A Crisis of Confidence or a Crisis of Capital?

China’s property market is in deep trouble. The sector, which accounts for about 22% of the country’s GDP, has been facing a series of challenges that threaten its stability and growth.

One of these challenges is the tightening of credit and regulatory policies, which have reduced the access and availability of financing for developers and homebuyers. Another challenge is the rising debt and default risks of developers, which have increased the financial pressure and vulnerability of the sector.

Some of the major developers, such as Evergrande and Country Garden, have resorted to debt restructuring or defaulting on their bonds, causing anger and frustration among homebuyers who have paid deposits for unfinished flats. A third challenge is the falling demand and prices of new and existing homes, which have created a vicious cycle of declining sales and cash flow for developers and homebuyers.

To address this problem, some local governments have come up with a new initiative called the “old-for-new” scheme, which aims to boost the liquidity and vitality of the market by encouraging residents to sell their old homes and buy new ones. But how effective is this scheme in solving the problems the Chinese real estate market continues to face?

In this article, we will explore the details, impacts, and challenges of the old-for-new scheme, and whether it can offer a sustainable solution for the market. We will also discuss the role and potential of affordable housing in the market, and how it can benefit the poor and the economy.

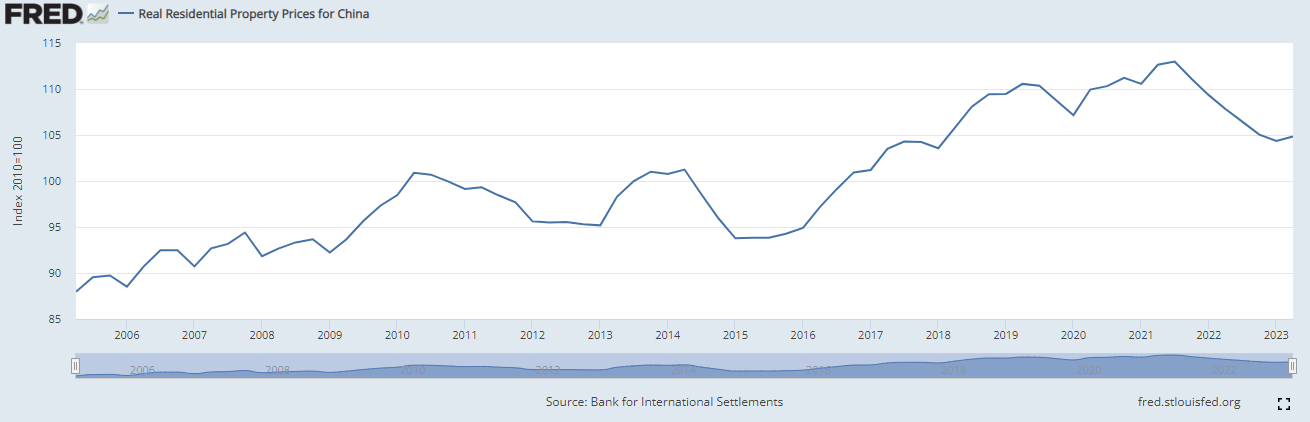

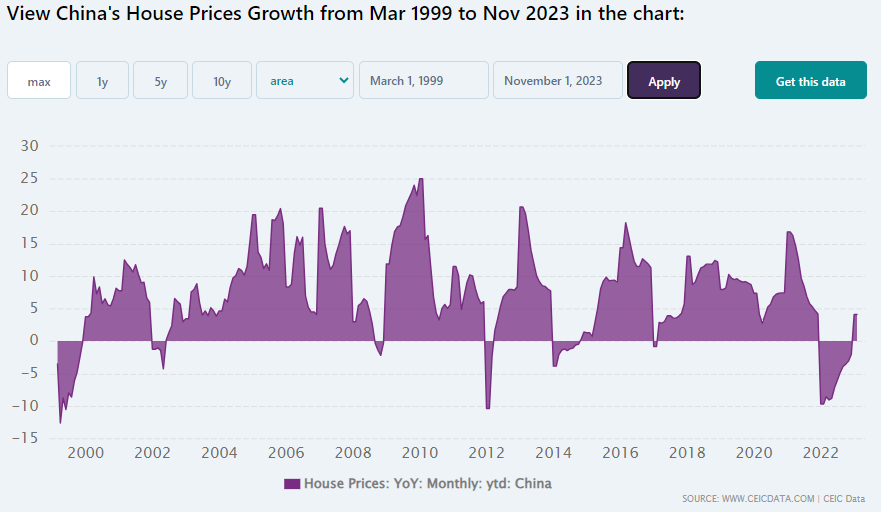

The old-for-new scheme is designed to stimulate the demand and supply of new homes in the Chinese property market, which has been suffering from a slowdown and a decline in recent years. According to the official data from the National Bureau of Statistics, the average new home prices in China’s 70 major markets fell by 0.38% month-on-month in October 2023, the biggest drop since December 2014. The year-on-year growth rate also slowed down to 2.5%, the lowest since February 2016.

