China's Property Market in Turmoil: Understanding the Crisis

The once-booming property market in China is now facing unprecedented challenges, with major developers such as Evergrande, Country Garden, and Vanke struggling to navigate through financial distress. In this comprehensive article, we will delve deep into the current state of the Chinese economy, explore the intricacies of the troubles plaguing these developers, and analyze the potential global implications of this crisis.

As China's ceremonial national legislature convenes in Beijing, the spotlight is on efforts to revive a slowing economy. Despite optimistic expectations for a robust recovery post-2022, the reality has fallen short. Challenges such as an aging workforce, strained international relations, particularly with the United States, and a crisis in housing construction continue to exert pressure on economic growth. Premier Li Qiang is anticipated to announce an official economic growth target, with projections indicating a potential slowdown to below 5%.

At the forefront of China's property market crisis are Evergrande and Country Garden. Evergrande, once hailed as the largest real estate developer in China, recently faced a severe setback when a Hong Kong court ordered its liquidation after it failed to restructure its colossal debt. Following in Evergrande's footsteps, Country Garden, another major player in the industry, finds itself entangled in a legal battle as it confronts a winding-up petition from creditor Ever Credit in the Hong Kong High Court. The petition seeks to liquidate Country Garden's assets to settle a debt of $204 million, compounded with interest.

The financial woes for Country Garden commenced in October 2022 when it encountered challenges in repaying debts amidst plummeting housing prices and dwindling sales revenue. The announcement of its default and subsequent petition for liquidation triggered a massive sell-off, causing Country Garden's shares to nosedive by more than 12%. This sharp decline reflects not only investor apprehension but also the pervasive uncertainty engulfing the property market.

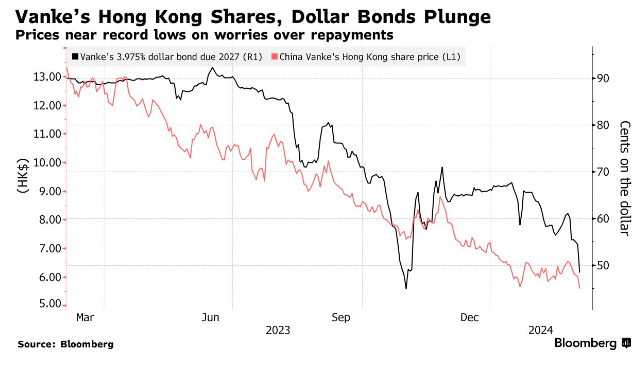

The tumult in China's property sector is further compounded by concerns surrounding China Vanke Co., the nation's second-largest property developer by sales. Chinese insurers have sounded the alarm over debt risks associated with Vanke, urging annuity managers to closely monitor credit risks. Vanke's shares and bonds have witnessed significant declines, with both markets hitting record lows in Hong Kong and Shenzhen.

The failure to reach an agreement on extending the maturities of certain private borrowings has raised alarm bells among shareholders and creditors alike, particularly in the aftermath of defaults by other major developers. Vanke's debt concerns are exacerbated by China's sluggish home sales, despite regulatory efforts aimed at bolstering the sector.

The potential collapse of these prominent Chinese developers reverberates far beyond the confines of the country's borders. Analysts caution that unraveling Evergrande's staggering $300 billion debt post-liquidation could span over a decade, exacerbating market uncertainty. Given the pivotal role of China's property industry in the nation's GDP, the crisis poses a formidable challenge for Beijing.

Furthermore, the specter of China's economic slowdown and financial instability casts a shadow over global markets and investor confidence. Could this lead to Chinese developers selling off global assets in order to stave off defeat at home?

As China grapples with the property market crisis, the repercussions for the global economy remain uncertain, with potential ripple effects across various sectors.

The confluence of factors contributing to the crisis in China's property market underscores the formidable challenges confronting the nation's economy. With major developers facing imminent liquidation and debt risks, the implications extend far beyond China's borders, potentially impacting global markets and investor sentiment. As China's leadership endeavors to stabilize the property market and stimulate economic growth, the road ahead remains fraught with uncertainty.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.