Canadian Existing Home Sales Hit Their Lowest Point in 15 Years

In December 2023, the Canadian housing market sent shockwaves through the real estate landscape. A surprising jump of 8.7% in home sales raised eyebrows, prompting a closer look at the data, trends, and potential implications for the average homeowner. This article delves into the details, dissecting the intricacies of the Canadian housing market, exploring regional nuances, and projecting what the future might hold for prospective buyers and sellers.

The abrupt increase in Canadian home sales in December 2023, reaching a notable 8.7% month-over-month, was like a gust of wind through the real estate market. It caught many by surprise, leaving analysts and industry experts analyzing the data for underlying trends.

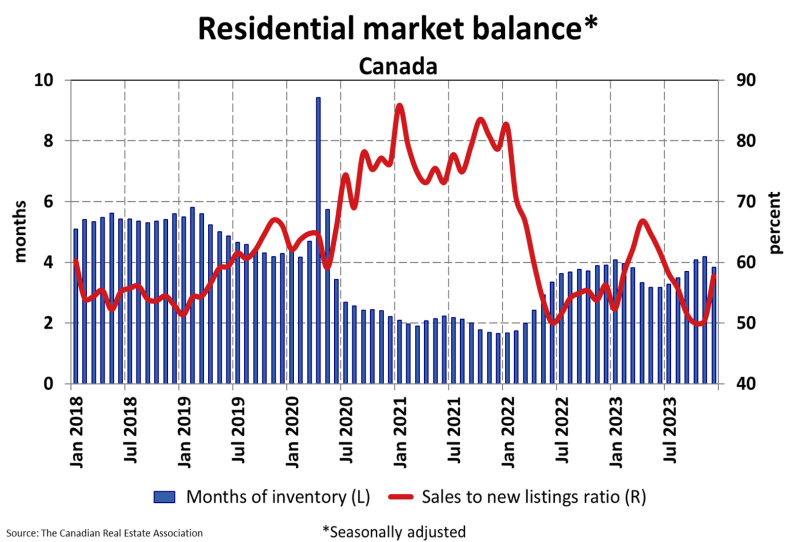

Newly listed properties, however, didn't join the festive dance. They decreased by 5.1% month-over-month, marking the lowest level since June. The sales-to-new listings ratio tightened to 57.8%, up from 50.5% in November. This dance of figures paints a picture of a market in flux, where demand appears to outpace supply.

The MLS® Home Price Index (HPI), a crucial indicator of market health, showed its own set of moves. Falling by 0.8% month-over-month, it managed to hold onto a 0.7% year-over-year increase. The Aggregate Composite MLS® HPI presented a mixed bag. Markets in Ontario, especially the Greater Golden Horseshoe, witnessed price declines, while the national average sale price in December 2023 was $657,145, reflecting a 5.1% increase from December 2022.

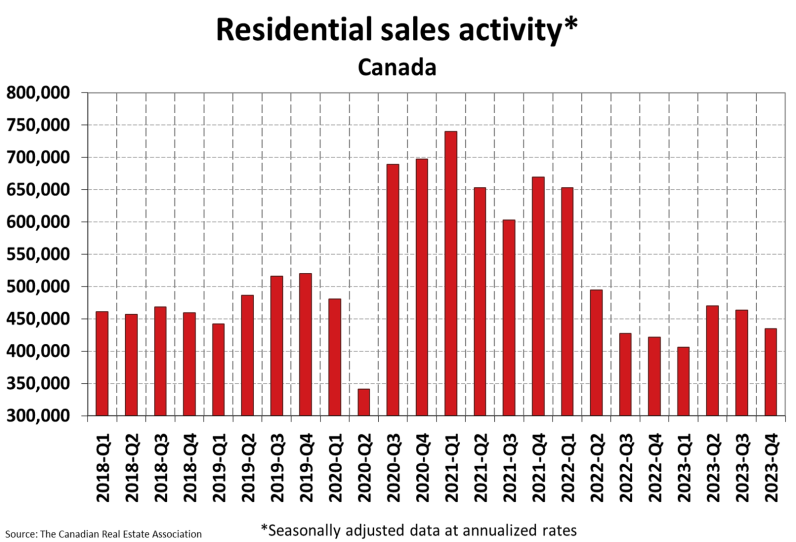

Zooming out for a broader perspective, the entirety of 2023 saw a total of 443,511 home sales. This marked an 11.1% decline from the previous year, making it technically the lowest annual level for national sales activity since 2008.

However, it's crucial to note that this figure was remarkably close to the levels recorded in each of the five years following the Global Financial Crisis (GFC) in 2008, as well as the first year the uninsured stress test was implemented in 2018.

Despite the December surge, experts are cautious about interpreting it as a full-fledged recovery. The cautious tone is warranted as we navigate through uncertain economic landscapes and unpredictable market dynamics.

Analysts, led by Shaun Cathcart from the Canadian Real Estate Association (CREA), foresee a potential recovery in housing demand in 2024. Clarity is expected in the coming months as the market reacts to various stimuli.

