Could higher inflation, ranging between 3-4%, persist for the foreseeable future?

In December 2023, the Canadian Consumer Price Index (CPI) revealed interesting shifts and projections that merit a closer examination. The subtle uptick in inflation, primarily driven by the energy component, indicated the sensitivity of inflation to fuel costs. Despite a Business Outlook Survey suggesting fewer firms expected significant price changes in the upcoming year, Canadian expectations for rent price growth remained elevated.

The Bank of Canada's preferred core CPI measures experienced a bounce, though inflationary pressures showed signs of narrowing over the last three months. Firms reported a shift towards normal or reduced price increases, reflecting a perception of weaker demand. While Canadian consumers anticipate higher rents, there's a contrasting trend in the slowing growth of food prices.

Claire Fan, an economist at RBC, contributed valuable insights into macroeconomic trends and key indicators for both Canada and the US. The report emphasized the impact of abnormal inflation on consumer purchases and highlighted the stickiness of inflationary pressures.

Canada's headline inflation rate jumped to 3.4% in December, marking a persistent inflationary trend. Base effects, coupled with specific contributing factors, played a role in this increase, with gas prices in December 2022 influencing the comparison.

Economists anticipate the Bank of Canada to maintain a cautious stance, given that both headline and core inflation measures are notably above the desired neutral rate of 2%. The "stickiness" of recent inflation readings poses a challenge in bringing inflation sustainably back below 3%.

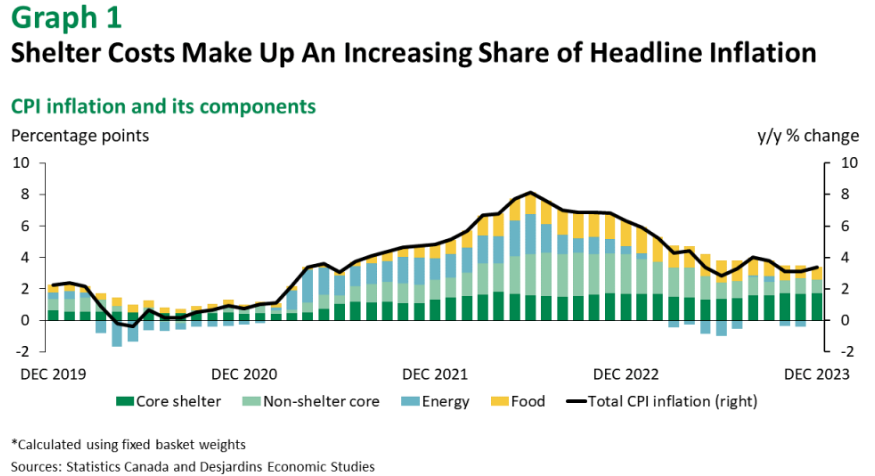

Analysts note the complexity of the last mile in reducing inflation from around 3% to the target of 2%, with progress stalling over the past six months. Mortgage interest costs and shelter expenses, notably mortgage interest and rent, continue to significantly contribute to headline inflation.

The report emphasizes monitoring wage trends stuck in the 4%-to-5% range and anticipates the Bank of Canada's cautious stance in the upcoming rate decision and Monetary Policy Report. Mortgage interest and rent are identified as the two largest contributors to inflation, providing insights into the housing market and interest rate forecasts for 2024.

The headline Consumer Price Index rose by 3.4% year-over-year in December 2023, aligning with predictions and economist consensus. However, the seasonally adjusted monthly move raises concerns, revealing potential challenges and inconsistent patterns.

Bank of Canada's preferred core inflation measures, CPI median, and trimmed mean remained slightly higher than in November, while traditional measures excluding food and energy held steady at 3.8%. Despite aligning with predictions, there are concerns regarding the outsized contribution of shelter, higher inflation in underlying indicators, and evidence of progress but lowered expectations for future inflation and economic activity.

Desjardins' outlook suggests a call for rate cuts by mid-2024, subject to reevaluation after the upcoming rate announcement. Real GDP growth in Q4 and consumer/business surveys point to lowered expectations, adding weight to the argument for potential rate cuts.

The persistent inflation trends, coupled with the Bank of Canada's cautious stance and expert insights, contribute to a complex economic narrative. As we step further into 2024, closely monitoring key indicators becomes crucial for understanding the trajectory of inflation and its implications for the broader economy.

Notably, a crucial question looms on the horizon: Could higher inflation, ranging between 3-4%, persist for the foreseeable future? The indicators and expert analyses presented in this article underscore the challenges in taming inflation to the desired levels. The Bank of Canada's cautious approach, coupled with the complexities surrounding factors like mortgage interest and shelter costs, suggests that the path to reaching the 2% target might be more intricate than anticipated.

As economic uncertainties persist, the coming months will undoubtedly shed more light on whether the inflationary trends observed in December 2023 will evolve into a more enduring reality.

Not sure if you should sell?

We get it. The market is weird. If you’re not sure if selling your home is the right move for you right now, get in touch. We’ll go over the details of your specific situation and help you make the right decision.