Beyond the Brink: RBC's Alarming Data and Toronto's Housing Lifeline

In 2023, the housing landscape in Canada faced increasing challenges, prompting a comprehensive retrospective by the Canada Mortgage and Housing Corporation (CMHC). As a trusted authority for over 75 years, CMHC played a crucial role in understanding and addressing the complexities of the housing market.

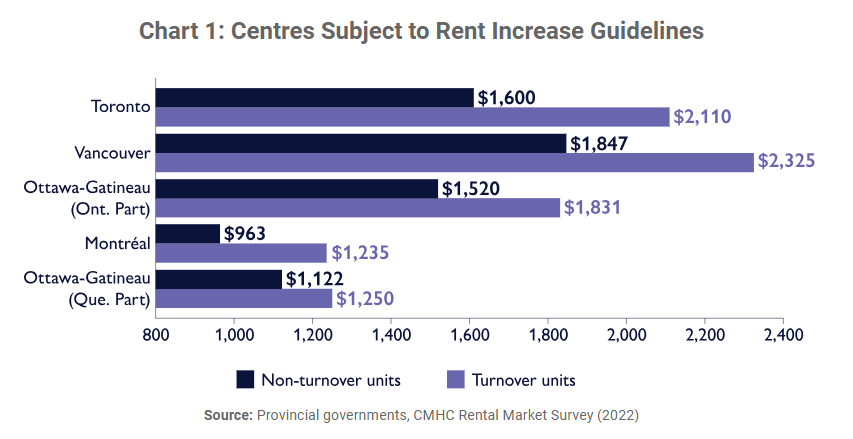

One of the key focuses in 2023 was on the Rental Market, as highlighted in the Rental Market Report released in January. This report delved into critical aspects such as rental turnover rates, shedding light on the mobility of tenants and the pace at which rental units changed hands. The data revealed increased turnover in urban centers, emphasizing the need for nuanced policy approaches to address challenges faced by both tenants and landlords.

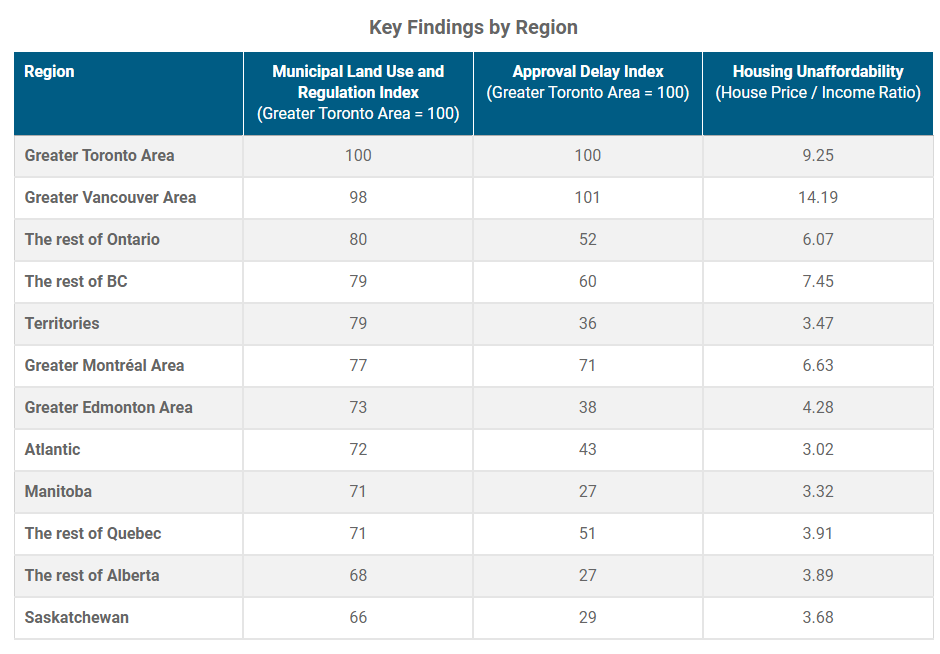

Another significant revelation came from the Municipal Land Use and Regulation Survey in July 2023. This survey unearthed a compelling connection between land use regulations and housing affordability, particularly in highly regulated cities. The index, measuring the degree of land use regulation, showcased how cities with stringent regulations experienced a scarcity of developable land, leading to inflated housing prices. This finding prompted calls for a more flexible and adaptive approach to urban planning.

The CMHC also addressed the pressing issue of housing supply gaps, estimating a demand for 3.5 million more homes than anticipated by 2030. This staggering gap underscored the urgency for comprehensive strategies to address the housing shortage in both rental and ownership markets.

Insights from the Residential Mortgage Industry further contributed to the understanding of the financial landscape underpinning housing transactions. Noteworthy observations included the role of government interventions in stabilizing mortgage markets during challenging times and the evolving preferences of homebuyers regarding mortgage products.