The old-for-new scheme aims to boost the liquidity and vitality of the market by increasing the turnover and transaction volume of new and existing homes. By offering subsidies and vouchers to homebuyers who sell their old homes and buy new ones, the scheme hopes to reduce the cost and hassle of upgrading homes and to create more demand and cash flow for developers. By helping homebuyers sell their old homes, the scheme also hopes to increase the supply and circulation of existing homes and to improve the quality and diversity of the urban housing stock.

However, the scheme also faces some challenges and limitations that may undermine its effectiveness and sustainability. For one thing, the scheme only covers selected new properties, which means that homebuyers’ options are limited. Moreover, many of these new properties are still under construction with unspecified delivery dates, which may deter some homebuyers who prefer ready-to-move-in homes. For another thing, the scheme relies on the cooperation and coordination of multiple parties, such as brokerage firms, developers, and local governments, which may create some conflicts of interest and inefficiencies. For instance, brokerage firms may have an incentive to lower the prices of old homes to sell them faster, while developers may have an incentive to raise the prices of new homes to increase their profits. Furthermore, the scheme may not be able to address the fundamental issues that affect the demand and supply of new homes, such as the weak market sentiment, the low income and employment prospects, and the uncertain home price trends. As a result, the scheme may only have a marginal and temporary impact on the market, but not a fundamental and lasting one. Let’s take a closer look at these issues in the next section.

The old-for-new scheme may seem like a clever and innovative way to revive the Chinese property market, but it cannot solve the fundamental problems that plague the market. These problems are rooted in the structural and cyclical factors that affect the demand and supply of new homes, as well as the confidence and expectations of homebuyers and developers.

One of the main problems is the weak demand for new homes, which is driven by the low-income and employment prospects of the Chinese population. According to the official data from the National Bureau of Statistics, the per capita disposable income of urban residents in China grew by only 5.2% year-on-year in the first three quarters of 2023, the lowest since 2002. The urban unemployment rate also rose to 5.3% in September 2023, the highest since 2016.

These factors have reduced the purchasing power and willingness of homebuyers, especially the younger and middle-income groups, who are the main target of the old-for-new scheme. Many of them are struggling to afford the high prices and down payments of new homes, even with the subsidies and vouchers offered by the scheme. Moreover, many of them are reluctant to sell their old homes at a big discount, as they fear that they will lose their hard-earned wealth and security.

Another problem is the uncertain and downward trend of home prices, which is influenced by the excess supply and the policy tightening of the Chinese property market. According to the data from the China Real Estate Information Corporation, the inventory of unsold new homes in China’s 100 major cities reached 657.9 million square meters in October 2023, up by 8.7% year-on-year. The average sales-to-supply ratio, which measures the balance between demand and supply, dropped to 0.77, the lowest since 2015.

These factors have created a vicious cycle of falling prices and declining sales, as homebuyers and developers become more pessimistic and cautious about the market outlook. Homebuyers tend to postpone or cancel their purchases, hoping for lower prices in the future. Developers tend to cut prices or offer discounts, hoping to clear their inventory and improve their cash flow. As a result, the old-for-new scheme may not be able to stimulate the demand and supply of new homes, as it cannot change the fundamental market forces and expectations.

A third problem is the rising debt and default risks of the Chinese property sector, which is caused by the over-leveraging and over-expansion of developers and local governments. According to the data from the China Banking and Insurance Regulatory Commission, the outstanding loans to the real estate sector in China reached 55.2 trillion yuan ($8.5 trillion) in September 2023, up by 11.1% year-on-year. The ratio of non-performing loans to the real estate sector also rose to 1.02%, the highest since 2017.

These factors have increased the financial pressure and vulnerability of the property sector, as many developers and local governments have been struggling to repay their debts and complete their projects. Some of the major developers, such as Evergrande and Powerlong, have resorted to debt restructuring or defaulting on their bonds. This has caused anger and frustration among homebuyers who have paid deposits for unfinished flats. It has also caused concern and uncertainty among investors and creditors who have lent money to the property sector.

The old-for-new scheme may not be able to address these debt and default risks, as it may not generate enough revenue and cash flow for developers and local governments to service their debts. It may also increase the debt and financial risks for local governments, as they have to subsidize homebuyers and acquire old homes through LGFVs. As a result, the old-for-new scheme may not be able to stabilize and support the property sector, as it cannot resolve the debt and default problems.

