Snowbound Sales: Understanding the Cold Snap in Canadian Home Transactions

The latest statistics on existing home sales for November 2023 have surfaced, providing a nuanced perspective on the current state of affairs. The figures reveal a 0.9% dip in existing home sales and a correlating 1.1% decrease in benchmark house prices compared to the previous month.

This trend is not isolated, as it echoes the broader economic climate characterized by anemic growth and the reverberations of increased interest rates on household spending. Examining the transactional landscape, November witnessed a 0.9% decrease in existing home sales on an unadjusted basis from the same period last year. This dip was mirrored in the new listings, which contracted by 1.8% month-over-month in November, following a 2.2% drop in October.

Delving into the long-term trends, over three and five years, house prices exhibited substantial growth, with increases of 22.8% and 36.7%, respectively. However, the recent economic challenges, marked by higher interest rates, have prompted households to scale back spending, contributing to the observed decline in both sales and prices.

Taking into account the national perspective, the Canadian Real Estate Association (CREA) reports a measured stability in national home sales for November 2023. The MLS® Home Price Index (HPI) recorded a 1.1% month-over-month decrease but showed a 0.6% year-over-year increase. The national average sale price climbed by 2% year-over-year, reaching $646,134.

Larry Cerqua, Chair of CREA, anticipates a stabilizing market, suggesting a soft-landing scenario. Shaun Cathcart, CREA’s Senior Economist, notes a trend of buyers stepping back until next spring, while sellers are also pausing, expecting a potentially more active spring market.

However, regional variations are evident, with price declines primarily observed in Ontario, while stability or increases are noted in Alberta, Saskatchewan, New Brunswick, Prince Edward Island, and Newfoundland and Labrador.

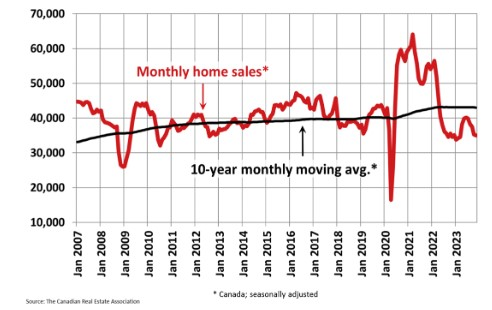

As we navigate through these market intricacies, it becomes apparent that the Canadian housing market is undergoing a transformation. Existing home sales in November 2023 experienced a 0.9% decline, marking the fifth consecutive monthly decrease. This is indicative of a broader economic context, where real GDP growth in Q4 2023 is projected to be in the range of 0% to 0.5%, slightly below the Bank of Canada's latest projection of 0.8%.

The impact of accumulated rate hikes is palpable, affecting both homeowners and prospective buyers. National sales have retraced more than 80% of gains seen between January and June, with declines widespread in November, particularly in the Toronto and Vancouver markets.

New listings, after a rise from April to September, have declined for the second consecutive month, as sellers await more favorable conditions. This has led to a broad-based rise in inventory across large provinces, signaling less support for current housing prices in the coming months.

Prospective buyers find themselves in a favorable position in major markets, with weakening demand-supply conditions and an increase in inventory. The weakening housing market, coupled with broader economic challenges, is expected to prompt the Bank of Canada to maintain its current monetary policy, with an anticipation of a shift from hiking to cutting interest rates by the middle of the next year.

The complexities of the market extend to the nuanced analysis provided by CIBC's Deputy Chief Economist, Benjamin Tal. The Canadian housing market, according to Tal, is undergoing a substantial correction, transforming into a buyers' market. The current challenges, marked by increased supply, reduced demand, and high mortgage costs, signal a healthy correction in the market.

This transition is not without its hurdles, especially in the condo market, which is experiencing a rapid slowdown as investors withdraw. The cautious optimism for 2024 is rooted in the expected rise in home prices, driven by strong immigration numbers and a predicted decline in interest rates. However, concerns linger about the potential hindrance of new builds, contributing to a looming housing supply shortage.

The Canadian real estate market is at a pivotal juncture, experiencing shifts that demand careful consideration and strategic navigation. As existing home sales decline, the market grapples with the aftermath of economic challenges, accumulated rate hikes, and the evolving dynamics of supply and demand. The future trajectory remains uncertain, emphasizing the need for stakeholders to stay attuned to market conditions, adapt to changing scenarios, and seek expert guidance for informed decision-making.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.