Real estate differs across regions. Price declines, a notable theme, are predominantly observed in Ontario markets, especially the Greater Golden Horseshoe. Meanwhile, other regions exhibit stability or continued growth, defying the general trend.

The once-clear lines of regional differences are blurring as market conditions evolve. Understanding these regional variations becomes crucial for anyone considering a foray into the real estate market, whether buying or selling.

December 2023 left the Canadian real estate market with 3.8 months of inventory nationally, down from 4.2 months in November. The sales-to-new listings ratio surpassed the long-term average, reaching 57.8%. Larry Cerqua, Chair of CREA, emphasizes the importance of a game plan for those looking to buy or sell in 2024.

Shaun Cathcart suggests that December's surge might be more about sellers and buyers aligning their expectations than a sign of a complete market recovery. The real test lies in the spring, and housing demand recovery is projected for 2024. These insights underscore the resilience of the market amidst uncertainties.

Shifting the spotlight to existing home sales, the surge in December 2023 reached 8.7%, with Ontario, B.C., and Alberta leading the charge. The sales-to-new listings ratio tightened to 57.8%, surpassing its long-term average. Average home prices also saw a 2% month-on-month increase, driven by gains in Manitoba, Ontario, and Nova Scotia.

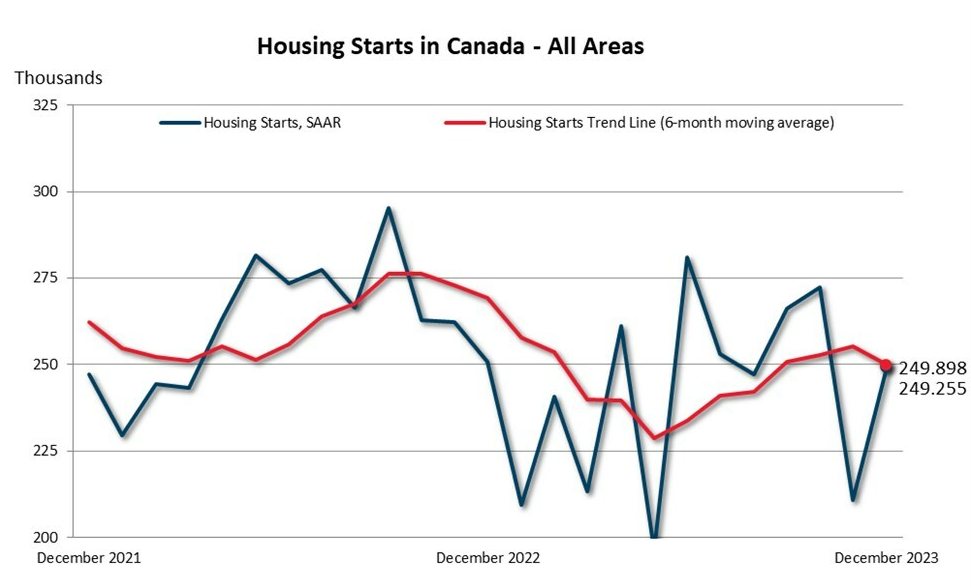

Toronto and Vancouver step into the limelight, navigating the twists of housing starts. While the national picture tells one story, these cities have their narratives. Toronto and Vancouver experienced a 5% and 28% increase, respectively, in 2023, driven by higher multi-unit starts.

2023 wasn't a banner year for Canadian real estate. With 443,511 homes sold, it marked the lowest level since the GFC. December brought a temporary surge, with 38,135 homes sold, an 8.7% increase from November. However, the Aggregate Composite MLS Home Price Index (HPI) declined for the third consecutive month.

CREA's gaze is on 2024, anticipating a 10.4% annual increase in home sales. The crystal ball extends to 2025, projecting a 7.3% climb in national home sales, with the average home price increasing by 4%. Regional variations are expected, with Alberta, Quebec, New Brunswick, Nova Scotia, and Newfoundland and Labrador poised for price increases.

In a similar trend, housing starts took a hit in 2023, witnessing an 18% rebound in December but ending the year with a 7% decline compared to 2022. Canada faces a housing shortage, with affordability at its lowest since 1982. Population growth, a whopping 3.2% rise, contributes to this deficit, creating a challenging scenario.

The Canada Mortgage and Housing Corp. (CMHC) estimates that the country needs 3.5 million additional housing units by 2030 to make housing affordable. BMO Capital Markets projects a need for an additional 170,000 residences every three months to accommodate new households.

Addressing this deficit requires substantial efforts in construction and policy changes. The challenges, however, are substantial, from borrowing conditions to labor shortages.

Despite a challenging year, the Canadian real estate market hints at a rebound in 2024. Interest rate cuts and heightened demand are set to play pivotal roles. As we navigate these trends, staying informed is the compass for a successful real estate journey.

Not sure if you should sell?

We get it. The market is weird. If you’re not sure if selling your home is the right move for you right now, get in touch. We’ll go over the details of your specific situation and help you make the right decision.