Canadian Mortgages Break Below 5%

In the ever-shifting landscape of the Canadian housing market, a significant development is making waves—mortgage rates falling below the 5% threshold. This groundbreaking trend is driven by a notable decrease in bond yields, prompting mortgage providers to respond with rate cuts.

Recent Rate Drops and Market Responses

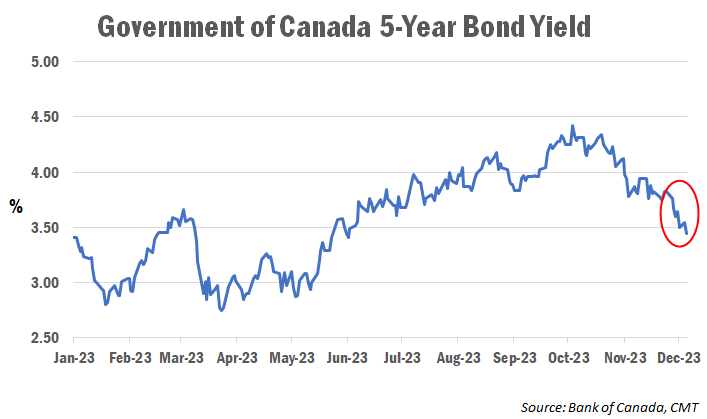

Bond yields in Canada have experienced a substantial 38 basis points drop since early last week and nearly a full percentage point decline since October.

Major players in the mortgage industry, including Scotiabank and CIBC, are quick to react by slashing fixed rates by 20-30 basis points. This move aims to make high-ratio rates more competitive, a strategy already embraced by True North Mortgage, introducing a 4.99% 1-year fixed rate with certain conditions.

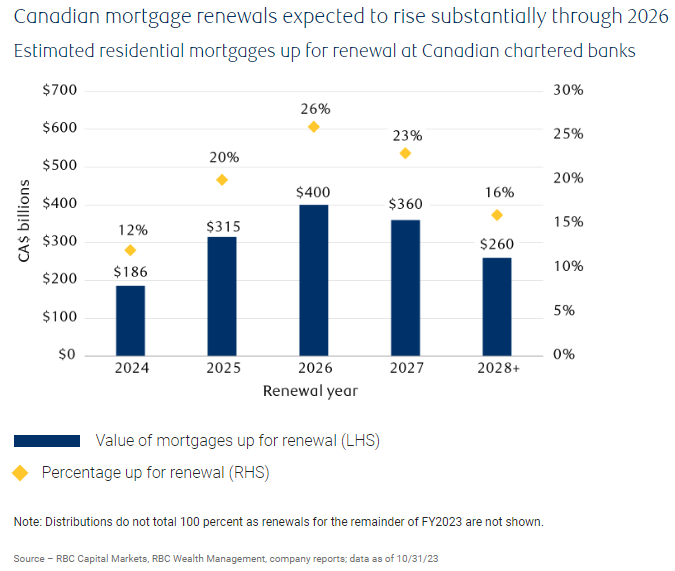

This easing in securitizing high-ratio rates has caught the attention of industry experts, with Ron Butler anticipating a domino effect as other lenders are likely to follow suit. The optimistic outlook suggests a positive impact on the impending "renewal cliff," where hundreds of billions of dollars worth of mortgages are set to renew over the next three years.

Impact on Borrowers and Borrower Trends

For borrowers, the rate cuts translate to a tangible benefit, with approximately $13 per month shaved off for every $100,000 of mortgage debt with a 25-year amortization. Notably, Butler Mortgage leads the pack with a market-leading 4.99% rate for its insured 5-year fixed product, targeting purchases with a down payment of less than 20%.

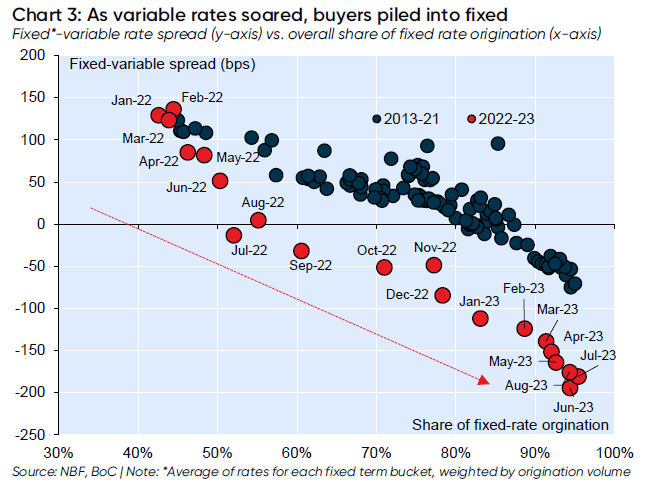

Recent data indicates a shift in borrower preferences towards shorter mortgage terms due to rising rates over the past year. However, concerns are arising about the high costs associated with shorter-term fixed rates, leading to a nuanced landscape where borrowers weigh their options in a changing market.

