Canada's Quiet Struggle: The Anatomy of Economic "Slow Bleed"

Canada's economy is often celebrated for its stability and resilience, yet beneath this veneer lies a critical issue that has plagued the nation for decades: stagnant productivity growth. Productivity, a key driver of economic prosperity, has failed to keep pace with other advanced economies, leaving Canada trailing behind.

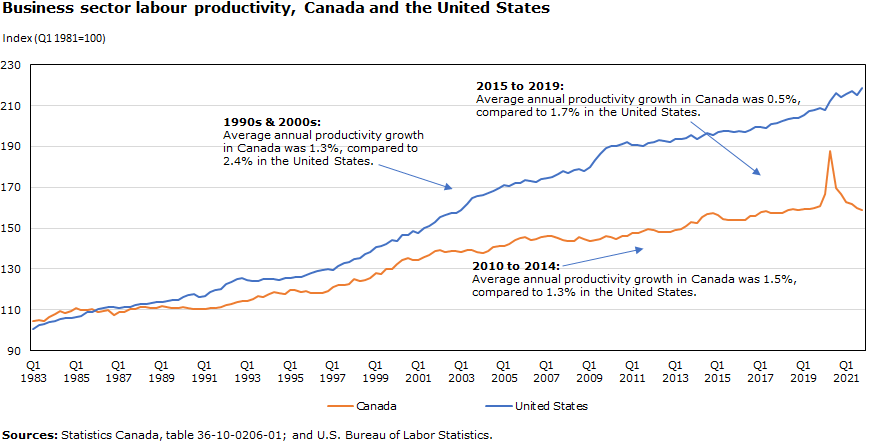

Canada experienced robust productivity growth in the post-war era, driven by industrial expansion and technological advancements. However, since the 1970s, this growth has slowed significantly. OECD data reveals that Canada's GDP per hour worked grew at an average annual rate of only 1.2% from 1970 to 2020, compared to 1.8% in the United States and 2.0% in other leading OECD nations. This persistent lag in productivity growth poses substantial challenges to Canada's economic competitiveness and future prosperity.

Regulatory and Administrative Hurdles

One of the primary obstacles to productivity in Canada is its complex regulatory environment. Obtaining regulatory approvals, permits, and licenses is often slow, cumbersome, and costly for businesses. According to the Fraser Institute, Canada ranks lower than the United States and other OECD countries on the World Bank's Ease of Doing Business Index. For instance, procedures related to construction permits take an average of 249 days in Canada, significantly longer than the 81 days required in the United States. These regulatory inefficiencies deter entrepreneurship, investment, and innovation, thereby limiting overall economic growth potential.

Lackluster Business Investment

Canadian businesses allocate significantly less capital per worker compared to their U.S. counterparts, approximately half the amount on average. This disparity widened notably after the 2008-09 global financial crisis and the subsequent 2015 oil price collapse, exacerbated further by the pandemic's impact. Since the financial crisis, capital investment in Canada has contributed less than half of what it did in the preceding decade, pointing to a marked decline in productivity growth.

A substantial portion of this reduced investment stems from decreased spending in Canada's oil and gas sector, influenced by global shifts towards renewable energy sources. However, broader trends indicate a broader issue: Canadian manufacturing has attracted a smaller share of GDP investment compared to the United States over the past decade.

Interestingly, the challenge does not stem from a lack of available funds. Despite central banks raising interest rates, Canadian businesses retain significant cash reserves, amounting to nearly a third of the GDP. Yet, businesses frequently cite a cumbersome project approval process that inflates investment costs within Canada. This administrative burden not only deters potential investors but also contributes to the perpetuation of smaller-scale enterprises—98% of Canadian businesses employ fewer than 100 workers—historically less productive on average.

Internal Trade Fragmentation

Internal trade barriers within Canada present another significant impediment to productivity growth. Canada's federal system results in a patchwork of regulations and standards across provinces and territories. The International Monetary Fund estimates that these barriers could reduce Canada's GDP by up to 3.8% annually. In contrast, countries like Australia, operating under federal systems, have made significant strides in harmonizing internal trade regulations, thereby improving economic efficiency and productivity. Canada's failure to address these barriers effectively increases costs, inefficiencies, and reduces competitiveness globally.