These are some of the reasons why the old-for-new scheme cannot solve the fundamental problems of the Chinese property market. The scheme may have some positive effects, such as enhancing the efficiency and liquidity of the market and improving the quality and diversity of the housing stock. But it may also have some negative effects, such as creating more excess supply and downward pressure on prices and adding more debt and financial risks to local governments. In the long run, the scheme may not be able to sustain and revitalize the market, as it cannot address the structural and cyclical factors that affect the demand and supply of new homes, as well as the confidence and expectations of homebuyers and developers.

While the old-for-new scheme may not be able to solve the fundamental problems of the Chinese property market, there may be another policy that can have some positive effects: the construction of affordable housing. Affordable housing refers to housing units that are provided by the government or the market at a lower cost than the market price, and that are accessible and suitable for low and middle-income households.

The construction of affordable housing may have some benefits for the poor and the economy in the Chinese property market. One of the benefits is that it can represent a transfer of wealth from local governments to poor households, who can enjoy better living conditions and security. According to some estimates, the construction of 10 million units of affordable housing in China can represent a one-off transfer of roughly 2-5% of one year’s GDP. However, since most of these units are likely to be rented out, the annual amount of the transfer may be much less, no more than 0.1-0.2% of GDP.

Another benefit is that it can increase the supply and diversity of low-cost housing for the needy, who may otherwise face difficulties in finding and affording suitable homes in the market. According to the official data from the National Bureau of Statistics, the urbanization rate of China reached 64.8% in 2022, which means that more than 900 million people live in urban areas. However, many of them are migrant workers, renters, or low-income earners, who do not have access to adequate and affordable housing. The construction of affordable housing can help alleviate this problem and improve the social welfare and stability of the urban population.

A third benefit is that it can stimulate economic activity and employment in the construction and related sectors, which have been hit hard by the slowdown and decline of the property market. According to the data from the China Association of Construction Enterprise Management, the construction industry accounted for 6.8% of China’s GDP and 13.5% of its employment in 2022. The construction of affordable housing can create more demand and jobs for the industry, and boost its output and income.

However, the construction of affordable housing also faces some challenges and trade-offs that may limit its effectiveness and feasibility. One of the challenges is the funding and financing of affordable housing projects, which may pose a heavy burden on the local governments and their fiscal budgets. According to some estimates, the construction of 10 million units of affordable housing in China may cost about 2.5 trillion yuan ($385 billion), which is equivalent to 2.3% of China’s GDP in 2022.

However, the local government revenue from land sales and taxes has been declining due to the weak property market, and their debt level has been rising due to the expansionary fiscal policy. Therefore, the local governments may have to resort to selling their assets, lowering their interest rates, or borrowing more money to fund affordable housing projects, which may create more financial risks and imbalances.

Another challenge is the allocation and management of affordable housing units, which may involve some conflicts of interest and inefficiencies. For instance, the local governments may have to decide who is eligible and how to distribute the affordable housing units among the applicants, which may create some disputes and dissatisfaction among the potential beneficiaries. Moreover, the local governments may have to monitor and regulate the use and maintenance of affordable housing units, which may create some costs and difficulties in ensuring the quality and sustainability of the housing stock.

A third challenge is the impact and coordination of the affordable housing policy with the other policies and measures that affect the property market, such as the old-for-new scheme, the credit and regulatory policies, and the land and urban planning policies. For instance, the construction of affordable housing may have some negative effects on the property market, such as creating more excess supply and downward pressure on prices and reducing the incentives and profits of developers and homebuyers. Therefore, the local governments may have to balance and harmonize the affordable housing policy with the other policies and measures and consider the short-term and long-term effects and trade-offs of the policy.

These are some of the challenges and trade-offs that the construction of affordable housing faces in the Chinese property market. The policy may have some positive effects, such as transferring wealth from local governments to poor households, increasing the supply and diversity of low-cost housing for the needy, and stimulating economic activity and employment in the construction and related sectors.

However, it may also have some negative effects, such as adding more debt and financial risks to local governments, creating more conflicts and inefficiencies in the allocation and management of housing units, and creating more excess supply and downward pressure on prices in the property market.

Providing more affordable housing for the poor won't reverse the decline in the country's property market, which suffers from excess supply and receding demand. It might even make things a little worse for the sector by increasing supply at the bottom end.

In the long run, the policy may not be able to reverse the decline of the property market, "which suffers from excess supply and receding demand. It may even make things a little worse for the sector by increasing supply at the bottom end," argues Michael Pettis, Finance Professor at Peking University. Therefore, the policy may need to be carefully designed and implemented, and coordinated with the other policies and measures, to achieve its intended goals and benefits.

We have seen that the old-for-new scheme may not be able to solve the fundamental problems of the market, such as the weak demand, the uncertain and downward trend of prices, and the rising debt and default risks of the sector. We have also seen that the affordable housing policy may have some benefits for the poor and the economy, but it may also face some challenges and trade-offs, such as funding and financing, allocation and management, and the impact and coordination of the policy.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.