Rate Adjustment Concerns and Future Predictions

While the bond yields trigger a welcome reduction in mortgage rates, some experts note that fixed rates are not dropping as quickly as expected. Factors such as risk premiums due to economic uncertainty and profit-taking by lenders are contributing to this phenomenon. A sustained easing in bond yields is deemed necessary for continued rate drops.

Despite these challenges, there's optimism regarding the renewal cliff, with expectations that rates by the latter half of 2025 into 2026 may start with a 4, providing relief for borrowers. The market, however, expresses reservations about the speed of the drop, suggesting that fixed rates should be decreasing more in alignment with bond yields.

Bank of Canada's Role and Future Economic Trends

The Bank of Canada's decision to maintain its trend-setting interest rate at 5% in December 2023 marks the end of a significant rate-hiking cycle. This stability in rates is seen as a positive development for the mortgage market, providing relief for variable-rate mortgage holders and potentially paving the way for decreased fixed mortgage rates.

Analysts are closely scrutinizing economic conditions, including flat third-quarter GDP growth and fewer-than-expected new job positions in November, to glean insights into the central bank's future decisions. The potential for rate cuts in 2024 is on the horizon, and economists anticipate a decrease, possibly as early as March or April, signaling stability in borrowing costs.

Mortgage Market Landscape and Preferences

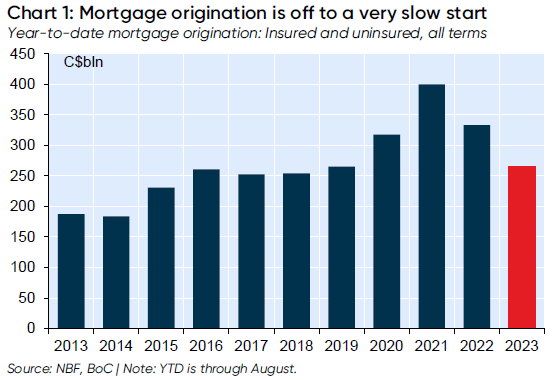

The recent high interest rates have left an indelible mark on Canada's mortgage market, with new mortgage activity experiencing its weakest pace since 2001. Fixed-rate mortgages have become the preferred choice for new borrowers, constituting approximately 95% of new mortgage originations. This shift is a stark contrast to the early 2022 housing market boom when variable-rate mortgages peaked at nearly 57%.

The slowdown in mortgage activity is evident, with a 25% decrease compared to 2022, reaching a 22-year low in September. However, this decline doesn't fully capture the impact of rising borrowing costs in the fall, according to National Bank economist Taylor Schleich. Static-payment variable-rate mortgages, despite criticism from banking regulator OSFI, have contributed to maintaining mortgage growth, especially at major banks like BMO and CIBC.

Future Outlook and Strategic Considerations for Borrowers

Three major banks—Scotiabank, BMO, and TD—have recently reduced fixed mortgage rates by 15 to 25 basis points. This move, following a period of inaction by the Big 6 banks, is attributed to a decline in the 5-year Government of Canada bond yield. Industry experts anticipate further rate reductions by mortgage providers, signaling potential future rate cuts.

The Canadian banking industry, often characterized by a herd mentality, may witness other banks following suit to stay competitive. This development, coupled with the potential for Bank of Canada rate cuts, indicates a dynamic landscape where borrowers may need to strategically consider their mortgage options. The preference for fixed rates, the shrinking discounts on variable rates, and the cautious optimism regarding the housing market's future add layers of complexity for borrowers navigating this evolving financial landscape.

The dive in Canadian mortgage rates below 5% is a multifaceted phenomenon shaped by changes in bond yields, market responses, and economic conditions. Borrowers stand to benefit from this trend, but strategic considerations are crucial in navigating the complexities of the mortgage market. As the landscape continues to shift, staying informed and adapting to emerging trends will be key for both current and potential homeowners. The story unfolds, and the Canadian housing market remains an intriguing terrain for those seeking financial stability and growth.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.