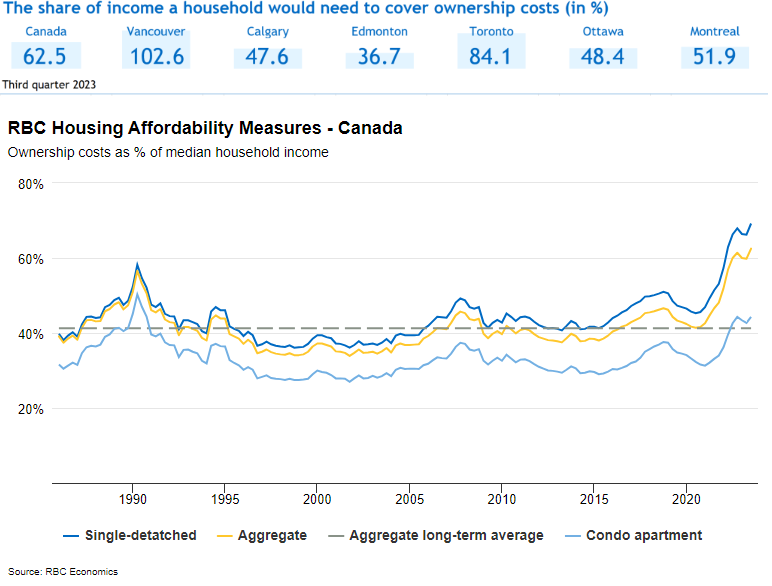

However, despite these insights, the challenges in the housing market persisted. Ownership costs in Canada saw a rise again in the third quarter of 2023, driven by mortgage rate increases and modest appreciation in home prices. The RBC's aggregate affordability measure increased by 2.8 percentage points to 62.5%, reversing a modest improvement in the second quarter. The situation was particularly tense in Vancouver, Victoria, and Toronto, where the costs of owning a home reached sky-high levels.

Amidst these challenges, an announcement by the federal government brought both hope and criticism. Toronto is set to receive nearly half a billion dollars in housing funding, aiming to fast-track the construction of close to 12,000 additional units over the next three years. While Prime Minister Justin Trudeau emphasized the positive impact of this funding, including simplifying rezoning requirements and modernizing regulations, criticisms arose.

Some critics pointed to the need for a more comprehensive approach, addressing not only funding but also the fundamental issues driving the housing crisis. The call for systemic reforms in municipal zoning and permit processes was echoed, emphasizing that true affordability requires a multi-faceted strategy.

The latest government announcement injecting nearly half a billion dollars into Toronto's housing market reflects a step toward addressing the housing shortage. Still, criticisms highlight the need for a more holistic approach. The focus must extend beyond funding to include systemic reforms, such as addressing municipal zoning and permit processes, to create lasting change.

In tandem with these efforts, RBC's data on housing affordability trends provides a stark reality check. The significant loss of affordability during the pandemic has shrunk the pool of homebuyers in Canada, with close to 60% of all households affording a regular condo apartment in 2019 compared to 45% in 2023. This, coupled with the estimate of a demand for 3.5 million more homes than anticipated by 2030, emphasizes the magnitude of the challenge at hand.

The economic outlook adds another layer to the complexity. Recent indicators suggest a softening in the housing market, with price declines in parts of Canada. However, the looming specter of mortgage renewals at higher interest rates poses a potential shock to the market, affecting over $675 billion in mortgage loans, representing close to 40% of the Canadian economy.

As the housing market faces challenges and governments make efforts to address them, the road ahead remains uncertain. While the CMHC's insights provided valuable guidance in understanding the intricacies of the housing crisis, the need for innovative, evidence-based solutions becomes even more urgent. The promise of increased funding must align with comprehensive reforms to truly create a sustainable, inclusive, and affordable housing future for all Canadians.

Looking ahead, the CMHC's analysis and data in 2023 have played a crucial role in increasing awareness among Canadians and policymakers regarding the multifaceted challenges facing the housing markets. The various outputs from CMHC cover aspects ranging from rental dynamics to the impact of land use regulations and delve into the supply gap and nuances of the residential mortgage industry. These outputs serve as a valuable guide for stakeholders in crafting effective policies and strategies, aiming to create a sustainable, inclusive, and, most importantly, affordable housing future.

The confluence of insights from the CMHC, RBC, and government announcements paints a nuanced picture of the challenges and opportunities in Canada's housing market. The road ahead requires not only financial investments but also comprehensive systemic reforms to build a housing landscape that is not only economically viable but also socially inclusive and affordable for all. The ongoing collaboration between government initiatives, financial institutions, and housing authorities is paramount to realizing this vision and ensuring a brighter, more accessible future for Canadians in need of affordable housing.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.