Infrastructure Challenges

Infrastructure deficiencies, including bottlenecks in transportation networks and logistics, further contribute to Canada's productivity woes. The World Bank's Logistics Performance Index consistently ranks Canada lower than many OECD peers in infrastructure quality and efficiency. For example, Canadian ports experience longer turnaround times compared to their counterparts in the United States, impacting supply chain efficiency and overall economic competitiveness. Moreover, inadequate investment in transportation infrastructure and logistics systems exacerbates these challenges, limiting Canada's ability to capitalize on global trade opportunities.

Sectoral Imbalances in Investment

Canada exhibits significant imbalances in investment across sectors, with a disproportionate focus on traditional industries such as construction and real estate, compared to innovation-driven sectors like technology and advanced manufacturing. Investment in residential and non-residential construction has consistently accounted for a larger share of Canada's GDP compared to investments in intellectual property products like software and patents. This imbalance suggests a misallocation of resources, where capital flows towards less productive sectors, hampering overall economic diversification and growth.

Service Sector Productivity Stagnation

The service sector, a major contributor to Canada's GDP and employment, faces persistent challenges in achieving productivity gains. While the sector has expanded in terms of employment, productivity growth has been lackluster. OECD data indicates that from 2000 to 2020, productivity in Canada's service sector grew at an average annual rate of just 0.7%, significantly lower than the 1.3% growth rate observed in the United States over the same period. Factors contributing to this disparity include differences in skill levels, education attainment, and technological adoption among service sector workers in Canada.

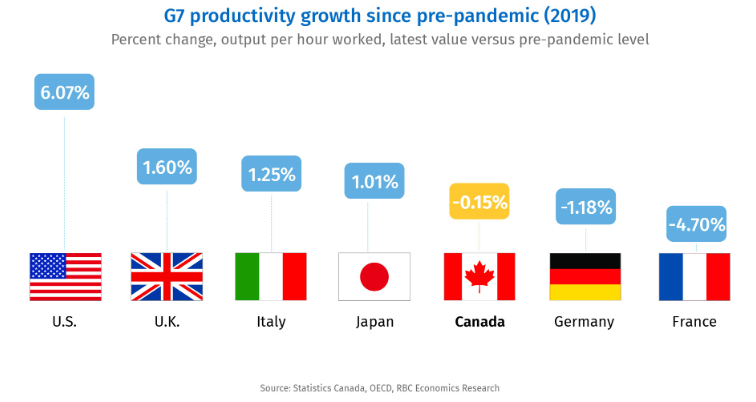

Comparative Analysis with the United States and OECD

Comparing Canada's productivity performance with the United States and OECD countries highlights significant disparities. Canada's labor productivity, measured by GDP per hour worked, continues to lag behind that of the United States and several OECD nations.

Moreover, Canada has fallen behind other major economies since 2000. At the turn of the century, Canada's economic output per capita was on par with Australia. However, today Australians are almost 10% more productive, with their economy growing 50% faster per person than Canada's over the past quarter-century. Compared to the United States, Canada is approximately 30% less productive, positioning it closer in economic performance to lower-income states like Alabama than tech-rich states such as California or New York. This decline has seen Canada's rank in the OECD's productivity standings drop from 6th place in 1970 to 18th as of 2022.

The productivity gap with the United States translates into approximately $20,000 less GDP per person per year for Canadians, placing their wages roughly 8% below their American counterparts. This disparity is also evident in capital markets, where investments in Canada's main stock index have significantly underperformed compared to the U.S. S&P 500 index over the past two decades, reflecting broader economic challenges.

Canada's persistent productivity challenges represent a critical economic issue with profound implications for its future. Structural barriers, including regulatory complexities, inadequate business investment, internal trade fragmentation, infrastructure deficits, sectoral imbalances, and service sector stagnation, collectively contribute to Canada's productivity gap relative to its OECD counterparts and the United States. Addressing these challenges requires comprehensive policy reforms and strategic investments to foster innovation, enhance competitiveness, and unlock Canada's full economic potential in the global arena.

Not sure if you should sell?

We get it. The market is weird. If you’re not sure if selling your home is the right move for you right now, get in touch. We’ll go over the details of your specific situation and help you make the right decision.