigate potential fallout, OSFI aims to ensure that lenders and insurers hold more capital against mortgages exhibiting extended repayment terms.

Negative Amortization Concerns

The growing prevalence of negative amortizations has become a focal point of concern. Many homeowners, constrained by rising interest rates, are opting for longer mortgage repayment terms. This phenomenon raises apprehensions about the overall stability of the financial system.

Superintendent, Peter Routledge, emphasizes the significance of this move, stating, "These changes enhance the resilience of Canada's financial system, ensuring a robust response to potential challenges in the mortgage market."

Revised Capital Guidelines

OSFI has announced changes to capital guidelines, effective from the upcoming year. Institutions will be required to hold more capital specifically earmarked for negatively amortizing mortgages. This adjustment reflects a proactive measure to enhance the overall resilience of Canada's financial institutions in the face of economic uncertainty and interest rate fluctuations.

Bank Responses and Market Impact

The top six banks in Canada have collectively set aside approximately $3.5 billion for bad debt provisions in response to the changing dynamics of the mortgage market. Over the first nine months of the fiscal year, they allocated a staggering $9.45 billion, surpassing the previous year's amount fourfold.

The impact on the stock market has been notable, with shares of the big six banks experiencing losses ranging from 3% to 12% this year. This trend reflects the challenges and uncertainties introduced by the shifting landscape of the mortgage market.

Types of Mortgages and Shifting Trends

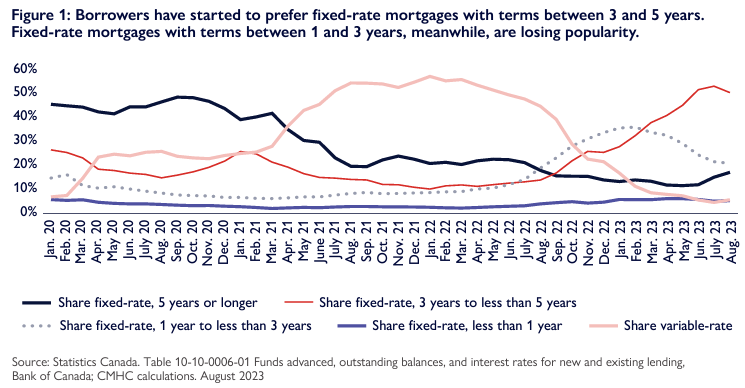

One of the critical aspects prompting regulatory action is the shift in the types of mortgages Canadians are undertaking. With the Bank of Canada's interest rate hike to 5%, variable-rate mortgages, especially fixed-payment variable-rate options, have been significantly affected. Homebuyers are reassessing their preferences, and there is a noticeable trend toward mortgages with fixed rates.

Furthermore, OSFI has introduced changes to various requirements, including Capital Adequacy Requirements, Life Insurance Capital Adequacy Test, Minimum Capital Test, and Mortgage Insurer Capital Adequacy Test. These adjustments aim to align regulatory measures with the evolving risks in the mortgage finance system.

Risks and Vulnerabilities to the Housing Finance System

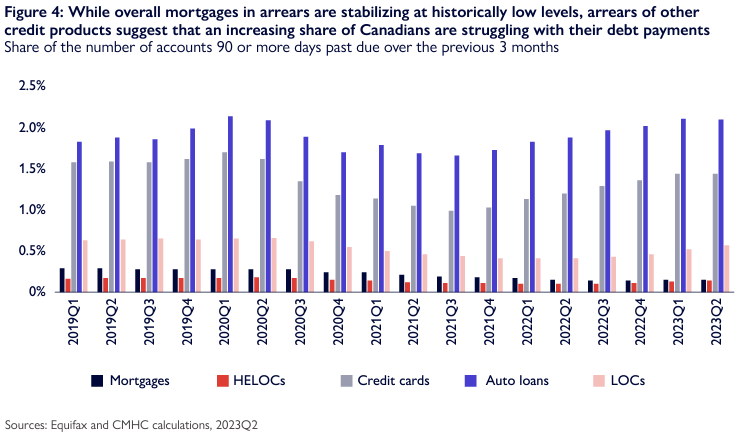

The directive from OSFI reflects broader concerns about the risks and vulnerabilities present in the housing finance system. The decreasing ability of Canadians to make their debt payments, indicated by a high debt-to-income ratio (171.9% in 2023Q2), coupled with the significant share of mortgages with variable rates, poses challenges.

While overall mortgages in arrears (delinquent for 90 or more days) have stabilized at historically low levels, other delinquency indicators suggest an increasing number of Canadians are grappling with debt payments. This is particularly evident in larger mortgage loans ($400,000 and up) showing an upward trend in arrears since 2022Q3.

OSFI's directive to mortgage insurers to bolster reserves underlines the regulator's commitment to ensuring the stability and resilience of Canada's financial system. As the mortgage market undergoes transformations driven by interest rate hikes, the regulatory measures aim to address both immediate challenges and long-term risks, fostering a more secure and sustainable housing finance environment

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.